- United States

- /

- Oil and Gas

- /

- NYSE:SD

US Undiscovered Gems To Watch In July 2025

Reviewed by Simply Wall St

As the U.S. stock market hovers near record highs despite recent trade policy uncertainties, investors are keeping a close watch on small-cap stocks, which often present unique opportunities amid broader economic shifts. In this dynamic environment, identifying promising small-cap companies requires a keen eye for those with strong fundamentals and potential resilience to external pressures such as tariffs and inflation concerns.

Top 10 Undiscovered Gems With Strong Fundamentals In The United States

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| West Bancorporation | 169.96% | -1.41% | -8.52% | ★★★★★★ |

| Oakworth Capital | 42.08% | 15.43% | 7.31% | ★★★★★★ |

| Wilson Bank Holding | 0.00% | 7.88% | 8.09% | ★★★★★★ |

| FineMark Holdings | 122.25% | 2.34% | -26.34% | ★★★★★★ |

| Metalpha Technology Holding | NA | 81.88% | -4.97% | ★★★★★★ |

| FRMO | 0.09% | 44.64% | 49.91% | ★★★★★☆ |

| Valhi | 43.01% | 1.55% | -2.64% | ★★★★★☆ |

| Pure Cycle | 5.02% | 4.35% | -2.25% | ★★★★★☆ |

| Solesence | 82.42% | 23.41% | -1.04% | ★★★★☆☆ |

| Reitar Logtech Holdings | 31.39% | 231.46% | 41.38% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

G-III Apparel Group (GIII)

Simply Wall St Value Rating: ★★★★★★

Overview: G-III Apparel Group, Ltd. is engaged in designing, sourcing, distributing, and marketing women's and men's apparel globally with a market capitalization of approximately $1.04 billion.

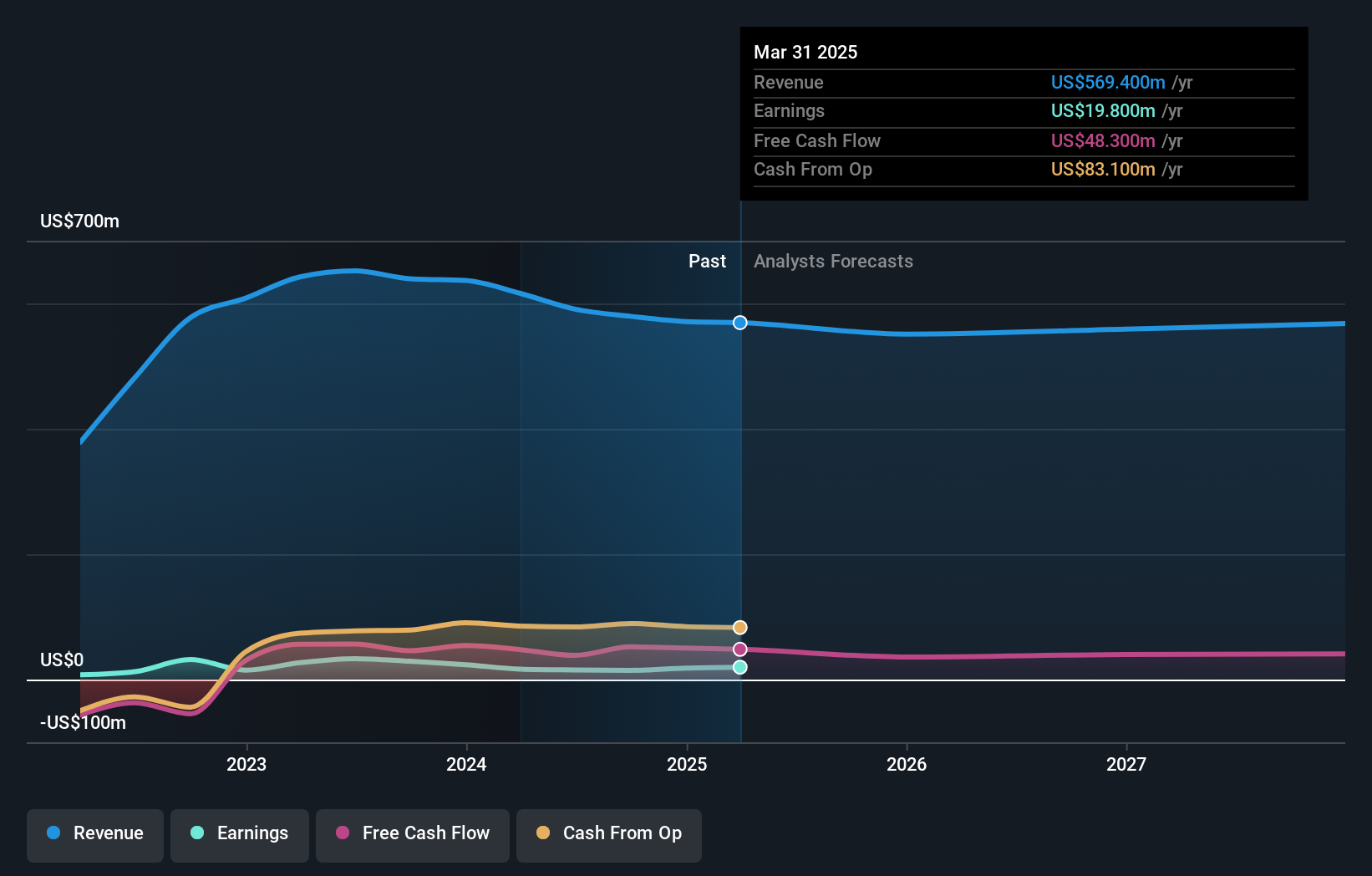

Operations: G-III generates revenue primarily from its wholesale segment, which accounts for $3.05 billion, while its retail segment contributes $172.31 million.

G-III Apparel Group, a notable player in the apparel industry, has demonstrated impressive financial health. Its earnings grew by 9% over the past year, outpacing the luxury industry's 3%. With a price-to-earnings ratio of 5.3x, it stands well below the US market average of 18.7x, indicating potential value for investors. The company's interest payments are comfortably covered by EBIT at a ratio of 21x. Additionally, G-III's debt levels have significantly improved over five years from a debt-to-equity ratio of 72% to just over 1%. Recently, it repurchased shares worth US$20 million and reaffirmed its guidance for fiscal year sales at approximately US$3 billion.

Ranger Energy Services (RNGR)

Simply Wall St Value Rating: ★★★★★★

Overview: Ranger Energy Services, Inc. offers onshore high specification well service rigs and wireline services to exploration and production companies in the United States, with a market cap of approximately $276.95 million.

Operations: Ranger Energy Services generates revenue primarily from high specification rigs ($343.90 million), wireline services ($94.60 million), and processing solutions and ancillary services ($130.90 million). The company focuses on providing specialized equipment and services to the energy sector in the United States, supporting exploration and production activities.

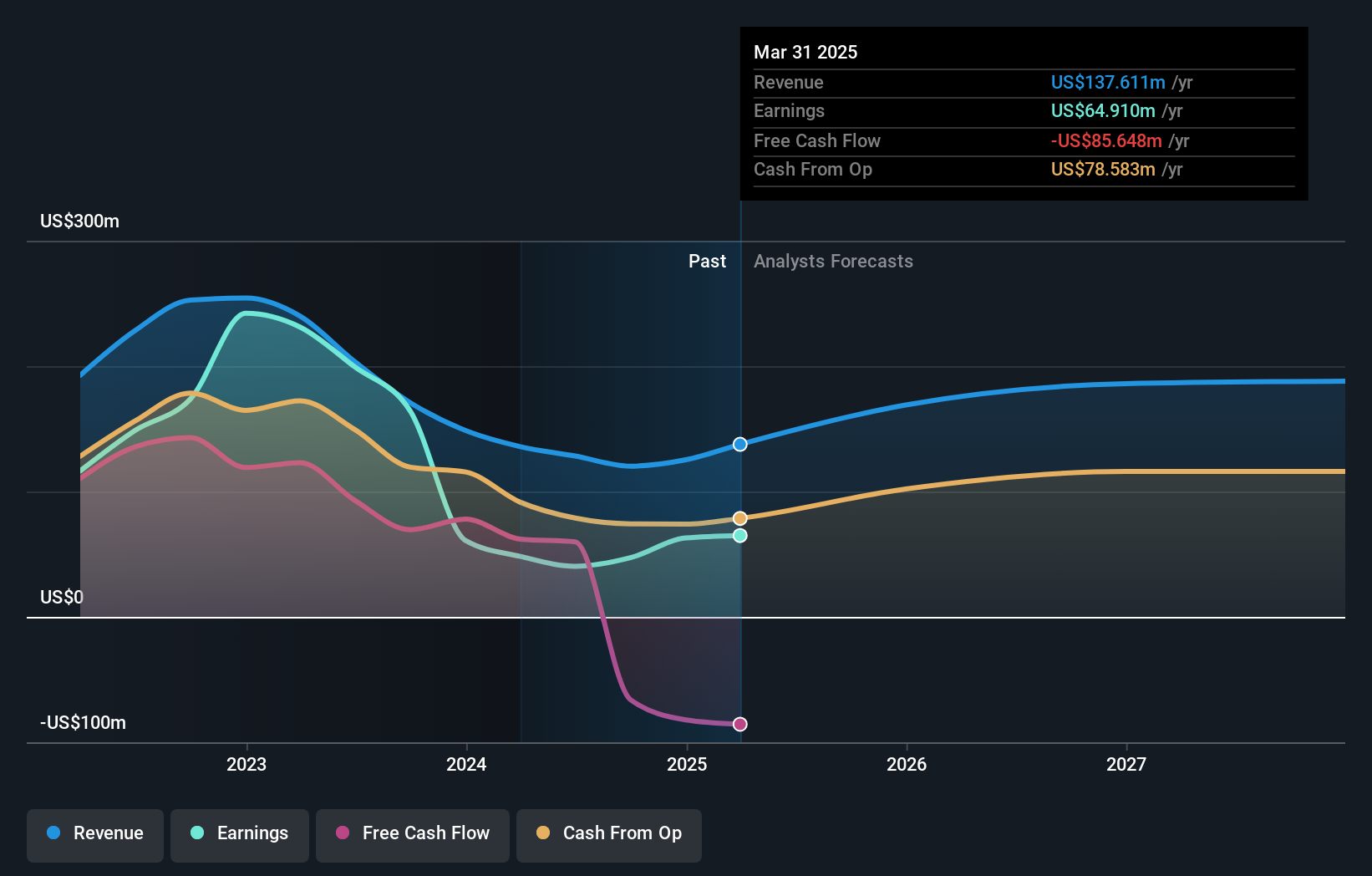

Ranger Energy Services, a nimble player in the energy sector, is making waves with its debt-free status and impressive earnings growth of 17.9%, outpacing the industry average of 7.8%. Trading at a significant discount—78% below estimated fair value—it offers potential upside for investors. Despite a slight revenue dip to US$135.2 million from US$136.9 million year-on-year, net income turned positive at US$0.6 million from a previous loss of US$0.8 million, reflecting high-quality earnings and effective cost management. Recent moves include filing for a $10.87 million shelf registration and maintaining consistent dividend payouts at $0.06 per share.

SandRidge Energy (SD)

Simply Wall St Value Rating: ★★★★★★

Overview: SandRidge Energy, Inc. focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids in the United States Mid-Continent region with a market capitalization of approximately $401.51 million.

Operations: SandRidge Energy generates revenue primarily from the acquisition, development, and production of oil, natural gas, and natural gas liquids, amounting to $137.61 million.

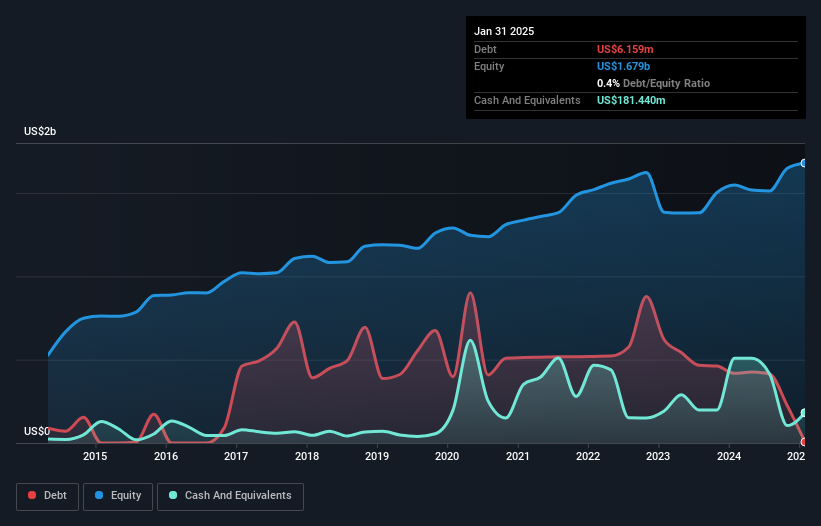

SandRidge Energy, a nimble player in the energy sector, showcases a compelling value proposition with its price-to-earnings ratio at 6.2x compared to the broader US market's 18.7x. The company stands out by being debt-free, a stark contrast to five years ago when it had an 11.8% debt-to-equity ratio. Recent earnings surged by 34.6%, outpacing the oil and gas industry’s negative growth of -9.7%. In Q1 2025, SandRidge reported US$42.6 million in revenue and net income of US$13.05 million, while also completing share repurchases worth US$5.33 million for over 473k shares this year alone.

Key Takeaways

- Embark on your investment journey to our 279 US Undiscovered Gems With Strong Fundamentals selection here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SD

SandRidge Energy

Engages in the acquisition, development, and production of oil, natural gas, and natural gas liquids in the United States Mid-Continent region.

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives