- United States

- /

- Energy Services

- /

- NYSE:SMHI

SEACOR Marine Holdings' (NYSE:SMHI) Earnings Aren't As Good As They Appear

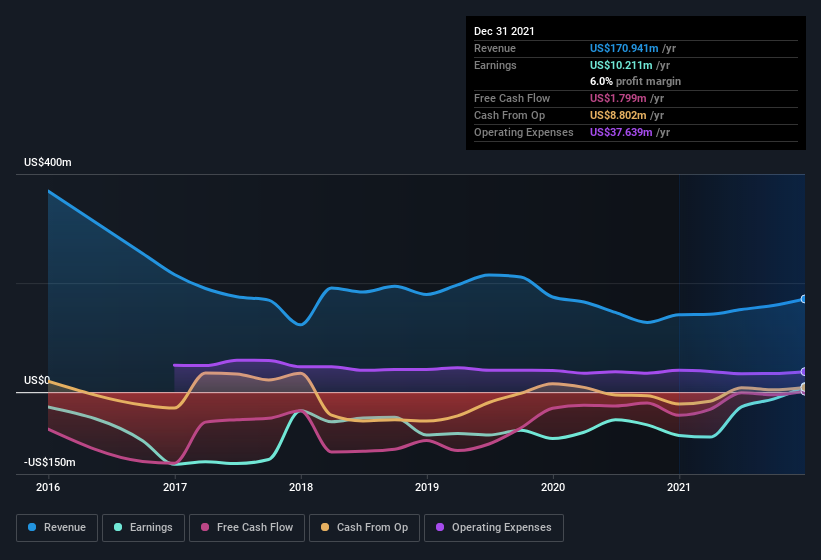

Investors were disappointed with SEACOR Marine Holdings Inc.'s (NYSE:SMHI) recent earnings release. We did some analysis and believe that they might be concerned about some weak underlying factors.

See our latest analysis for SEACOR Marine Holdings

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. As it happens, SEACOR Marine Holdings issued 11% more new shares over the last year. As a result, its net income is now split between a greater number of shares. Per share metrics like EPS help us understand how much actual shareholders are benefitting from the company's profits, while the net income level gives us a better view of the company's absolute size. You can see a chart of SEACOR Marine Holdings' EPS by clicking here.

A Look At The Impact Of SEACOR Marine Holdings' Dilution on Its Earnings Per Share (EPS).

SEACOR Marine Holdings was losing money three years ago. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. What we do know is that while it's great to see a profit over the last twelve months, that profit would have been better, on a per share basis, if the company hadn't needed to issue shares. And so, you can see quite clearly that dilution is influencing shareholder earnings.

In the long term, if SEACOR Marine Holdings' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For that reason, you could say that EPS is more important that net income in the long run, assuming the goal is to assess whether a company's share price might grow.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Alongside that dilution, it's also important to note that SEACOR Marine Holdings' profit was boosted by unusual items worth US$82m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. Which is hardly surprising, given the name. SEACOR Marine Holdings had a rather significant contribution from unusual items relative to its profit to December 2021. As a result, we can surmise that the unusual items are making its statutory profit significantly stronger than it would otherwise be.

Our Take On SEACOR Marine Holdings' Profit Performance

To sum it all up, SEACOR Marine Holdings got a nice boost to profit from unusual items; without that, its statutory results would have looked worse. And furthermore, it went and issued plenty of new shares, ensuring that each shareholder (who did not tip more money in) now owns a smaller proportion of the company. Considering all this we'd argue SEACOR Marine Holdings' profits probably give an overly generous impression of its sustainable level of profitability. So while earnings quality is important, it's equally important to consider the risks facing SEACOR Marine Holdings at this point in time. To that end, you should learn about the 5 warning signs we've spotted with SEACOR Marine Holdings (including 2 which are a bit unpleasant).

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there is always more to discover if you are capable of focussing your mind on minutiae. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:SMHI

SEACOR Marine Holdings

Provides marine and support transportation services to offshore oil, natural gas, and windfarm facilities in the United States, Africa, Europe, the Middle East, Asia, and Latin America.

Mediocre balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives