- United States

- /

- Energy Services

- /

- NYSE:TDW

What Type Of Shareholders Own The Most Number of Tidewater Inc. (NYSE:TDW) Shares?

Every investor in Tidewater Inc. (NYSE:TDW) should be aware of the most powerful shareholder groups. Institutions will often hold stock in bigger companies, and we expect to see insiders owning a noticeable percentage of the smaller ones. We also tend to see lower insider ownership in companies that were previously publicly owned.

With a market capitalization of US$497m, Tidewater is a small cap stock, so it might not be well known by many institutional investors. Our analysis of the ownership of the company, below, shows that institutions own shares in the company. Let's delve deeper into each type of owner, to discover more about Tidewater.

View our latest analysis for Tidewater

What Does The Institutional Ownership Tell Us About Tidewater?

Institutional investors commonly compare their own returns to the returns of a commonly followed index. So they generally do consider buying larger companies that are included in the relevant benchmark index.

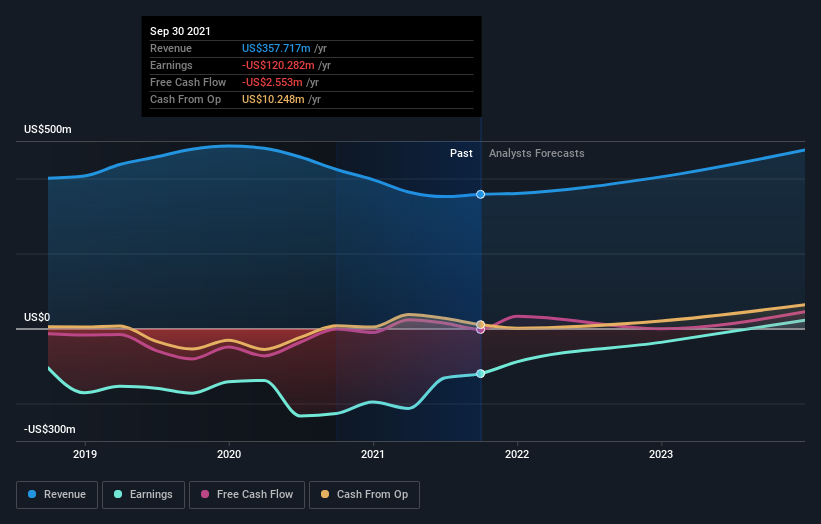

As you can see, institutional investors have a fair amount of stake in Tidewater. This suggests some credibility amongst professional investors. But we can't rely on that fact alone since institutions make bad investments sometimes, just like everyone does. If multiple institutions change their view on a stock at the same time, you could see the share price drop fast. It's therefore worth looking at Tidewater's earnings history below. Of course, the future is what really matters.

Institutional investors own over 50% of the company, so together than can probably strongly influence board decisions. Tidewater is not owned by hedge funds. The company's largest shareholder is T. Rowe Price Group, Inc., with ownership of 19%. Meanwhile, the second and third largest shareholders, hold 6.8% and 6.0%, of the shares outstanding, respectively. Additionally, the company's CEO Quintin Kneen directly holds 0.7% of the total shares outstanding.

We did some more digging and found that 7 of the top shareholders account for roughly 54% of the register, implying that along with larger shareholders, there are a few smaller shareholders, thereby balancing out each others interests somewhat.

While studying institutional ownership for a company can add value to your research, it is also a good practice to research analyst recommendations to get a deeper understand of a stock's expected performance. There are a reasonable number of analysts covering the stock, so it might be useful to find out their aggregate view on the future.

Insider Ownership Of Tidewater

The definition of an insider can differ slightly between different countries, but members of the board of directors always count. Management ultimately answers to the board. However, it is not uncommon for managers to be executive board members, especially if they are a founder or the CEO.

Insider ownership is positive when it signals leadership are thinking like the true owners of the company. However, high insider ownership can also give immense power to a small group within the company. This can be negative in some circumstances.

Shareholders would probably be interested to learn that insiders own shares in Tidewater Inc.. It has a market capitalization of just US$497m, and insiders have US$14m worth of shares, in their own names. Some would say this shows alignment of interests between shareholders and the board. But it might be worth checking if those insiders have been selling.

General Public Ownership

With a 18% ownership, the general public, mostly comprising of individual investors, have some degree of sway over Tidewater. This size of ownership, while considerable, may not be enough to change company policy if the decision is not in sync with other large shareholders.

Next Steps:

While it is well worth considering the different groups that own a company, there are other factors that are even more important.

I like to dive deeper into how a company has performed in the past. You can access this interactive graph of past earnings, revenue and cash flow, for free.

If you are like me, you may want to think about whether this company will grow or shrink. Luckily, you can check this free report showing analyst forecasts for its future.

NB: Figures in this article are calculated using data from the last twelve months, which refer to the 12-month period ending on the last date of the month the financial statement is dated. This may not be consistent with full year annual report figures.

Valuation is complex, but we're here to simplify it.

Discover if Tidewater might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:TDW

Tidewater

Provides offshore support vessels and marine support services to the offshore energy industry through the operation of a fleet of offshore marine service vessels worldwide.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Growing between 25-50% for the next 3-5 years

SLI is share to watch next 5 years

The "Molecular Pencil": Why Beam's Technology is Built to Win

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026