- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Targa Resources (TRGP): Assessing Valuation Following Major Growth Project Announcements

Reviewed by Kshitija Bhandaru

Targa Resources (TRGP) is making headlines after unveiling a series of large-scale organic growth projects, including the Speedway NGL Pipeline and expanded processing capacity in the Permian Basin. These moves aim to support growing demand and future earnings growth.

See our latest analysis for Targa Resources.

Targa Resources’ recent flurry of major project announcements is helping to offset softness in its share price, which has trended down nearly 12% year-to-date. Even so, the story for long-term holders remains compelling, with a 1-year total shareholder return in positive territory and a remarkable 931% total return over five years. This signals momentum and strong value creation for patient investors.

If you’re inspired by Targa’s big growth bets, this could be a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

With shares lagging but analyst targets suggesting up to 27% upside, the key question is whether Targa stock is still undervalued after these expansion plans or if investors have already factored in the coming wave of growth.

Most Popular Narrative: 21.4% Undervalued

Compared to Targa Resources' last close of $161.30, the narrative consensus sets fair value at $205.30. This highlights a wide gap between market price and long-term earnings potential. This difference raises the stakes for investors closely watching the company’s ambitious growth initiatives as valuation narratives diverge from recent share performance.

Substantial investment in integrated export infrastructure, including the expansion and debottlenecking of LPG export facilities and new fractionation trains, directly leverages rising international and petrochemical-sector demand for U.S. NGLs. This creates long-term opportunities to enhance utilization and operating leverage, which should support higher earnings and margins.

Want to know what powers this undervalued call? The narrative relies on aggressive revenue climbs, rising profit margins, and robust long-term demand projections unlike anything seen in recent years. Curious about the bullish foundation beneath this price target? The full narrative reveals the financial leap that supports it.

Result: Fair Value of $205.30 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition in the Permian and the risk of overbuilding export infrastructure could threaten Targa’s growth outlook if market dynamics shift unexpectedly.

Find out about the key risks to this Targa Resources narrative.

Another View: Multiples Tell a Different Story

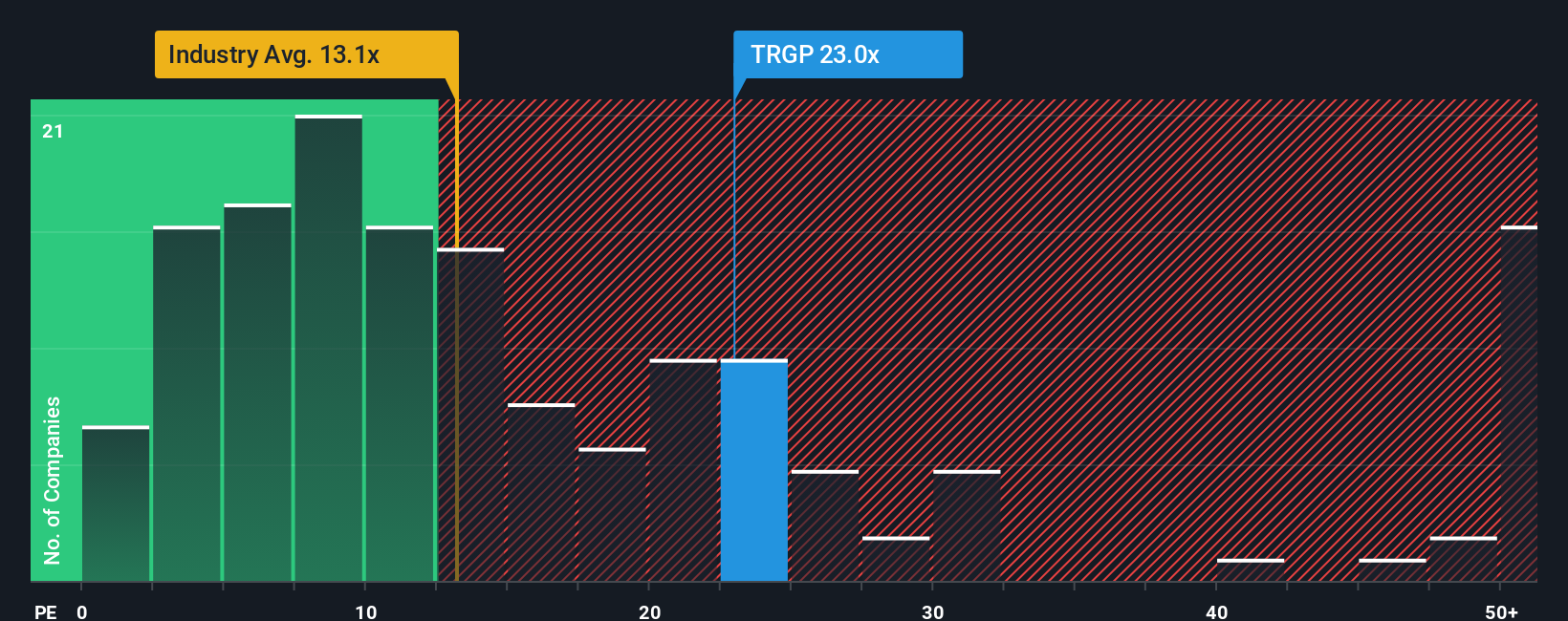

While the narrative consensus sees Targa Resources as undervalued, the company’s price-to-earnings ratio of 22.8x stands well above both the US Oil and Gas industry average (13.1x) and its own fair ratio of 19.2x. This suggests the market is already pricing in significant optimism, potentially raising the risk for new buyers. Could investors be assuming too much upside?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Targa Resources Narrative

If you’d rather form your own perspective instead of following consensus, it’s quick and easy to dig into the data and shape your own story in just minutes. Do it your way

A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Compelling Investment Ideas?

Don’t miss out on standout opportunities just waiting to be uncovered. Broaden your watchlist with smart picks tailored to the trends shaping tomorrow’s markets.

- Uncover rapid growth with these 25 AI penny stocks by focusing on artificial intelligence breakthroughs and companies leading digital transformation.

- Tap into consistent yield potential by adding these 18 dividend stocks with yields > 3%, which may offer steady returns to help support financial goals even in uncertain times.

- Catch the next wave of blockchain innovation as you spot the newest market leaders inside these 79 cryptocurrency and blockchain stocks for dynamic digital asset exposure.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives