- United States

- /

- Oil and Gas

- /

- NYSE:TRGP

Strong Earnings and Expanded Buyback Program Might Change the Case for Investing in Targa Resources (TRGP)

Reviewed by Simply Wall St

- Targa Resources recently reported second-quarter results, including revenue of US$4.26 billion and net income of US$629.1 million, alongside confirmation of a share repurchase program up to US$1 billion and full-year 2025 net income guidance of US$1.83 billion.

- Management emphasized a focus on organic growth while remaining open to bolt-on acquisitions, and continued delivering higher NGL production and robust shareholder returns through stock buybacks.

- We'll explore how Targa Resources' strong earnings and expanded buyback program potentially influence its long-term investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Targa Resources Investment Narrative Recap

To be a shareholder in Targa Resources, you need to believe in the company's ability to sustain growth in natural gas liquids (NGL) and gas volumes, supported by robust export demand and fee-based contracts. The recent earnings beat and expanded buyback program reinforce management’s focus on driving higher per-share returns, but do not fundamentally alter the main short-term catalyst, expanding NGL export capacity, nor the persistent risk of midstream overbuild and increased competition in key regions.

The announcement of a new US$1 billion share repurchase program stands out, as it directly supports per-share earnings and underscores the company’s confidence in its financial position and future cash flows. This ties in with the most significant catalyst: continued growth from new processing and export facility capacity coming online, which is central to Targa’s near-term outlook.

Yet, against this optimism, investors should be aware that increased competition and potential margin compression from maturing contracts in key basins...

Read the full narrative on Targa Resources (it's free!)

Targa Resources' outlook anticipates $23.3 billion in revenue and $2.4 billion in earnings by 2028. This scenario assumes an 11.0% annual revenue growth rate and a $0.9 billion increase in earnings from the current $1.5 billion.

Uncover how Targa Resources' forecasts yield a $205.97 fair value, a 26% upside to its current price.

Exploring Other Perspectives

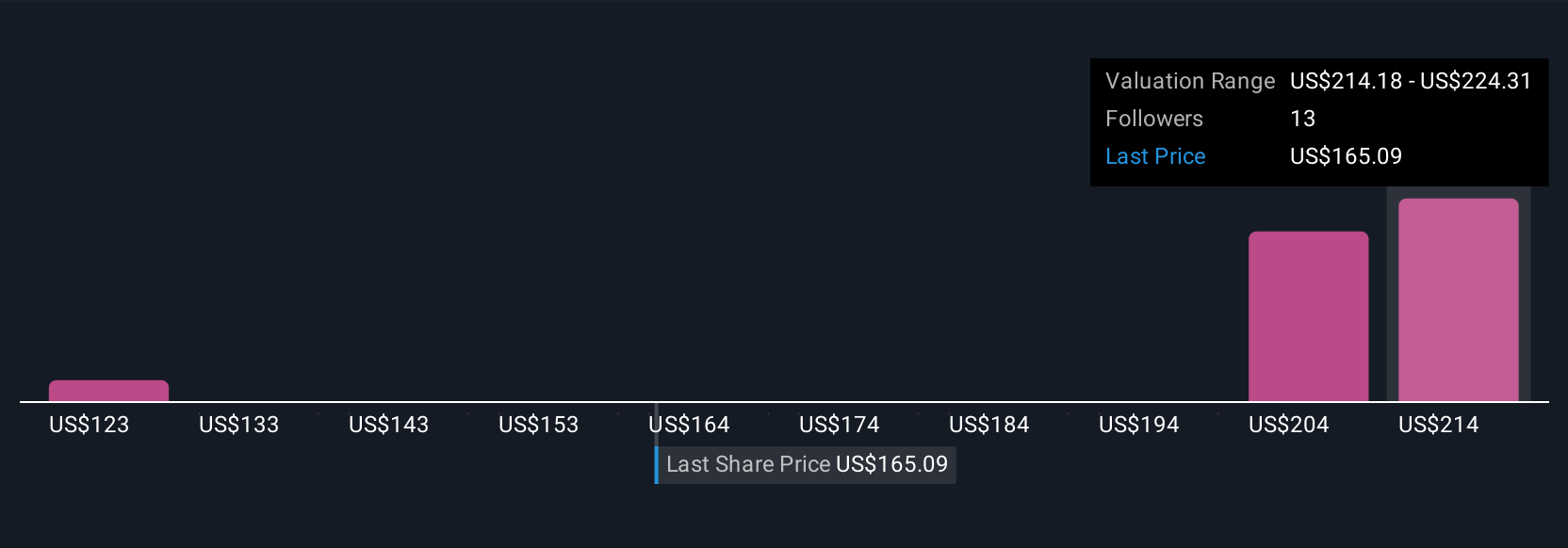

Five members of the Simply Wall St Community estimate Targa’s fair value between US$123 and US$224.31 per share. While the company’s ongoing NGL infrastructure expansions fuel optimism among some, others may focus on the sector’s competitive pressures and the impact these could have on future margins, reminding you there are always several alternative viewpoints to consider.

Explore 5 other fair value estimates on Targa Resources - why the stock might be worth 24% less than the current price!

Build Your Own Targa Resources Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Targa Resources research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Targa Resources research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Targa Resources' overall financial health at a glance.

Ready For A Different Approach?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Outshine the giants: these 20 early-stage AI stocks could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- AI is about to change healthcare. These 27 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Targa Resources might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TRGP

Targa Resources

Together with its subsidiary, Targa Resources Partners LP, owns, operates, acquires, and develops a portfolio of complementary domestic infrastructure assets in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives