- United States

- /

- Energy Services

- /

- NYSE:USAC

Debt Refinancing Move Raises New Questions About USAC’s Long-Term Leverage Strategy

Reviewed by Simply Wall St

- USA Compression Partners, LP recently completed a private placement of US$750 million in 6.250% senior unsecured notes due 2033, targeting qualified institutional buyers and non-U.S. investors.

- This debt refinancing seeks to redeem higher-coupon notes due 2027, indicating a focus on lowering interest costs and extending the company’s financial flexibility.

- We’ll explore how this refinancing initiative could impact USA Compression Partners’ long-term earnings outlook and ability to manage leverage.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

USA Compression Partners Investment Narrative Recap

Being a shareholder in USA Compression Partners means believing in the sustained demand for large-horsepower natural gas compression and the company's ability to maintain long-term contracts and distributions, even as capital costs and customer concentration remain key watch points. The recent US$750 million refinancing initiative moderately addresses short-term pressure from upcoming debt maturities, but does not fundamentally change the largest risk: reliance on a concentrated customer base for revenue stability.

One recent move closely tied to this refinancing was the Eighth Amended and Restated Credit Agreement, which extends the maturity of USAC’s senior secured credit facility until August 2030. Together, these steps slightly extend financial flexibility but do not address ongoing net margin pressure from rising costs or the need for consistent customer renewals.

By contrast, investors should be aware that even as debt costs stabilize, the concentration of revenue among just a handful of major customers means...

Read the full narrative on USA Compression Partners (it's free!)

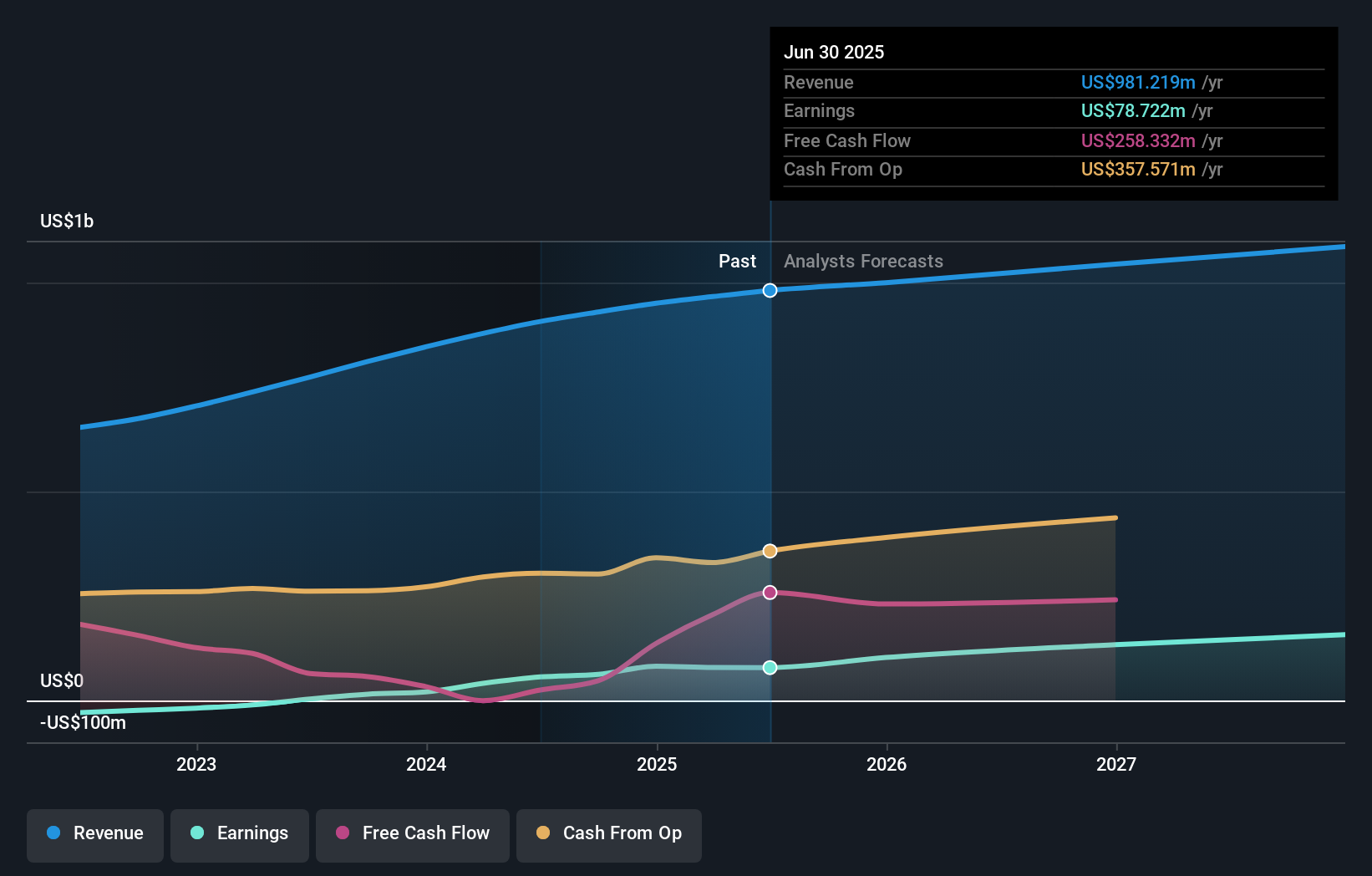

USA Compression Partners is projected to reach $1.1 billion in revenue and $185.2 million in earnings by 2028. This outlook is based on a 4.2% annual revenue growth rate and an increase in earnings of $106.5 million from current earnings of $78.7 million.

Uncover how USA Compression Partners' forecasts yield a $26.50 fair value, a 13% upside to its current price.

Exploring Other Perspectives

Three perspectives from the Simply Wall St Community estimate USAC’s fair value between US$15.01 and US$26.50 per unit. While opinions differ widely, macro and customer risks remain critical factors for ongoing company performance.

Explore 3 other fair value estimates on USA Compression Partners - why the stock might be worth 36% less than the current price!

Build Your Own USA Compression Partners Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your USA Compression Partners research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free USA Compression Partners research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate USA Compression Partners' overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USAC

USA Compression Partners

Provides natural gas compression services in the United States.

Proven track record with moderate growth potential.

Similar Companies

Market Insights

Community Narratives