- United States

- /

- Oil and Gas

- /

- NYSE:VG

Does Venture Global’s 29.9% Drop Signal an Opportunity in 2025?

Reviewed by Bailey Pemberton

If you’re sitting on the fence about what to do with Venture Global stock right now, you’re certainly not alone. Over the past month, the company has been on a wild ride, with the stock dropping an eye-catching 29.9% this past week and falling 33.0% for the month. Year to date, it has declined a substantial 61.9%. That kind of volatility grabs everyone’s attention, whether you’ve held shares for a while or are only just considering a position.

Some of these moves are rooted in broader market developments and shifting investor perceptions of risk in the sector. While there’s no single event to point to that explains the sharp declines, it’s clear that uncertainty is weighing heavily. Savvy investors know that these big swings can sometimes spell opportunity for those who keep a cool head.

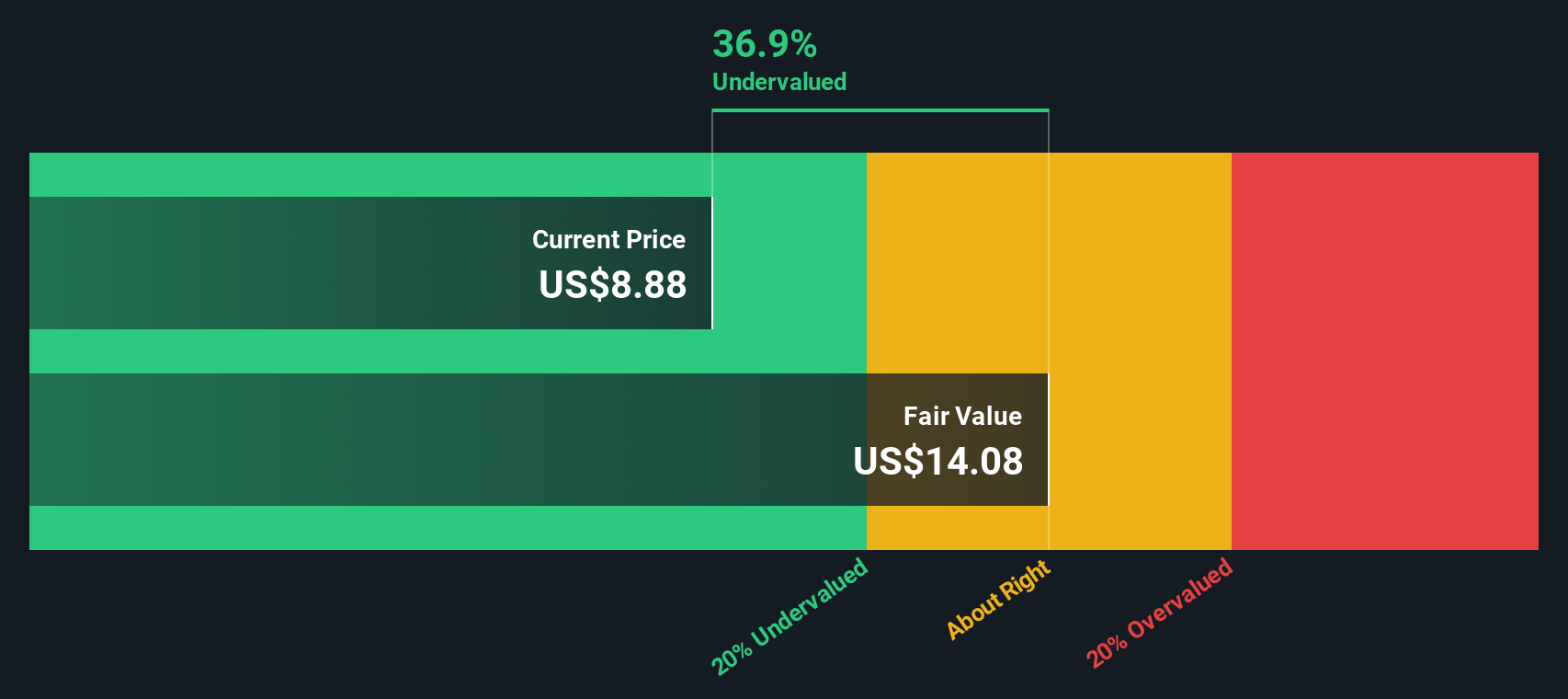

Now, with the stock sitting at $9.14 after this tumble, all eyes are turning to what the company is actually worth. On a basic value score, Venture Global lands at 3 out of 6, meaning it’s undervalued in half of the standard checks analysts use. It’s not a smoking gun for bargain hunters, but it’s certainly not a red flag either. This kind of score is exactly where things get interesting.

So, is the current drop a signal to dig deeper for hidden value, or is it a warning to stay away? Let’s walk through the key valuation approaches that can help answer that. At the end, I’ll share a smarter angle for thinking about whether Venture Global deserves a spot in your portfolio.

Approach 1: Venture Global Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow, or DCF, model is a cornerstone in stock valuation. It works by forecasting a company’s expected future cash flows and then discounting them to today’s values to find what those future dollars are worth right now. This approach tries to cut through short-term market noise and focus on how much cash the business can actually return to shareholders over time.

For Venture Global, the most recent figures show a last twelve months Free Cash Flow (FCF) of negative $8,983 Million. That reflects a growth phase, with outflows as the company invests heavily. Analyst projections become more promising in the coming years, and by 2029, FCF is expected to reach $1,735 Million. The DCF calculation also extends these forecasts out to 2035, with each year's projected FCF discounted back to today’s value by analysts and independent estimators.

Summing those discounted future cash flows leads to an estimated intrinsic value per share of $13.88. Compared to the current price of $9.14, this signals a 34.1% undervaluation. By this logic, the market is placing a steep discount on Venture Global’s future earning potential.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Venture Global is undervalued by 34.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Venture Global Price vs Earnings

The Price-to-Earnings (PE) ratio remains a tried and tested valuation method for companies generating positive earnings. It helps investors gauge how much they are paying for each dollar of profit, making it particularly relevant for established, profitable companies like Venture Global.

What is considered a fair PE ratio depends on several factors. Higher growth expectations or lower risk profiles can justify a higher multiple. More volatile or slower-growing companies usually trade at a lower PE. This dynamic means simply comparing against broad benchmarks gives only part of the story.

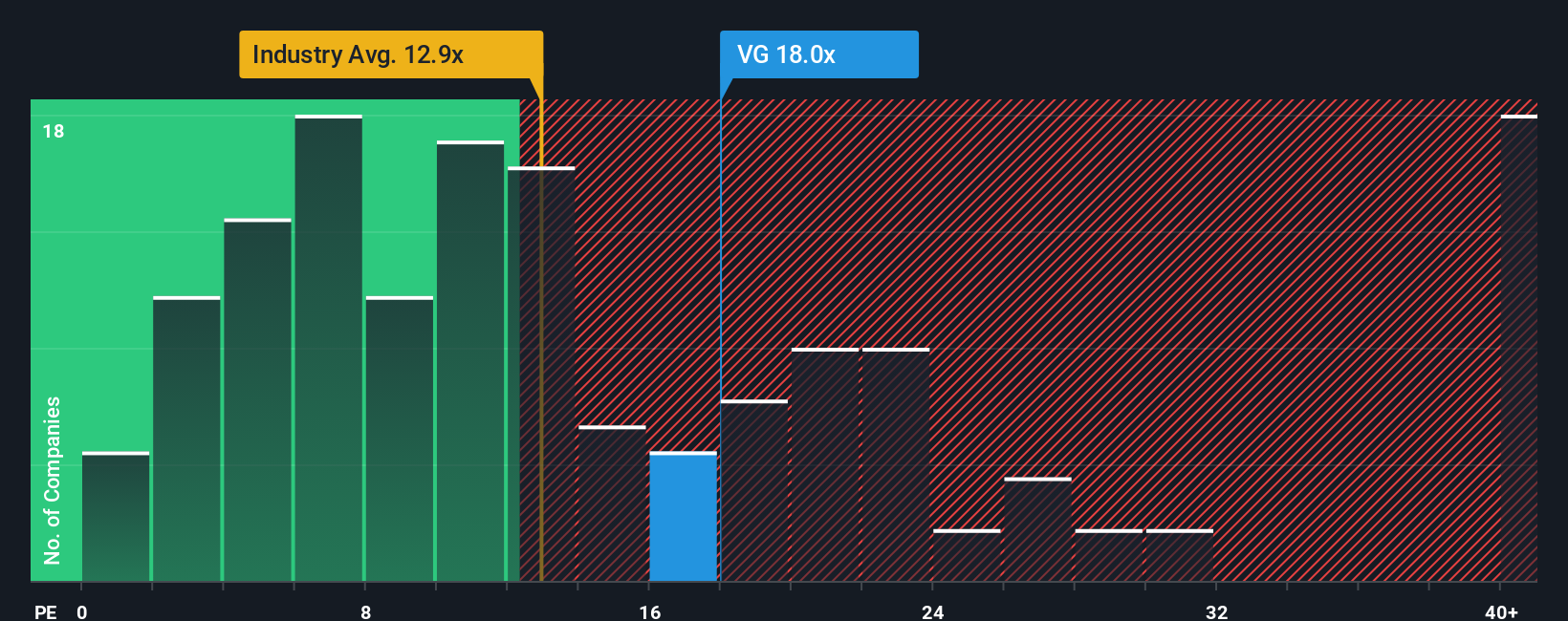

Venture Global currently trades at a PE ratio of 17.2x. For context, the average PE in the Oil and Gas industry is 13.1x. The company’s listed peers run considerably higher at 45.9x. While it may look more expensive than the industry, it is far cheaper than its typical peer. This suggests the market is not pricing in premium expectations here.

Simply Wall St’s Fair Ratio pegs Venture Global’s fair PE at 14.5x. Unlike a straight industry or peer comparison, this metric builds in the company’s growth outlook, profit margin, risks, industry specifics, and market cap to give a more tailored view.

With Venture Global’s actual PE just above the fair value estimate, the shares look only slightly higher than where data suggests they "should" trade. The gap is not large enough to signal a strong mispricing either way.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Venture Global Narrative

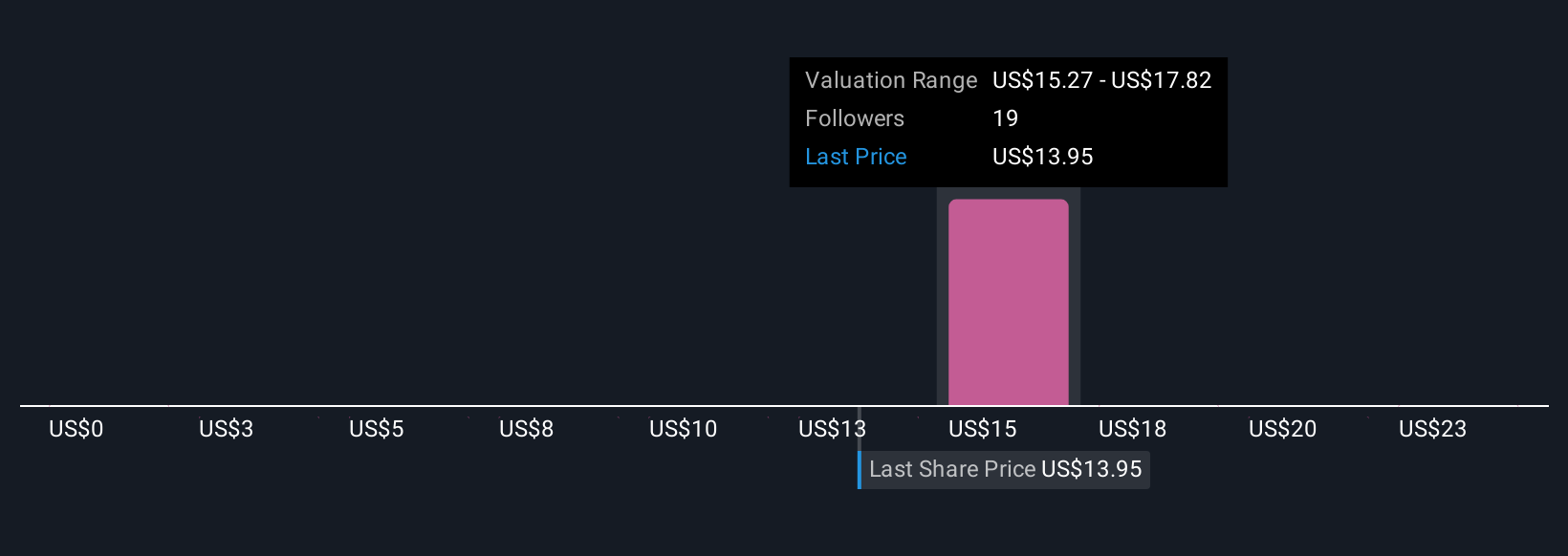

Earlier we mentioned that there’s an even better way to understand valuation, so let’s introduce you to Narratives. Rather than relying solely on numbers, Narratives allow you to anchor your investment decision in a story—your view on the company’s future, including its fair value and the assumptions you believe in for revenue, earnings, and margins.

A Narrative directly connects Venture Global’s real-world story to its financial forecasts and, ultimately, an estimate of what the stock is worth. It is quick and accessible on Simply Wall St’s Community page, a tool used by millions. Narratives empower you to make decisions by comparing your own Fair Value to the current market Price. These estimates update automatically when news or earnings create changes in the market.

For example, in the community, some investors take a very bullish view, forecasting a fair value well above $20, while others see headwinds and set theirs closer to $7, showing how Narratives reflect a wide range of perspectives on Venture Global’s future.

Do you think there's more to the story for Venture Global? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VG

Venture Global

Engages in the development, construction, and production of natural gas liquefaction and export projects near the U.S.

Fair value with limited growth.

Similar Companies

Market Insights

Community Narratives