- United States

- /

- Oil and Gas

- /

- NYSE:VLO

Valero Energy (NYSE:VLO) Declares US$1.13 Quarterly Dividend Per Share

Reviewed by Simply Wall St

Valero Energy (NYSE:VLO) recently announced a regular quarterly cash dividend of $1.13 per share, affirming its commitment to returning value to shareholders. This development coincided with a price move of 12% over the past month. During the same period, the company reported a net loss of USD 595 million for the first quarter which, along with ongoing stock buybacks, likely influenced the stock's performance. These company-specific events played out against a backdrop of mixed market movements, as investors awaited key macroeconomic decisions and trade talks between the U.S. and China, collectively adding context to Valero's market activity.

The recent announcement of Valero Energy's US$1.13 per share quarterly dividend underscores its intention to reward shareholders, a move possibly influencing its recent 12% share price surge. The company's strong focus on shareholder returns aligns with its broader financial strategy, even as it navigates a challenging quarter with a net loss of USD 595 million. Over the past five years, Valero's total return, which includes share price appreciation and dividends, achieved approximately 127.95%, highlighting its robustness amidst market fluctuations.

Compared to the broader US Oil and Gas industry, which saw a return of negative 10.2% over the past year, Valero underperformed, emphasizing the sector's mixed performance amidst macroeconomic uncertainties and regulatory challenges. The divergence in short-term performance compared to the five-year growth trajectory may reflect investor apprehensions over immediate operational hurdles and market dynamics.

The potential impacts of Valero's refinery optimization projects, alongside renewable diesel sector challenges, are crucial for understanding revenue and earnings forecasts. The St. Charles SEC unit upgrade is poised to enhance high-value product yields by 2026, potentially aiding future earnings growth. Despite immediate losses, Valero's commitment to optimizing operations and product output could sustain its revenue and margin projections amidst tight supply-demand balances favoring refining economics.

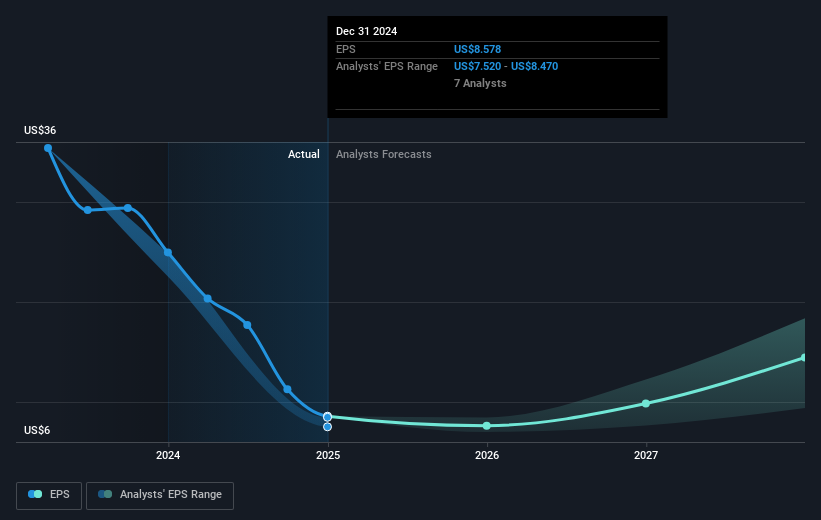

As for share price valuation, the current price at US$115.52 shows an 18.2% discount to the analyst consensus price target of US$141.25, indicating a potential upside. Analysts anticipate slight declines in revenue yet foresee substantial profit margin expansion, with future earnings potentially justifying this target through improved operational efficiencies and strategic market positioning.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VLO

Valero Energy

Manufactures, markets, and sells petroleum-based and low-carbon liquid transportation fuels and petrochemical products in the United States, Canada, the United Kingdom, Ireland, Latin America, Mexico, Peru, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives