- United States

- /

- Oil and Gas

- /

- NYSE:SBR

A Look at Sabine Royalty Trust’s (SBR) Valuation Following Lower Distribution and Production Drop

Reviewed by Kshitija Bhandaru

Sabine Royalty Trust (SBR) has caught investors’ attention after announcing a lower cash distribution for October 2025. The July production numbers also revealed a sharp decline in both oil and gas output compared to June.

See our latest analysis for Sabine Royalty Trust.

After a series of lower distributions and decreased production, Sabine Royalty Trust’s share price has seen some volatility, dropping 9.65% over the past month but still sitting up 6.38% for the year-to-date. Despite short-term headwinds, its 20.46% total shareholder return over the past year highlights the impressive long-term momentum at play.

If you’re curious about other opportunities showing strong momentum and insider conviction, now is a great chance to discover fast growing stocks with high insider ownership

With SBR trading at an apparent discount to its assessed value, the question remains: is Sabine Royalty Trust currently undervalued, or is the market already reflecting its future expectations and leaving little room for upside?

Price-to-Earnings of 13.7x: Is it justified?

Sabine Royalty Trust’s current price-to-earnings ratio of 13.7x stands out as significantly lower than the peer group average of 27.7x. This positions the stock as notably more affordable than comparable companies based on earnings alone. With the last close at $69.32, this comparison suggests the market is pricing in some conservatism, potentially opening a value opportunity for attentive investors.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of the company’s earnings. For resource royalty trusts such as SBR, this ratio highlights what the market expects in terms of future cash flows and the sustainability of its earnings streams, both important factors given commodity price swings.

Despite the attractive P/E versus peers, SBR trades at a slight premium to the broader US Oil and Gas industry average of 13.2x. While it looks inexpensive in a peer context, the market appears to be factoring in some company-specific strengths, such as exceptionally high profit margins and robust historical earnings growth, that may justify the small premium relative to the overall sector.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 13.7x (UNDERVALUED)

However, commodity price volatility and further production declines could quickly challenge the upside case and put pressure on Sabine Royalty Trust’s future performance.

Find out about the key risks to this Sabine Royalty Trust narrative.

Another View: What Does Our DCF Model Suggest?

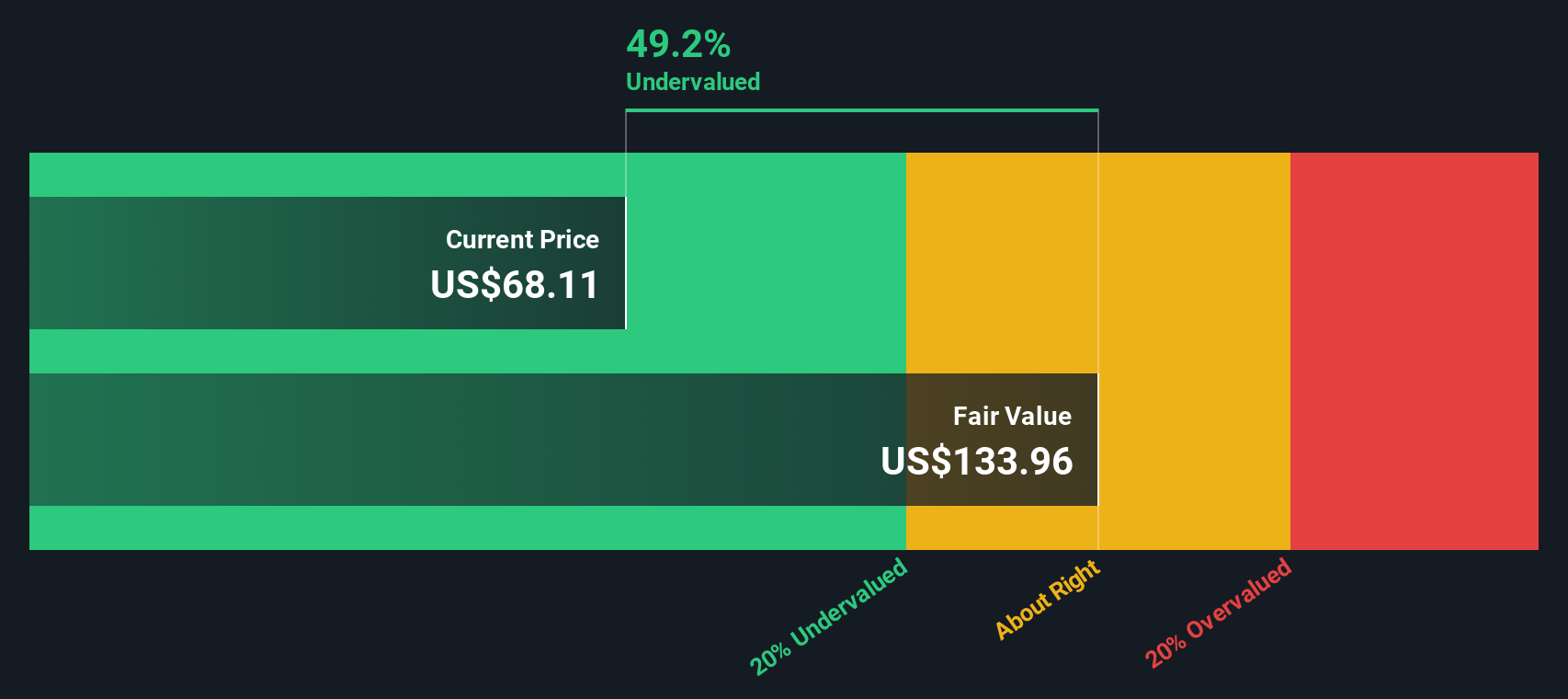

On the other hand, the SWS DCF model presents a very different perspective for Sabine Royalty Trust. It suggests the company is significantly undervalued, with the shares trading at around 48% below our fair value estimate of $133.96. This challenges the idea that the market is already accounting for all future risks and raises the question: is the opportunity greater than the risks suggest?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sabine Royalty Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sabine Royalty Trust Narrative

If you see things differently or want to dig deeper into the numbers yourself, building your own narrative is quick and straightforward. Do it your way

A great starting point for your Sabine Royalty Trust research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Seize this moment to uncover stocks and strategies that could reshape your portfolio. Great opportunities do not wait, so act now to keep your edge in today’s evolving market.

- Boost your passive income goals by tapping into these 18 dividend stocks with yields > 3% with attractive yields and strong fundamentals.

- Capitalize on the AI revolution by targeting these 25 AI penny stocks that have the potential to disrupt entire industries and deliver smart growth.

- Stay ahead of the curve by evaluating these 26 quantum computing stocks leading advancements at the frontier of technology and computation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SBR

Sabine Royalty Trust

Sabine Royalty Trust holds royalty and mineral interests in various producing oil and gas properties in the United States.

Flawless balance sheet and fair value.

Market Insights

Community Narratives