- United States

- /

- Oil and Gas

- /

- NYSE:TNK

Will Recent Trading Surges Reveal Deeper Shifts in Teekay Tankers’ (TNK) Market Position?

Reviewed by Simply Wall St

- In the past week, Teekay Tankers experienced heightened trading activity following several consecutive sessions of gains, attributed to improving conditions in the tanker shipping market.

- Despite increased interest, there have been no significant changes to consensus earnings forecasts, indicating that recent optimism is tied more to sector sentiment than any company-specific news.

- We will examine how optimism in the tanker market, reflected in recent trading volumes, could impact Teekay Tankers' investment outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Teekay Tankers Investment Narrative Recap

To be a shareholder in Teekay Tankers, you need confidence that seaborne crude demand will remain resilient despite headwinds from slowing global oil demand and increased pressure to decarbonize. The recent share price surge, fueled by improved tanker market sentiment, is encouraging, but consensus forecasts for earnings have not shifted, meaning the most important catalysts, sector utilization and vessel earnings, remain driven by global trade flows. For now, the primary risk of market volatility tied to oil demand and environmental policy appears unchanged and should stay front of mind.

Among recent announcements, the quarterly dividend declaration of US$0.25 per share stands out as most relevant for investors seeking steady returns, particularly as tanker market optimism rises. Dividend stability can appeal to income-focused shareholders but remains contingent on vessel utilization and sector profitability, both of which are presently shaped more by macro factors than company-specific developments.

However, in contrast to improved trading volume and share gains, investors should be aware of the persistent risk from regulatory changes and volatile tanker rates that could...

Read the full narrative on Teekay Tankers (it's free!)

Teekay Tankers' outlook projects $464.3 million in revenue and $238.5 million in earnings by 2028. This involves a yearly revenue decline of 22.5% and a $43.8 million decrease in earnings from the current $282.3 million.

Uncover how Teekay Tankers' forecasts yield a $53.33 fair value, in line with its current price.

Exploring Other Perspectives

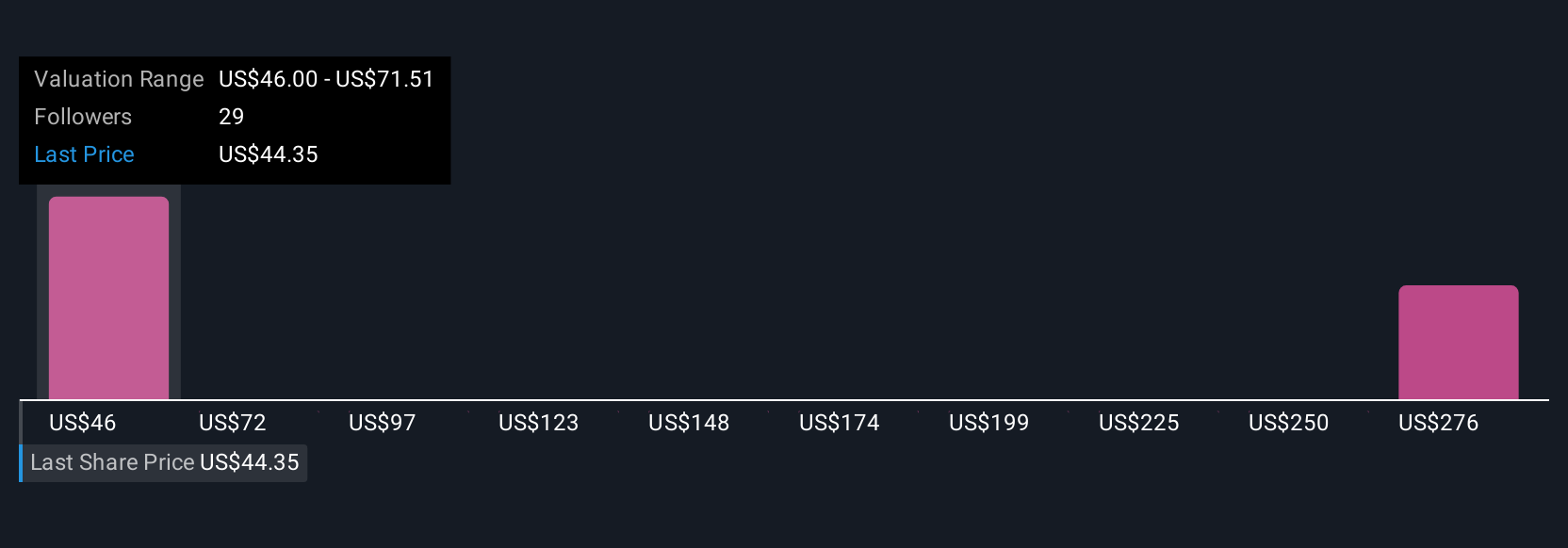

Five members of the Simply Wall St Community set fair value estimates for Teekay Tankers between US$46 and US$296, with most values clustering well above the current share price. With vessel utilization and regulatory risk remaining key uncertainties, you can explore a spectrum of opinions about what drives the company’s long-term prospects.

Explore 5 other fair value estimates on Teekay Tankers - why the stock might be worth over 5x more than the current price!

Build Your Own Teekay Tankers Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Teekay Tankers research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Teekay Tankers research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Teekay Tankers' overall financial health at a glance.

Want Some Alternatives?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Teekay Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:TNK

Teekay Tankers

Provides marine transportation services to oil industries in Bermuda and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives