- United States

- /

- Energy Services

- /

- NYSE:USAC

Assessing USA Compression Partners After Recent Earnings Miss and Share Price Dip

Reviewed by Bailey Pemberton

If you’re sitting there wondering whether USA Compression Partners deserves a spot in your portfolio, you’re not alone. It’s one of those intriguing stocks that keeps popping up on income investor watchlists, especially after such a wild ride over the last few years. The price closed most recently at $23.34, but the journey here has been anything but straightforward. In just the past week, shares have slipped by 3.3%, while the 30-day and year-to-date numbers are slightly negative, down 0.5% and 2.3% respectively. Yet, look longer term and you’ll see a different story: a robust 10.4% gain over the past year and a stunning 273.4% return over five years.

What’s behind this performance? Much of it ties back to broader developments in energy infrastructure and investor sentiment around stable, income-producing assets. Even as the market seesaws, USA Compression Partners has benefited from the steady demand for its compression services, as well as shifting perceptions of risk and growth potential. Investors are also keeping an eye on structural changes in the natural gas space. Any surprise tailwind here can quickly shift expectations and valuations.

Speaking of valuations, it’s always smart to dig a little deeper before making any moves. Based on six commonly used valuation checks, USA Compression Partners comes in with a valuation score of 3 out of 6, meaning it appears undervalued in roughly half of the areas analysts care most about. Of course, there’s more to the story than just this checklist. Let’s break down each valuation approach, and then I’ll share a smarter way to think about whether the stock is truly priced right.

Approach 1: USA Compression Partners Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) analysis tries to estimate the true value of a business today by taking its expected future cash flows and "discounting" them back into today’s dollars. This gives investors an idea of what the company could be worth if it continues to generate cash as projected, based on reasonable growth assumptions.

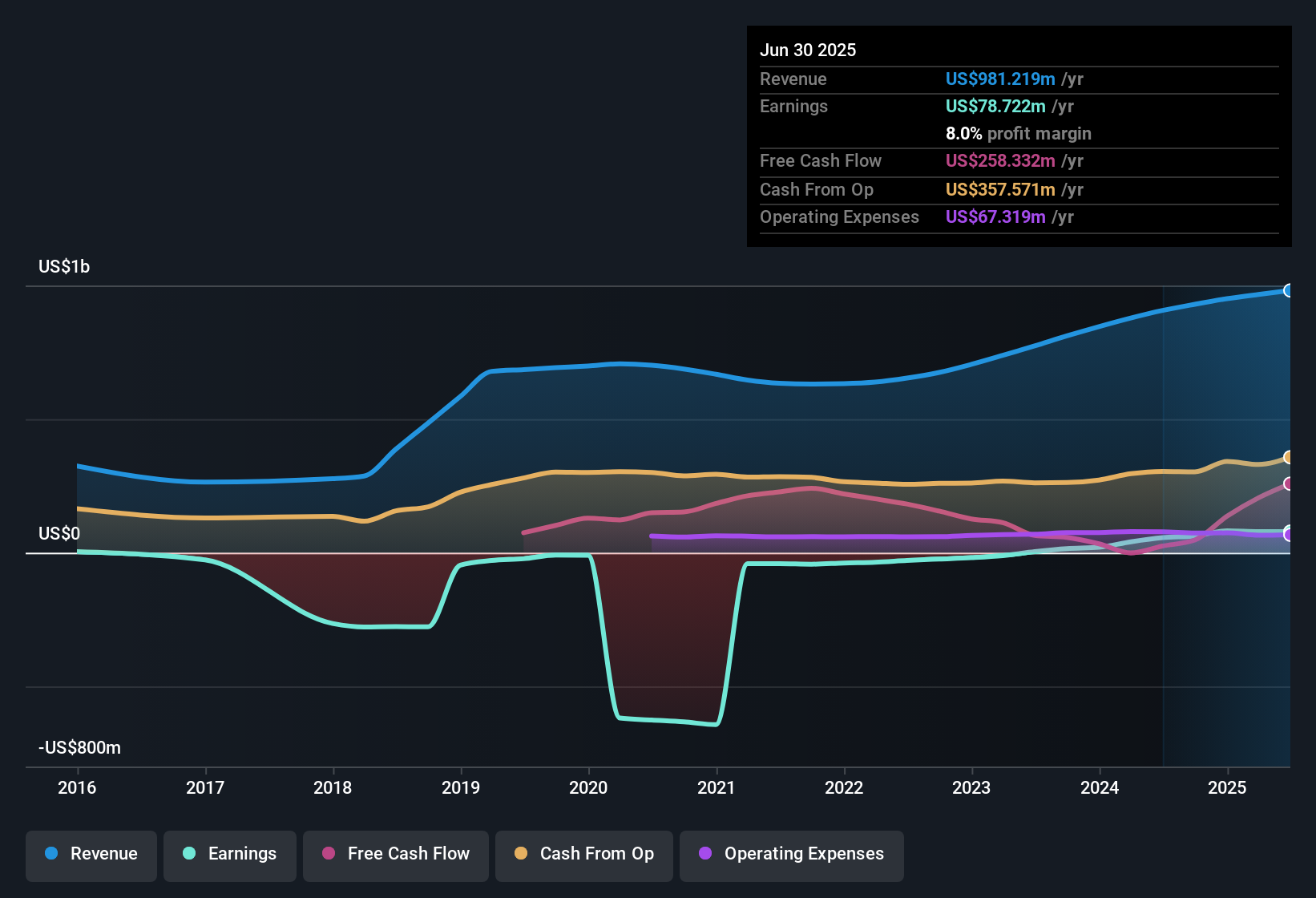

For USA Compression Partners, the latest reported Free Cash Flow sits at $145.5 Million. Analysts forecast this figure to grow steadily, projecting Free Cash Flow to reach $240.8 Million by the end of 2026. These projections extend even further, with extrapolated estimates showing potential Free Cash Flow nearing $499 Million by 2035. All values are calculated in US dollars, reflecting steady expansion in core operations and underlying demand for their services.

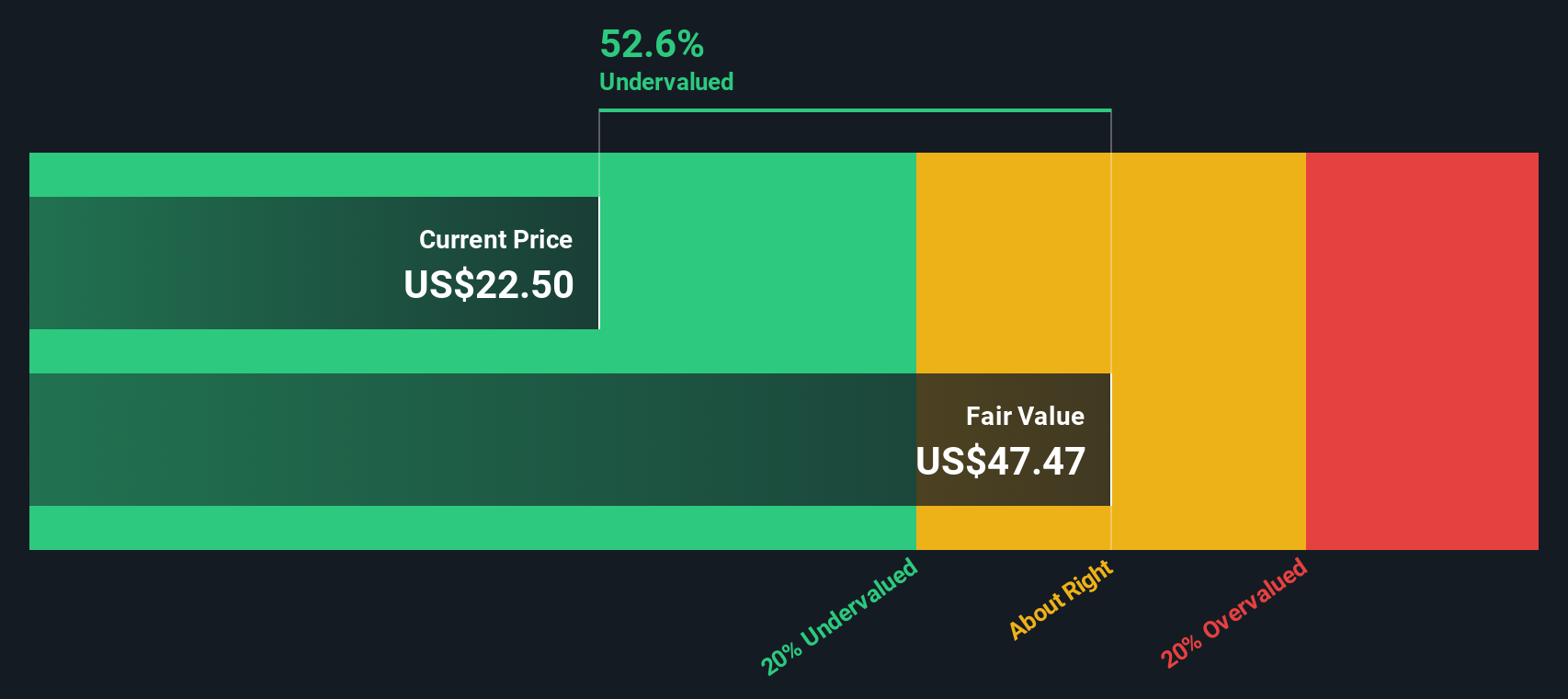

Based on these projections, Simply Wall St’s DCF model estimates the "fair value" at $47.50 per share, which represents a 50.9% premium to its most recent closing price of $23.34. This substantial intrinsic discount suggests the stock is significantly undervalued according to current cash flow expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests USA Compression Partners is undervalued by 50.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: USA Compression Partners Price vs Earnings

For companies that are consistently profitable, the Price-to-Earnings (PE) ratio is often the go-to metric for quick valuation comparisons. This ratio gives investors a sense of how much they are paying for each dollar of current earnings, making it particularly useful for companies like USA Compression Partners that reliably generate profits.

It’s important to remember, though, that what counts as a “normal” or “fair” PE ratio isn’t set in stone. Growth expectations and perceived risk play a big role; faster-growing companies, or those with highly predictable earnings, usually command higher PE ratios than riskier, slower-growing peers.

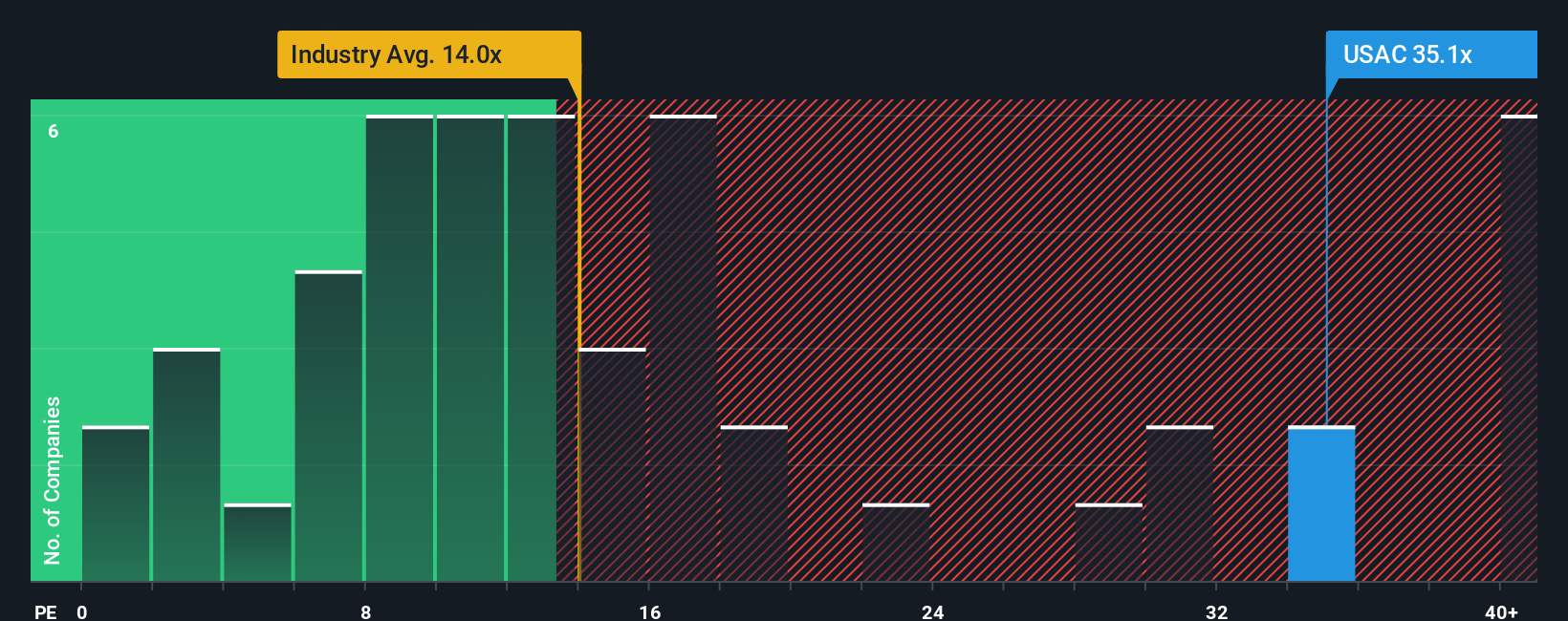

Currently, USA Compression Partners trades at a PE ratio of 36.4x. That is higher than the broader Energy Services industry average of 15.2x, but roughly in line with its peer group average of 38.8x. While these benchmarks offer a sense of context, they do not always tell the full story.

This is where Simply Wall St’s “Fair Ratio” comes in. Unlike a basic industry or peer comparison, the Fair Ratio incorporates more nuanced factors such as USA Compression Partners’ earnings growth prospects, profit margins, market capitalization, and company-specific risks. For USA Compression Partners, the Fair PE Ratio is calculated to be 19.8x.

Comparing the current PE of 36.4x to the Fair Ratio of 19.8x suggests that the stock is trading at a significant premium to what would be justified based

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your USA Compression Partners Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. Narratives are a smarter, more dynamic way to invest: they enable you to tie together your view of a company's story, such as industry trends, unique risks, and future opportunities, with your own forecasts for revenue, earnings, profit margins, and what a fair share price might be. On Simply Wall St’s Community page, millions of investors use Narratives to easily write their own perspectives and turn them into real-world financial forecasts, linking those stories directly to a calculated fair value.

Narratives empower you to clearly see how your outlook compares against the current market price and help you decide whether it might be time to buy, hold, or sell. Best of all, these Narratives are dynamic. They update automatically as new information, like recent earnings or market news, becomes available. For USA Compression Partners, for instance, one investor might believe robust LNG exports and AI-driven gas demand will drive earnings growth and support a fair value of $30.00, while another, more cautious peer sees rising costs and customer concentration risks justifying a fair value closer to $23.00. Narratives make it easy for you to build, tweak, and track your own investment case right alongside these multiple viewpoints.

Do you think there's more to the story for USA Compression Partners? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:USAC

USA Compression Partners

Provides natural gas compression services in the United States.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives