- United States

- /

- Oil and Gas

- /

- NYSE:SOC

Assessing Sable Offshore’s Valuation After Shares Drop 36% Amid Offshore Energy Volatility

Reviewed by Bailey Pemberton

Trying to decide what to do with Sable Offshore stock? You are not alone. After all, the share price has tumbled sharply over the past month, down nearly 36% in 30 days and just over 29% in the past week. Year to date, the stock has slid more than 39%, leaving many investors wondering whether this is a long-term buying opportunity or a red flag. Despite these setbacks, Sable Offshore still boasts a 42.7% gain over the past three years, which might catch the eye of those focused on the bigger picture.

Some of these price swings have come amid shifting market sentiment toward offshore energy companies. With renewed discussions about energy infrastructure and changing outlooks on global supply and demand, investors have been quick to adjust their expectations, sometimes too quickly. For Sable Offshore, this has led to a rollercoaster in share price as confidence wavers and rallies.

But does the current price really reflect the company’s true value? If we look at Sable Offshore’s valuation score, a simple tally based on six key checks for undervaluation, it scores just 2 out of 6. This suggests there may be some value hidden here, but it is not screamingly cheap by most traditional metrics. Before you make your next move, let us break down how we arrive at that score, using the main valuation approaches, and then, a little later, take a look at an approach to valuation that investors often overlook.

Sable Offshore scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sable Offshore Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s worth by projecting its future cash flows, then discounting those forecasts back to today’s value. This approach is especially helpful for companies whose future profitability is expected to change significantly compared to today.

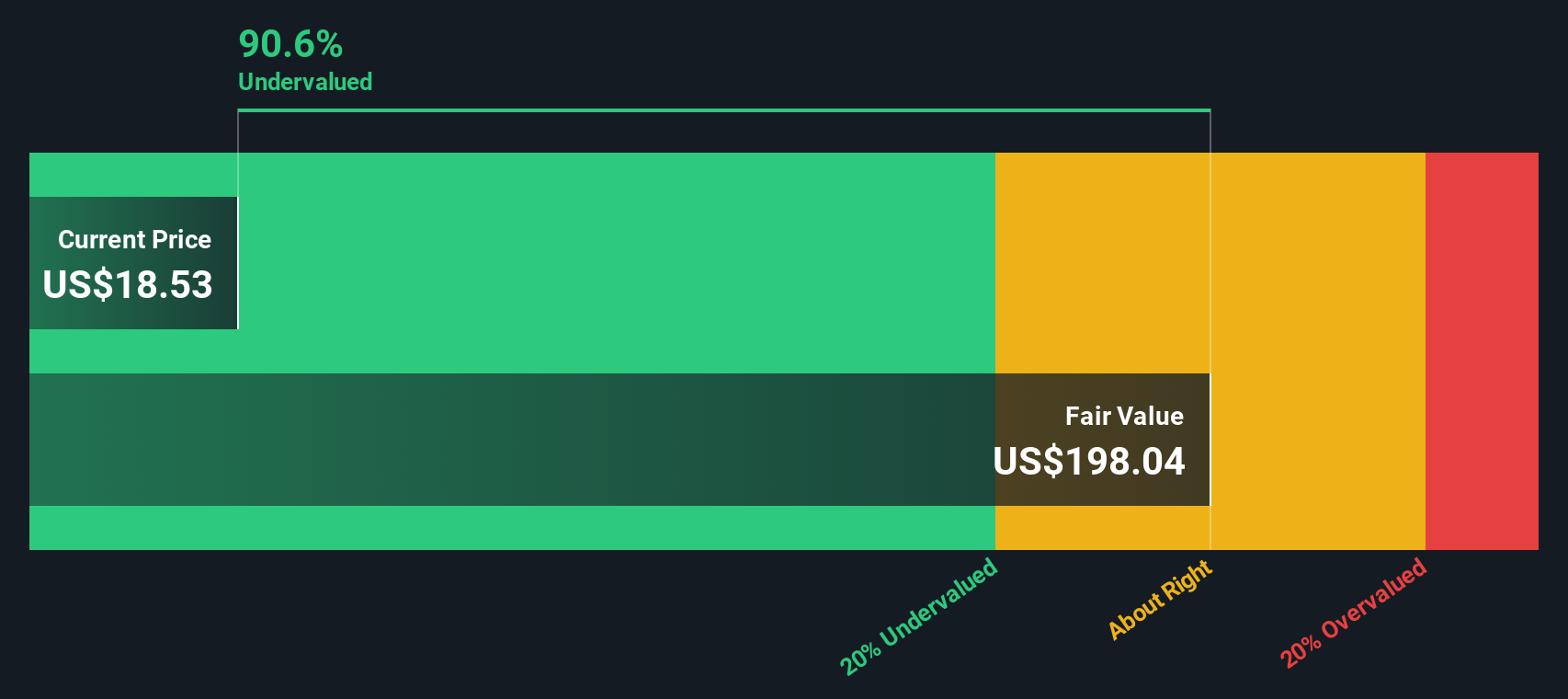

For Sable Offshore, the current Free Cash Flow sits at -$473 Million, indicating negative cash generation over the last twelve months. However, projections suggest a rapid change in fortune, with analysts expecting Free Cash Flow to rise to $279 Million by 2026. Beyond the near-term analyst estimates, long-range projections as extrapolated by Simply Wall St reflect expectations of a steady ramp up, reaching over $1.3 Billion by 2035. These forecasts are discounted to their current value using standard valuation principles, giving more weight to nearer-term, more credible cash flows.

The result of this 2 Stage Free Cash Flow to Equity DCF analysis is an estimated fair value of $204.92 per share. Compared to the current share price, this suggests Sable Offshore is trading at a hefty discount of roughly 93.1%. This signals a significant undervaluation by the market based on today’s forecasts and growth expectations.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Sable Offshore is undervalued by 93.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Sable Offshore Price vs Book

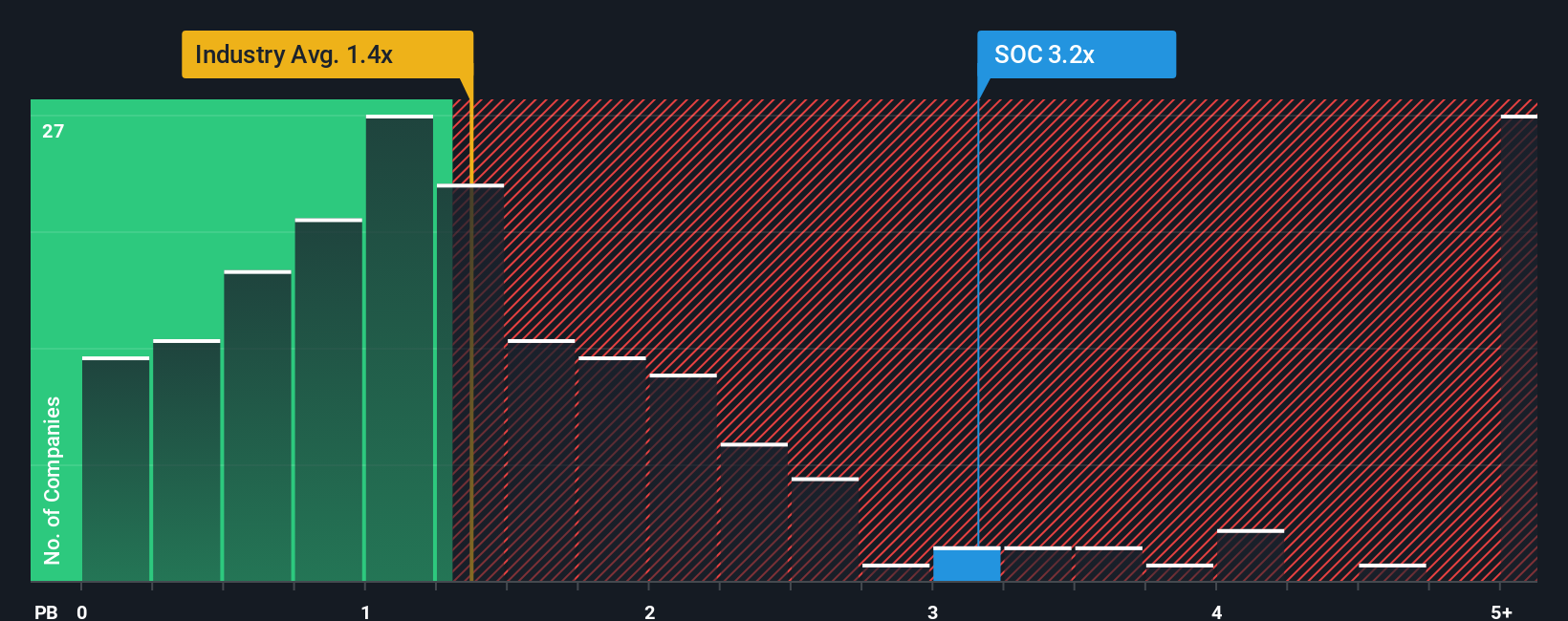

The Price-to-Book (P/B) ratio is a favored valuation metric for companies with volatile earnings or those still working toward consistent profitability, such as Sable Offshore. The P/B ratio offers insight into how much investors are willing to pay for each dollar of net assets on the balance sheet, making it well-suited for evaluating asset-heavy businesses in the Oil and Gas industry.

That said, "fair" multiples can swing widely based on a company’s growth prospects and risk profile. Companies with higher anticipated returns or lower risk profiles often justify richer multiples, while more mature or riskier players typically command less. For Sable Offshore, the current P/B is 3.16x, which is well above both its peer average of 0.78x and the industry average of 1.37x. At first glance, this might signal the stock is expensive relative to its tangible assets and competitors.

However, Simply Wall St’s proprietary “Fair Ratio” adapts these valuations to the specific context of each company. Instead of just comparing to peers or sector averages, the Fair Ratio factors in Sable Offshore’s unique attributes, such as expected earnings growth, risk, profit margins, and market capitalization. This tailored benchmark offers a more precise valuation gauge, one that goes beyond simple comparisons with the industry.

Comparing the Fair Ratio with Sable Offshore’s current P/B shows the valuation is about right, as the difference is less than 0.10x. This suggests the market’s pricing is closely aligned with the company’s fundamentals and outlook.

Result: ABOUT RIGHT

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Sable Offshore Narrative

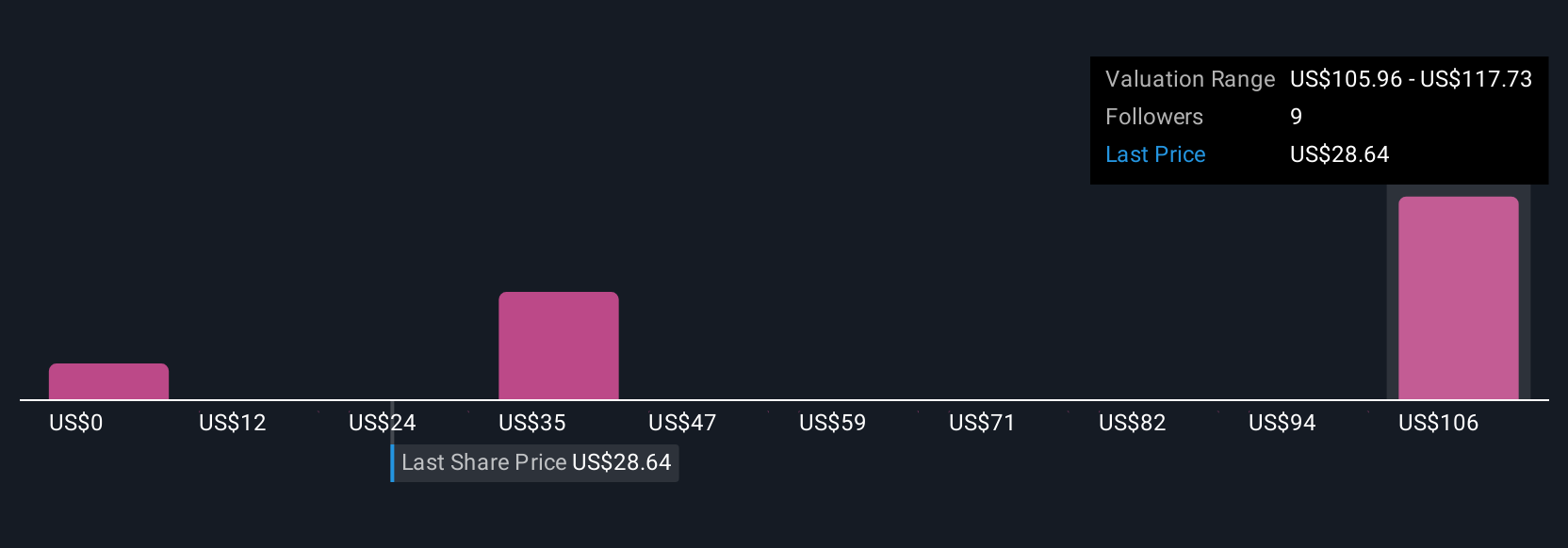

Earlier, we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized investment story. It is where your views about Sable Offshore’s future, such as revenue growth, profit margins, and fair value, come together in a single forecast. Narratives connect the company’s background and outlook to the actual numbers, turning a simple financial model into a story you believe in.

On Simply Wall St’s Community page, Narratives make finding your investment stance easy and accessible, letting millions of investors compare their outlook with others. They help you make better decisions by showing whether your Fair Value matches the current Price, and are kept up to date automatically when fresh news, earnings, or market shifts arise. For example, some investors see Sable Offshore as worth far more based on strong turnaround prospects, while others are far more cautious depending on their outlook and assumptions. With Narratives, you can see these perspectives and decide where you stand.

Do you think there's more to the story for Sable Offshore? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SOC

Sable Offshore

Operates as an independent oil and gas company in the United States.

High growth potential with slight risk.

Similar Companies

Market Insights

Community Narratives