- United States

- /

- Energy Services

- /

- NYSE:VAL

Does Valaris' All-In Reinvestment Strategy Signal a Sustainable Growth Path for VAL?

Reviewed by Sasha Jovanovic

- Valaris Limited recently reported strong financial health, highlighted by a return on equity of 12%, above the industry average, and significant net income growth driven by full profit reinvestment.

- The company’s decision to reinvest all profits rather than pay dividends has fueled substantial earnings expansion, although analysts anticipate that this growth may moderate in the future.

- We will explore how Valaris' above-average profit reinvestment shapes the company’s investment outlook and future growth prospects.

Find companies with promising cash flow potential yet trading below their fair value.

Valaris Investment Narrative Recap

To be a Valaris shareholder, you need to believe in the sustained demand for offshore drilling and the company's ability to convert its high-specification fleet and contract backlog into profitable growth. The recent strong ROE and profit reinvestment do not materially change the primary short-term catalyst: Valaris’s multi-year contract wins and backlog. The biggest risk remains potential overcapacity and softness in offshore rig day rates, which could pressure margins if industry utilization declines as forecast.

Among recent events, Valaris’s announcement of major contract extensions with Anadarko Petroleum, adding around US$760 million to its backlog, is most relevant. These contract wins expand near-term revenue visibility, underscoring the importance of backlog security in offsetting market volatility and mitigating earnings risk, even as analysts anticipate future growth moderation.

In contrast, investors should be aware that even with a record backlog, pressures from possible overcapacity and weaker day rates could still...

Read the full narrative on Valaris (it's free!)

Valaris is projected to reach $2.4 billion in revenue and $453.7 million in earnings by 2028. This scenario assumes an annual revenue decline of 1.2% and an earnings increase of $178.2 million from the current earnings of $275.5 million.

Uncover how Valaris' forecasts yield a $52.10 fair value, in line with its current price.

Exploring Other Perspectives

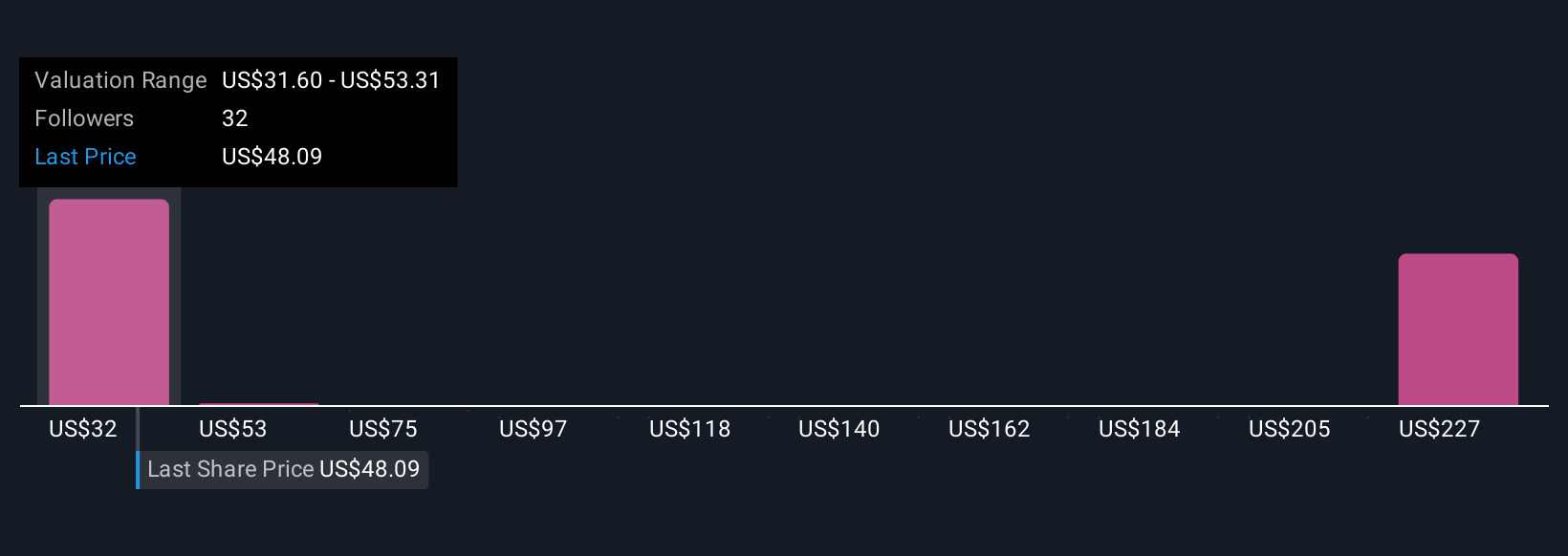

Eight fair value estimates from the Simply Wall St Community range from US$31.60 to US$262.64 per share. While opinions differ widely, many weigh Valaris’s large contract backlog as a key variable shaping the company's performance outlook.

Explore 8 other fair value estimates on Valaris - why the stock might be worth 38% less than the current price!

Build Your Own Valaris Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Valaris research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Valaris research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Valaris' overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:VAL

Valaris

Provides offshore contract drilling services in Brazil, the United Kingdom, U.S.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives