- United States

- /

- Oil and Gas

- /

- NYSE:RRC

Many Still Looking Away From Range Resources Corporation (NYSE:RRC)

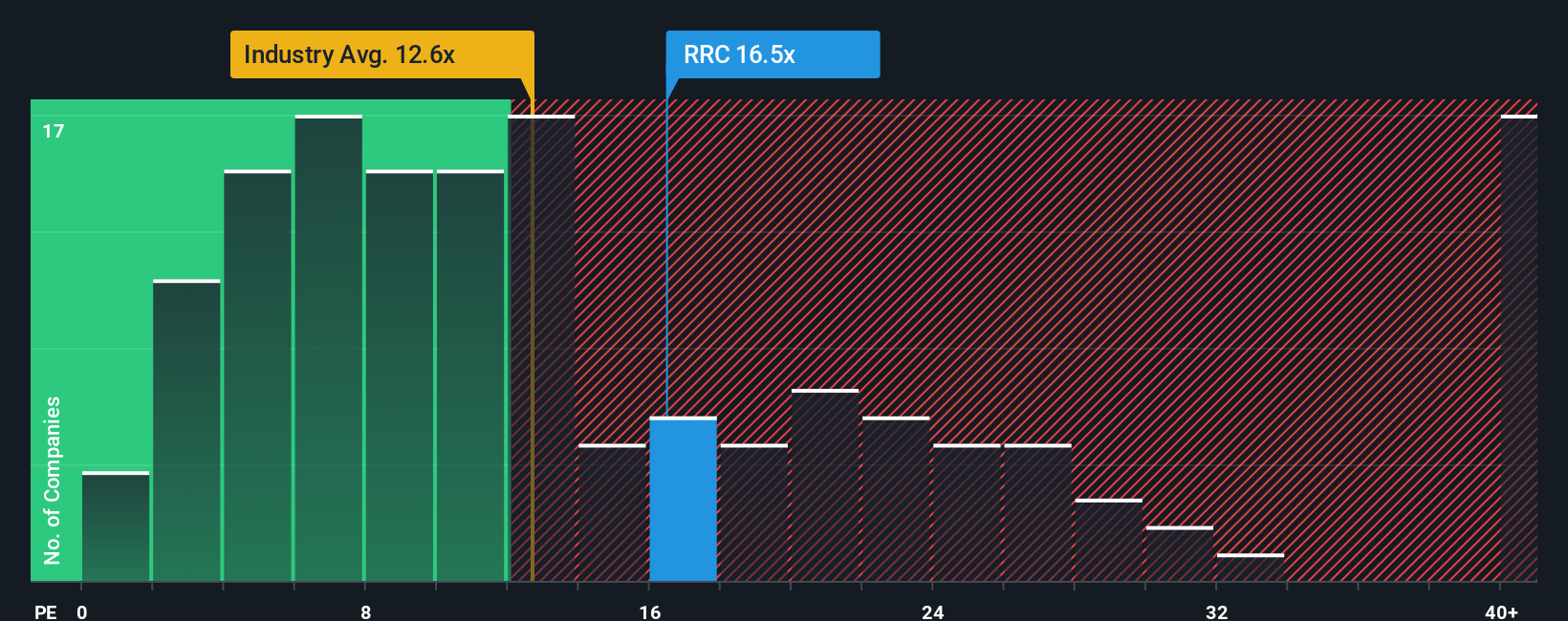

Range Resources Corporation's (NYSE:RRC) price-to-earnings (or "P/E") ratio of 16.5x might make it look like a buy right now compared to the market in the United States, where around half of the companies have P/E ratios above 19x and even P/E's above 33x are quite common. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/E.

With earnings growth that's inferior to most other companies of late, Range Resources has been relatively sluggish. The P/E is probably low because investors think this lacklustre earnings performance isn't going to get any better. If you still like the company, you'd be hoping earnings don't get any worse and that you could pick up some stock while it's out of favour.

View our latest analysis for Range Resources

How Is Range Resources' Growth Trending?

There's an inherent assumption that a company should underperform the market for P/E ratios like Range Resources' to be considered reasonable.

If we review the last year of earnings, the company posted a result that saw barely any deviation from a year ago. The lack of growth did nothing to help the company's aggregate three-year performance, which is an unsavory 6.9% drop in EPS. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Looking ahead now, EPS is anticipated to climb by 21% each year during the coming three years according to the analysts following the company. With the market only predicted to deliver 11% each year, the company is positioned for a stronger earnings result.

With this information, we find it odd that Range Resources is trading at a P/E lower than the market. It looks like most investors are not convinced at all that the company can achieve future growth expectations.

What We Can Learn From Range Resources' P/E?

Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Our examination of Range Resources' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E anywhere near as much as we would have predicted. When we see a strong earnings outlook with faster-than-market growth, we assume potential risks are what might be placing significant pressure on the P/E ratio. At least price risks look to be very low, but investors seem to think future earnings could see a lot of volatility.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for Range Resources with six simple checks on some of these key factors.

Of course, you might also be able to find a better stock than Range Resources. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RRC

Range Resources

Operates as an independent natural gas, natural gas liquids (NGLs), and oil company in the United States.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Near zero debt, Japan centric focus provides future growth

Corning's Revenue Will Climb by 12.73% in Just Five Years

GE Vernova revenue will grow by 13% with a future PE of 64.7x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026