- United States

- /

- Oil and Gas

- /

- NYSE:SFL

Are SFL Shares a Bargain After 10% Drop in June 2025?

Reviewed by Bailey Pemberton

If you have been keeping an eye on SFL lately, you might be feeling a little torn. On one hand, the numbers over the last month look rough, with shares slipping 10.3% and the stock down 29.2% year-to-date. Even the one-year return sits at a disappointing -28.6%. But zoom out and the longer-term picture tells a different story, with the stock still up over 57% in the last five years. Is this turbulent ride a warning sign, or does it suggest SFL is simply experiencing a dip before the next big climb?

There have been some interesting market developments adding to the recent volatility. Shifting sentiment in the sector has pushed risk perception higher, and broader market jitters have certainly played their part. Still, the resilience SFL has shown over the last few years hints there could be more behind these price swings than meets the eye. Maybe, just maybe, an opportunity exists for investors with patience.

Here's what really stands out for value-focused investors: SFL currently scores a 4 out of 6 on key valuation checks. That suggests it passes most measures of undervaluation, but not all, so there’s room for debate about whether it's a bargain or a value trap. Next, we'll break down exactly which valuation methods SFL excels in and where it falls short, and then take a look at a surprisingly powerful way to gauge whether this stock deserves a place in your portfolio.

Why SFL is lagging behind its peers

Approach 1: SFL Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s intrinsic value by projecting its future cash flows and then discounting them back to today’s dollars. This approach focuses on how much cash SFL is expected to generate each year and what that’s worth to investors right now.

SFL’s latest reported Free Cash Flow is negative, at -$159 Million, indicating recent operating headwinds. However, analysts project a turnaround. By 2027, annual Free Cash Flow is predicted to reach $211 Million, with further projections estimating around $109 Million in 2035. Most of these future cash flows are based on best estimates after the five-year analyst coverage ends.

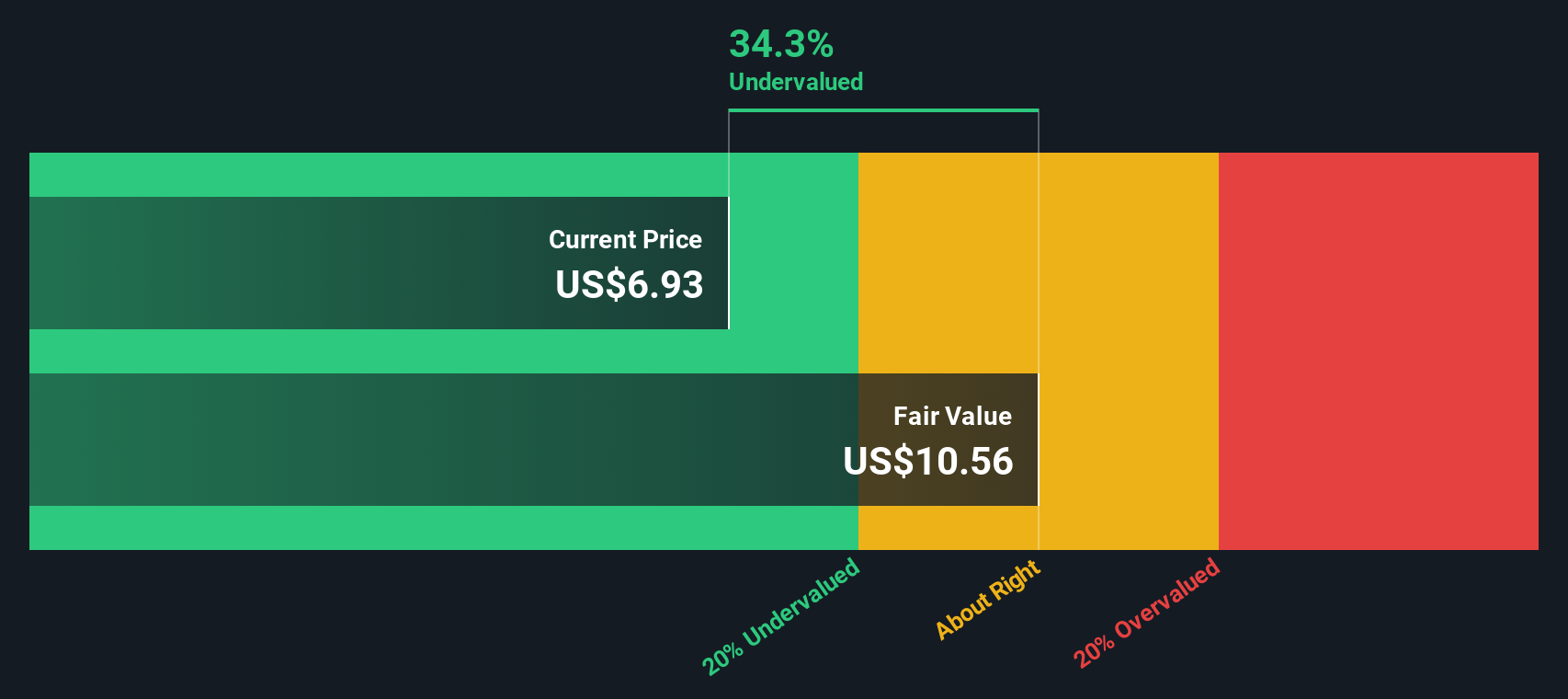

According to the DCF calculation using these figures, SFL’s intrinsic value comes out at $10.94 per share. Compared to its current market price, this implies the stock is trading at a 32.5% discount to its estimated fair value, suggesting that SFL is significantly undervalued according to this method.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests SFL is undervalued by 32.5%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: SFL Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely respected valuation metric, particularly for companies that are consistently profitable. It reveals how much investors are willing to pay for each dollar of SFL’s earnings, serving as a quick gauge of whether the stock is expensive or cheap compared to its profits.

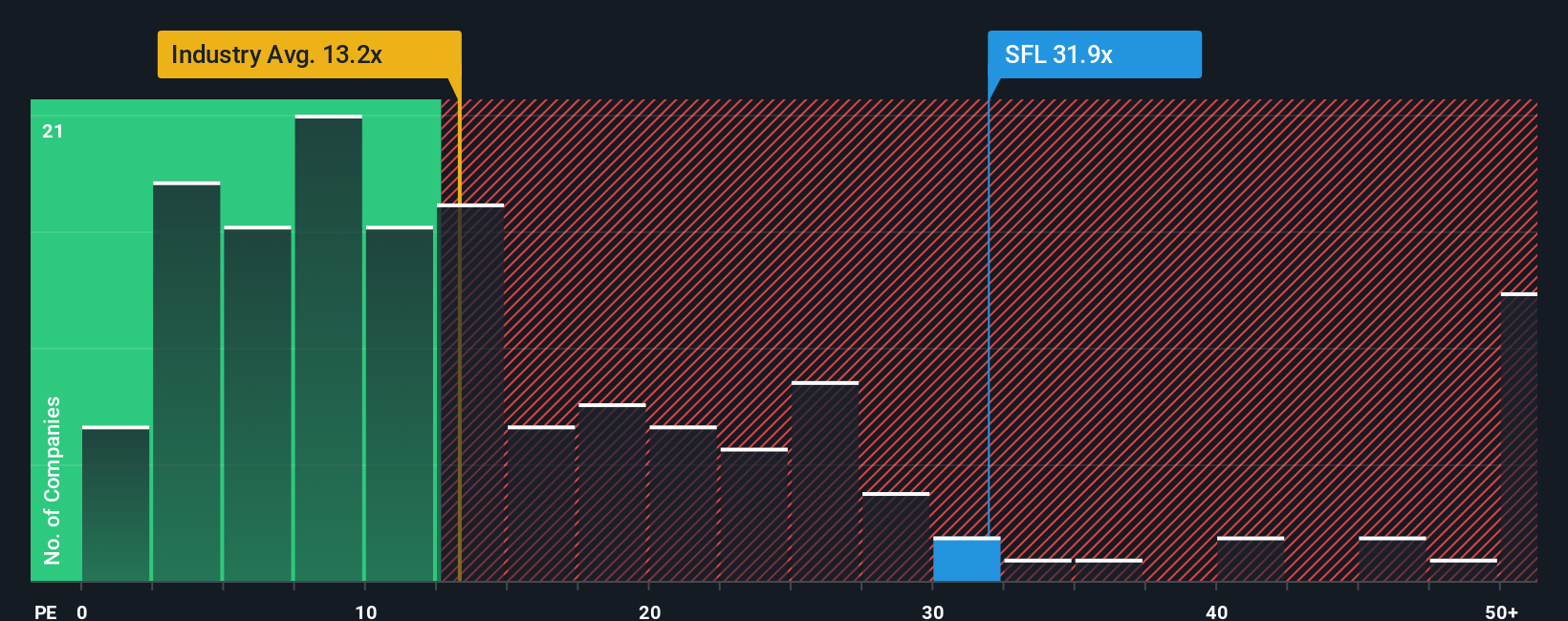

Not all PE ratios are created equal. A “normal” PE depends on factors like growth expectations and risk level. Fast-growing, lower-risk companies tend to command higher PE multiples, while mature or riskier businesses trade at lower ones. For SFL, the current PE stands at 28.6x, which is more than twice the industry average of 13.2x. It also sits below the peer average of 54.1x, reflecting how the company’s valuation stacks up within the oil and gas sector.

To provide a more tailored perspective, Simply Wall St calculates a proprietary “Fair Ratio” for SFL, coming in at 26.3x. This metric goes beyond basic comparisons by weighing the company’s growth prospects, margins, risks, industry trends, and overall size. Unlike a broad industry average, the Fair Ratio aims to pinpoint what would be a justified PE for SFL specifically, given its unique fundamentals and risk profile.

Comparing SFL’s current PE of 28.6x with its Fair Ratio of 26.3x, the difference is just over 2x. With a spread this small, it suggests the stock is trading about where it should be from an earnings-based perspective.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your SFL Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is simply your story for SFL, combining your unique perspective on its future, such as assumptions for revenue, earnings, and profit margins, with a financial forecast and an estimate of fair value.

Narratives tie together what you know about the company's strategy, risks, and industry trends, linking SFL’s business outlook to what you think the stock is worth today. On Simply Wall St’s Community page, millions of investors use Narratives to quickly build, track, and refine their investment reasoning as new updates and earnings details emerge.

This approach makes it easy for you to see when your calculated fair value is above or below the current market price, which can be a powerful signal for your decision to buy, hold, or sell. Because Narratives are dynamic, your valuation and scenario updates automatically reflect the latest news or financials, keeping your investment view up to date.

For example, SFL’s highest analyst price target is $11.40 while the lowest is $8.30, showing that different investors have differing Narratives based on assumptions about future shipping demand, fleet strategy, and risks such as regulation. With Narratives, you can build your own story and decide exactly which numbers truly matter for your next move.

Do you think there's more to the story for SFL? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SFL

SFL

A maritime and offshore asset owning and chartering company, engages in the ownership, operation, and chartering out of vessels and offshore related assets on medium and long-term charters.

Good value with slight risk.

Market Insights

Community Narratives