- United States

- /

- Oil and Gas

- /

- NYSE:TPL

Should TPL Investors Reconsider Outlook After Dual Listing Plan and Q2 Earnings Miss?

Reviewed by Sasha Jovanovic

- Texas Pacific Land Corporation announced in the past week that it will dual list its common stock on the new NYSE Texas exchange effective August 15, 2025, while retaining its primary listing on the New York Stock Exchange.

- This update coincided with the company's Q2 2025 earnings falling short of analyst expectations, highlighting both operational challenges and efforts to broaden its shareholder base and visibility.

- We'll explore how the earnings miss and dual listing plan may shift expectations around Texas Pacific Land's future revenue growth and market positioning.

Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

Texas Pacific Land Investment Narrative Recap

To be a shareholder of Texas Pacific Land, confidence in sustained royalty production growth and diversification of high-margin water services is essential, as both support stable income and cash flow. The recent NYSE Texas dual listing announcement has not brought an immediate catalyst or risk shift, while the earnings miss highlights ongoing challenges for meeting revenue and margin expectations; for now, the fundamental drivers and risks remain largely unchanged.

One recent announcement worth noting is the board's approval of amended bylaws granting proxy access rights to shareholders, reflecting a strengthening of corporate governance in a period of increased shareholder scrutiny. This added transparency could factor into sentiment, especially as investors remain focused on whether royalty volumes can keep pace with cash flow assumptions.

However, investors should be alert to regulatory and environmental risks impacting TPL’s heavy reliance on Permian Basin activity, particularly since...

Read the full narrative on Texas Pacific Land (it's free!)

Texas Pacific Land's narrative projects $895.3 million revenue and $610.3 million earnings by 2028. This requires 7.2% yearly revenue growth and a $150.1 million increase in earnings from $460.2 million currently.

Uncover how Texas Pacific Land's forecasts yield a $921.93 fair value, in line with its current price.

Exploring Other Perspectives

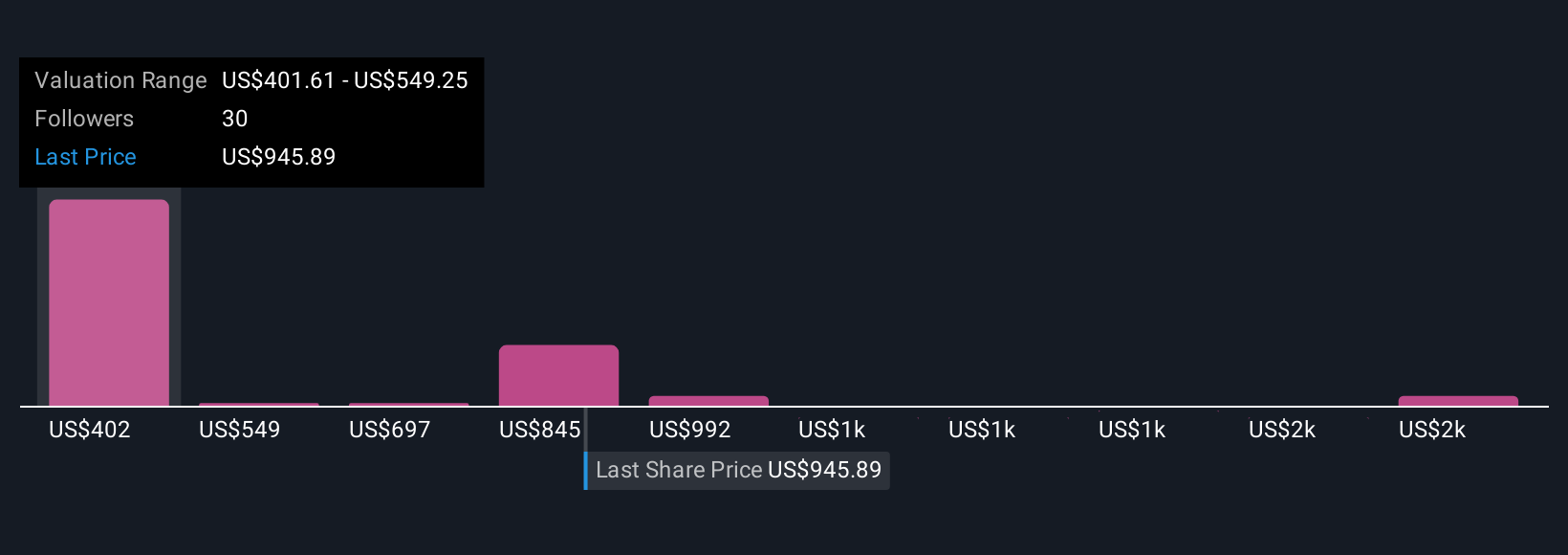

Thirteen members of the Simply Wall St Community estimate Texas Pacific Land’s fair value anywhere from US$401.61 to US$1,790.78 a share. With reliance on Permian Basin activity identified as a core risk, readers can explore how varied outlooks inform diverse expectations for the company’s resilience.

Explore 13 other fair value estimates on Texas Pacific Land - why the stock might be worth as much as 93% more than the current price!

Build Your Own Texas Pacific Land Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Texas Pacific Land research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Texas Pacific Land research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Texas Pacific Land's overall financial health at a glance.

Want Some Alternatives?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Texas Pacific Land might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TPL

Texas Pacific Land

Engages in the land and resource management, and water services and operations businesses.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives