- United States

- /

- Energy Services

- /

- NYSE:TTI

TETRA Technologies (TTI) Is Up 10.6% After Magnesium JV Deal at Evergreen Project - Has The Bull Case Changed?

Reviewed by Sasha Jovanovic

- TETRA Technologies recently announced it signed a term sheet to form a joint venture with Magrathea Metals to integrate electrolytic magnesium production into its Evergreen Project in Southwest Arkansas, which is expected to produce 75 million pounds of bromine annually and recover other critical minerals like lithium and magnesium.

- This collaboration aims to help rebuild the U.S. magnesium metal defense industrial base using brine-based resources, potentially broadening TETRA’s role in critical minerals and low-carbon energy supply chains.

- Next, we’ll examine how integrating Magrathea’s magnesium technology at the Evergreen Project could reshape TETRA’s critical minerals-focused investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

TETRA Technologies Investment Narrative Recap

To own TETRA Technologies, I think you need to believe in its shift from a cyclical oilfield services and industrial chemicals business toward bromine and other critical minerals that support low carbon energy and defense supply chains. The Magrathea JV term sheet strengthens the Evergreen Project’s critical minerals angle, but the near term story still hinges on deepwater completions, industrial chemical demand, and executing Arkansas capex without cost overruns or delays.

The company’s upcoming participation in the Wells Fargo 24th Annual Energy & Power Symposium, with meetings focused on Energy Services, Industrial Chemicals, and Critical Minerals, is timely alongside the Magrathea announcement. It gives TETRA another forum to explain how Evergreen’s bromine, lithium, and magnesium potential fits with its water treatment and zinc bromide battery electrolyte catalysts, and how that might balance risks tied to deepwater and U.S. land activity cycles.

However, investors also need to be aware that if Evergreen’s ramp-up or partner demand underwhelms, the sizeable Arkansas capex could...

Read the full narrative on TETRA Technologies (it's free!)

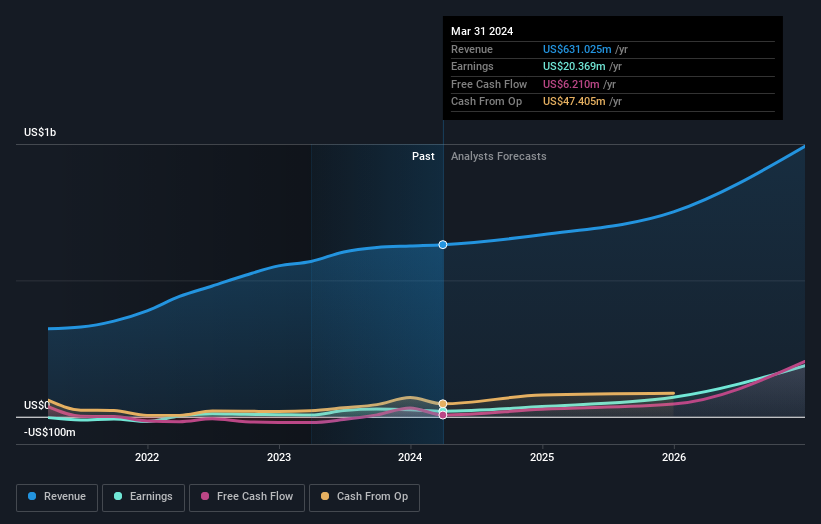

TETRA Technologies' narrative projects $661.4 million revenue and $1.8 million earnings by 2028. This requires 2.9% yearly revenue growth and a $118.6 million earnings decrease from $120.4 million today.

Uncover how TETRA Technologies' forecasts yield a $9.17 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates span from US$4.45 to about US$22.27 per share, showing how far apart individual views can be. You should weigh those opinions against the execution risk around TETRA’s Arkansas bromine and critical minerals build out, and explore several alternative viewpoints before deciding how this fits into your portfolio.

Explore 6 other fair value estimates on TETRA Technologies - why the stock might be worth 49% less than the current price!

Build Your Own TETRA Technologies Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your TETRA Technologies research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free TETRA Technologies research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate TETRA Technologies' overall financial health at a glance.

Seeking Other Investments?

Our top stock finds are flying under the radar-for now. Get in early:

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TETRA Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TTI

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026