- United States

- /

- Oil and Gas

- /

- NYSE:VG

Venture Global (VG) Is Down 32.3% After Major Arbitration Loss to BP Over LNG Contracts – Has the Bull Case Changed?

Reviewed by Sasha Jovanovic

- In early October 2025, Venture Global lost a significant arbitration case to BP after the International Chamber of Commerce ruled that the LNG exporter breached its contract by selling cargoes on the spot market rather than fulfilling long-term supply agreements.

- This development not only exposes Venture Global to over US$1 billion in potential damages but also highlights the increasing legal risks facing the LNG sector, as the outcome may affect the company’s other ongoing disputes with major customers.

- We'll explore how this legal setback and its implications for contractual reliability influence Venture Global's investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Venture Global's Investment Narrative?

To be a Venture Global shareholder right now means believing in the company’s ability to execute on major long-term LNG export contracts, expand its projects, and translate revenue growth into shareholder value despite a turbulent period. The recent arbitration loss to BP has elevated legal risks and thrown some of the previous growth narrative into question. With Venture Global facing potential liabilities in the billions of US dollars, the loss has also introduced near-term uncertainty around future cash flow and investor confidence, as seen in the share price drop of over 60% year to date. While regulatory wins, project milestones, and new long-term client agreements have previously acted as short-term catalysts, this legal setback now threatens to overshadow them, shifting investor focus to ongoing legal disputes and the company’s capacity to resolve or contain further claims. This risk fundamentally changes the immediate picture for both catalysts and risks around the stock. On the other hand, investors should consider how additional legal claims could grow even larger than the BP case.

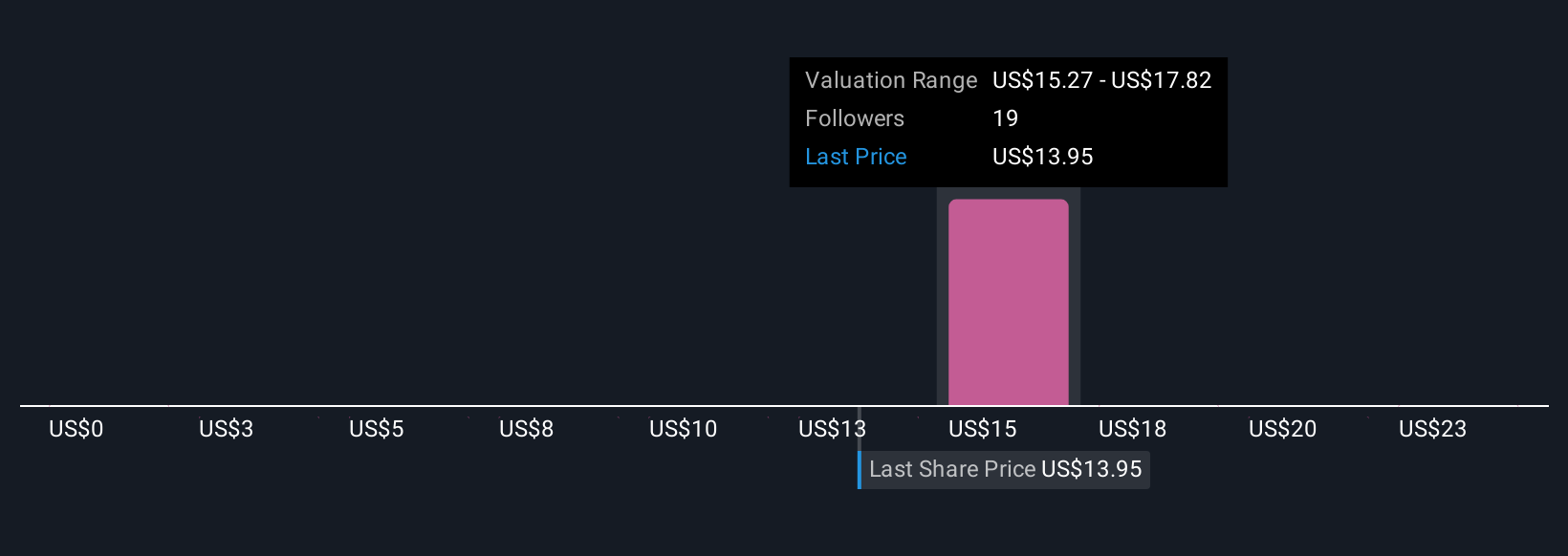

Despite retreating, Venture Global's shares might still be trading 33% above their fair value. Discover the potential downside here.Exploring Other Perspectives

Explore 7 other fair value estimates on Venture Global - why the stock might be worth less than half the current price!

Build Your Own Venture Global Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Venture Global research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Venture Global research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Venture Global's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives