- United States

- /

- Oil and Gas

- /

- NYSE:VG

Venture Global’s Valuation: Weighing Analyst Concerns Against Tokyo Gas Deal and Future Prospects

Reviewed by Simply Wall St

Venture Global, Inc. is drawing fresh attention after announcing a major 20-year LNG supply agreement with Tokyo Gas, even as the stock faces headwinds because of analyst concerns over profit margins and arbitration risks.

See our latest analysis for Venture Global.

Despite the headline-making LNG supply pact with Tokyo Gas and major expansion filings with regulators, Venture Global’s share price return tells a tougher story. The stock has dropped more than 70% year-to-date and momentum has been fading sharply, even as the company lands new long-term contracts and grows capacity.

If this mix of risk and potential has you wondering what other opportunities might be out there, take your research a step further and discover fast growing stocks with high insider ownership

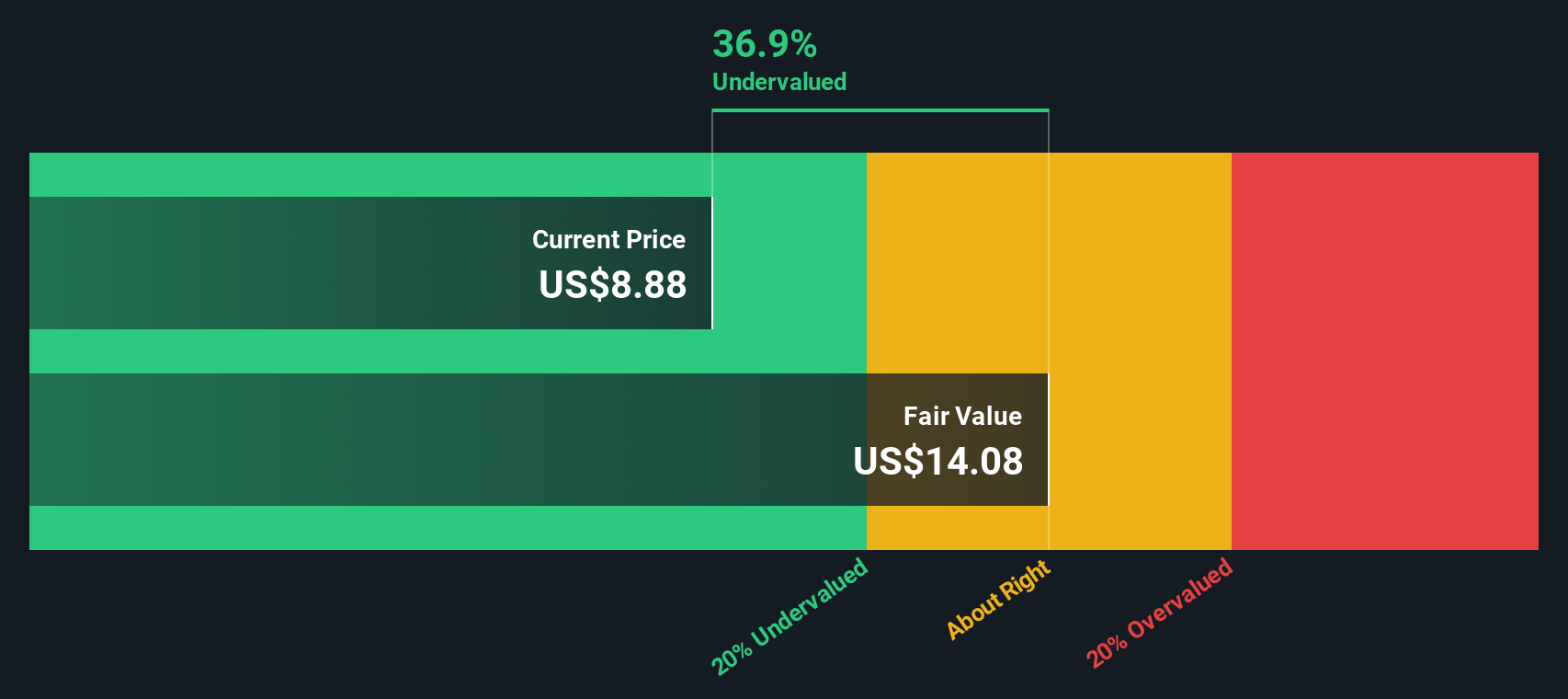

With the shares trading well below analyst targets after recent setbacks, it is worth asking: Is Venture Global now undervalued in light of its LNG deals, or is the market accurately pricing in future risks and limited growth?

Price-to-Earnings of 8.5: Is it justified?

Venture Global’s shares trade at a price-to-earnings (P/E) ratio of just 8.5, with the last close at $7.13. This is well below both its peer average and what the market typically pays for similar earning power, placing the stock firmly in undervalued territory by this metric.

The price-to-earnings ratio shows how much investors are willing to pay today for a single dollar of current earnings. For Venture Global, a P/E of 8.5 means the market is assigning a modest premium for its most recent profits, especially for an energy sector company with strong earnings growth recorded in recent years.

With Venture Global’s P/E at 8.5 compared to a peer average of 21.8 and an industry average of 13.1, the stock appears particularly discounted. Our fair value modeling suggests that the P/E ratio could justify a higher share price, with the estimated fair P/E standing at 11.2. The market may be underestimating recent profit growth and overlooking improving profit margins. If sentiment shifts, the stock could re-rate significantly higher.

Explore the SWS fair ratio for Venture Global

Result: Price-to-Earnings of 8.5 (UNDERVALUED)

However, lingering arbitration risks and negative net income growth could limit any potential upside if market sentiment remains cautious around Venture Global’s fundamentals.

Find out about the key risks to this Venture Global narrative.

Another View: Our DCF Model Reaches a Similar Verdict

Taking a step back from price-to-earnings, our DCF model also suggests Venture Global is undervalued, with the share price trading around 31.6% below the estimated fair value of $10.42. This second approach supports the case that the market may be discounting the company's future prospects too heavily. The big question is whether current risks truly justify this gap, or if opportunity is being overlooked.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Venture Global for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 927 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Venture Global Narrative

If this outlook does not quite align with your own views, you are encouraged to dive into the data yourself and assemble a narrative in just a few minutes. Do it your way

A great starting point for your Venture Global research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let a single stock define your investment journey. Broaden your horizon instantly with hand-picked opportunities from the Simply Wall Street Screener below.

- Capitalize on AI breakthroughs by checking out these 25 AI penny stocks where artificial intelligence is driving innovation among industry leaders and high-potential newcomers alike.

- Tap into stable income streams and see which companies are rewarding shareholders with consistently strong payouts through these 15 dividend stocks with yields > 3%.

- Jump on early-stage momentum by finding these 3578 penny stocks with strong financials that stand out for robust financials and above-average growth prospects.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Undervalued with proven track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

China Starch Holdings eyes a revenue growth of 4.66% with a 5-year strategic plan

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026