- United States

- /

- Oil and Gas

- /

- NYSE:SM

Is SM Energy a Bargain After Its Recent 12.6% Drop?

Reviewed by Bailey Pemberton

If you’re thinking about what to do with your SM Energy shares, or if you’re considering making a move, you’re hardly alone. It can be tough to make a confident call when a stock has seen its price swing so much lately. Over just the past week, SM Energy dropped a sizable 12.6%, with the 30-day move showing a slide of 15.5%. Year to date, it’s down 43.7%, and even over the past year it’s off by 49.1%. That said, there’s some serious history here. Zoom out to five years and the stock is up by more than 1,490%. That kind of long-term return can get even the most cautious investors curious about what’s happening beneath the surface.

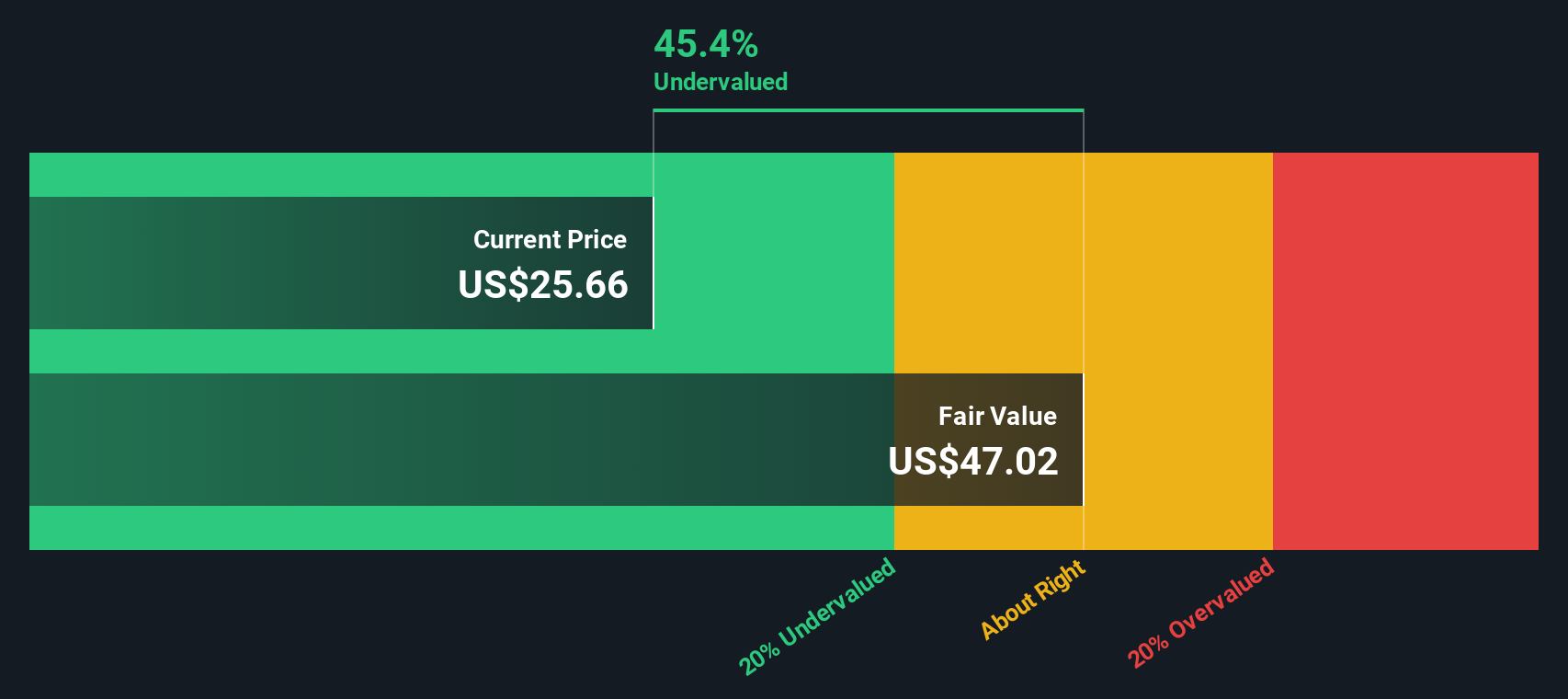

Some of these recent moves tie back to ongoing volatility in the energy sector, as well as broader market shifts that have led investors to reassess their risk appetite. But here’s where it gets interesting: when it comes to valuation, SM Energy stands out. Out of six common valuation checks, it comes up as undervalued in five, giving the company a strong value score of 5. That’s a signal that the steep declines may not have fully captured the company’s underlying worth, or at least that there’s more to the story than just price momentum and market sentiment.

Let’s dig into those valuation methods, see where SM Energy shines, and explore whether a traditional approach is enough, or if you’ll want to look at valuation from an even better perspective.

Why SM Energy is lagging behind its peers

Approach 1: SM Energy Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company's intrinsic value by projecting future cash flows and discounting them back to today's value. This helps investors see what a company could be worth, based on its future earnings potential, rather than just its current market price.

For SM Energy, the model uses a two-stage Free Cash Flow to Equity approach. The company’s most recent twelve months saw a free cash outflow of $148.9 Million, but analysts expect this trend to reverse. Analyst estimates provide Free Cash Flow projections for the next five years, with values like $650.5 Million in 2026 and $415 Million in 2029. Beyond analyst estimates, Simply Wall St extrapolates that cash flows will stay between roughly $344 Million and $343 Million per year by 2032 to 2035.

All cash flows are calculated in US Dollars. When these future flows are discounted to today’s value, the DCF model arrives at an estimated fair value of $52.68 per share. Compared to the current market price, this implies the stock is 57.1% undervalued.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SM Energy is undervalued by 57.1%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SM Energy Price vs Earnings

For companies generating solid profits like SM Energy, the Price-to-Earnings (PE) ratio is one of the most useful metrics to gauge valuation. PE tells us how much investors are willing to pay today for a dollar of current earnings, making it especially relevant for profitable companies in mature industries.

However, a “normal” or “fair” PE ratio can vary widely between companies depending on expectations for future growth as well as the risks involved. High-growth companies or those with more stable earnings often command higher PE ratios, while increased uncertainty or lower growth prospects can pull these multiples lower.

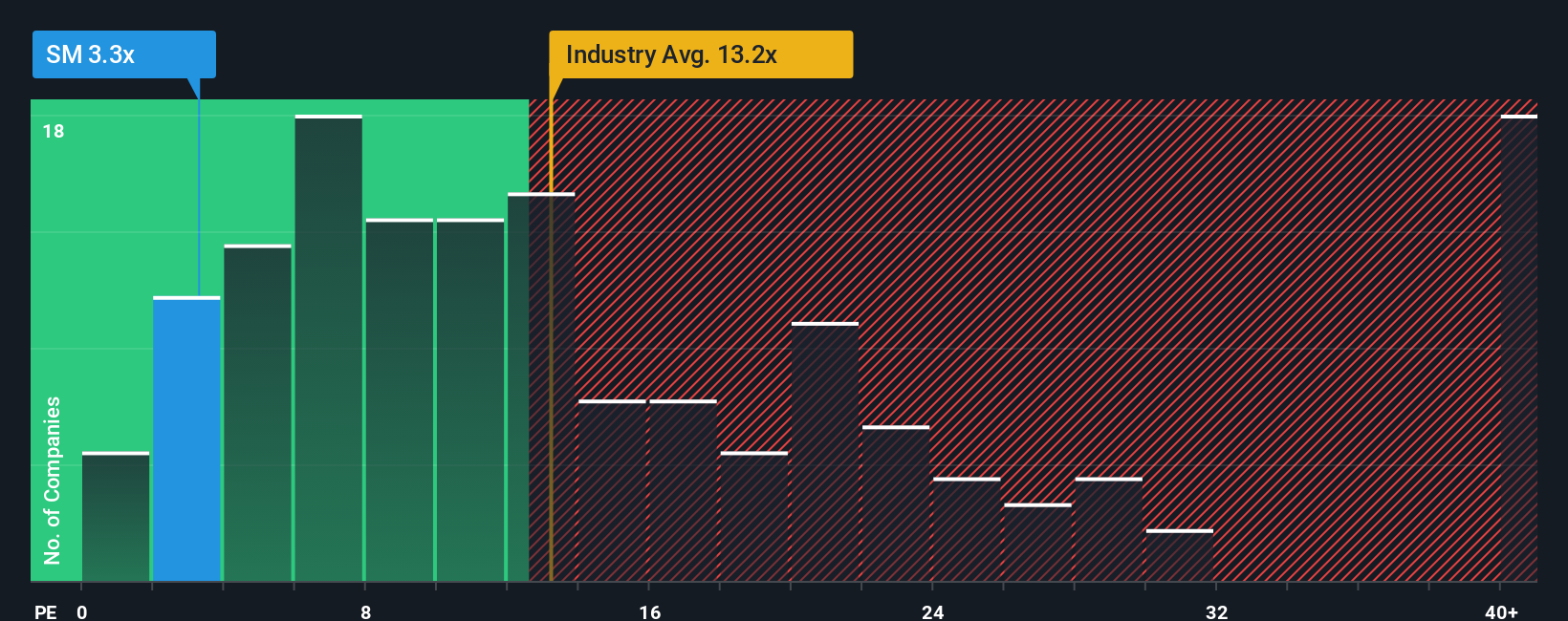

Looking at SM Energy, its current PE ratio sits at just 3.2x, which is very low compared to the Oil and Gas industry average of 13.2x and a peer group average of 10.5x. On the surface, this suggests the stock is trading at a significant discount. But there is another layer to consider. Simply Wall St’s “Fair Ratio” is a proprietary benchmark that estimates what PE multiple is truly reasonable for SM Energy right now, factoring in details like its earnings growth, industry, profitability, market capitalization, and risk factors.

Because this Fair Ratio is tailored to the company’s own financials and outlook, instead of relying only on broad peer or industry comparisons, it gives a more accurate picture of what SM Energy “should” be worth. For SM Energy, the Fair Ratio is 11.6x, well above the current PE. That indicates the market is likely undervaluing the company's earnings power, even after accounting for risks and other company-specific factors.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SM Energy Narrative

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your own, plain-language story about what you believe will drive a company's future. It combines your assumptions about a company’s prospects with forecasts for its future revenue, earnings, and margins, resulting in your unique estimate of its fair value. Narratives link a company's story directly to the numbers, turning abstract financial assumptions into a concrete investment view that is easy to build and update.

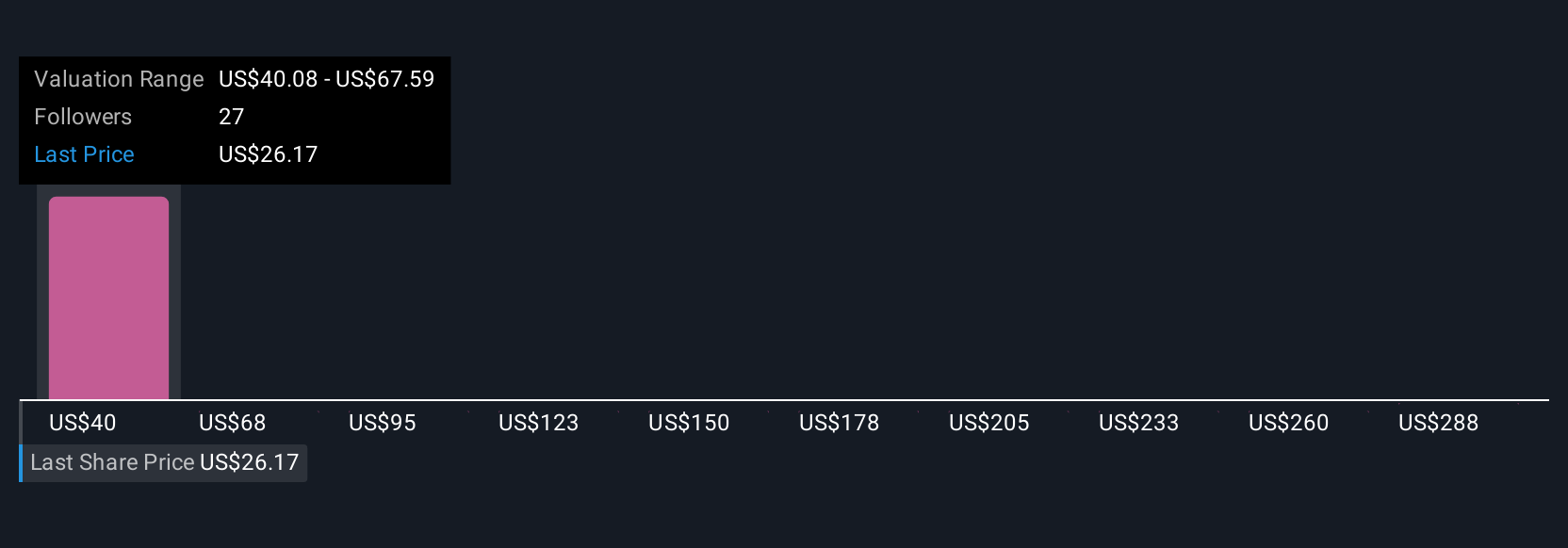

Simply Wall St’s Community page offers an accessible way to create, compare, and follow Narratives, helping millions of investors decide when to buy or sell by seeing how their Fair Value compares to the current Price. Narratives update automatically as new financial results or news are released, allowing you to adjust your perspective with the latest information. For example, some investors currently expect SM Energy’s fair value as high as $59 based on robust production growth and operational strength, while others see risks and value it closer to $27. Narratives let you make sense of these differing, dynamic viewpoints and choose the one that fits your outlook best.

Do you think there's more to the story for SM Energy? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SM

SM Energy

An independent energy company, engages in the acquisition, exploration, development, and production of oil, gas, and natural gas liquids in the state of Texas.

Undervalued average dividend payer.

Similar Companies

Market Insights

Community Narratives