- United States

- /

- Energy Services

- /

- NYSE:RIG

Assessing Transocean’s Value After Recent Share Price Surge in 2025

Reviewed by Bailey Pemberton

If you have been eyeing Transocean lately, you are not alone. The company’s share price has seen fresh momentum, climbing 10.3% in just the last week and 11.7% over the past month. It is a welcome shift for investors after a tough ride so far this year, with the stock still down 13.2% year-to-date and trailing 24.9% over the past twelve months. However, zoom out to the last five years, and Transocean boasts a staggering 310% gain, hinting at substantial growth potential if the broader energy themes play in its favor.

Some of this recent optimism can be tied to improving sentiment in the offshore drilling sector, as global oil prices hold firm and market participants speculate on increased demand for deepwater rigs. While Transocean has not had headline-making announcements, shifts in the macro environment and renewed interest in energy infrastructure seem to be sparking a new narrative for the stock.

The big question is whether the current share price fairly reflects what Transocean is really worth. To help answer that, let’s look at a simple value score: the company currently ticks 3 out of 6 boxes for being undervalued. That puts it right in the middle, neither a clear bargain nor an obvious overhang, which is where a closer look matters most.

Let’s dig into the key valuation approaches investors use to assess Transocean, and then explore a smarter way to judge value that could cut through all the noise.

Why Transocean is lagging behind its peers

Approach 1: Transocean Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by extrapolating its expected future cash flows and discounting them back to today's value. This approach helps investors get a clearer sense of whether the current share price reflects the real potential of the business.

For Transocean, the DCF uses a 2 Stage Free Cash Flow to Equity model. The company's latest reported Free Cash Flow sits at $52.88 million. Analyst estimates suggest strong growth in the coming years, with projections reaching $821.50 million in 2026 and $584 million by 2027. Looking further ahead, Simply Wall St extrapolates cash flow projections for the next decade, with 2035 marking an estimated Free Cash Flow of $338.01 million.

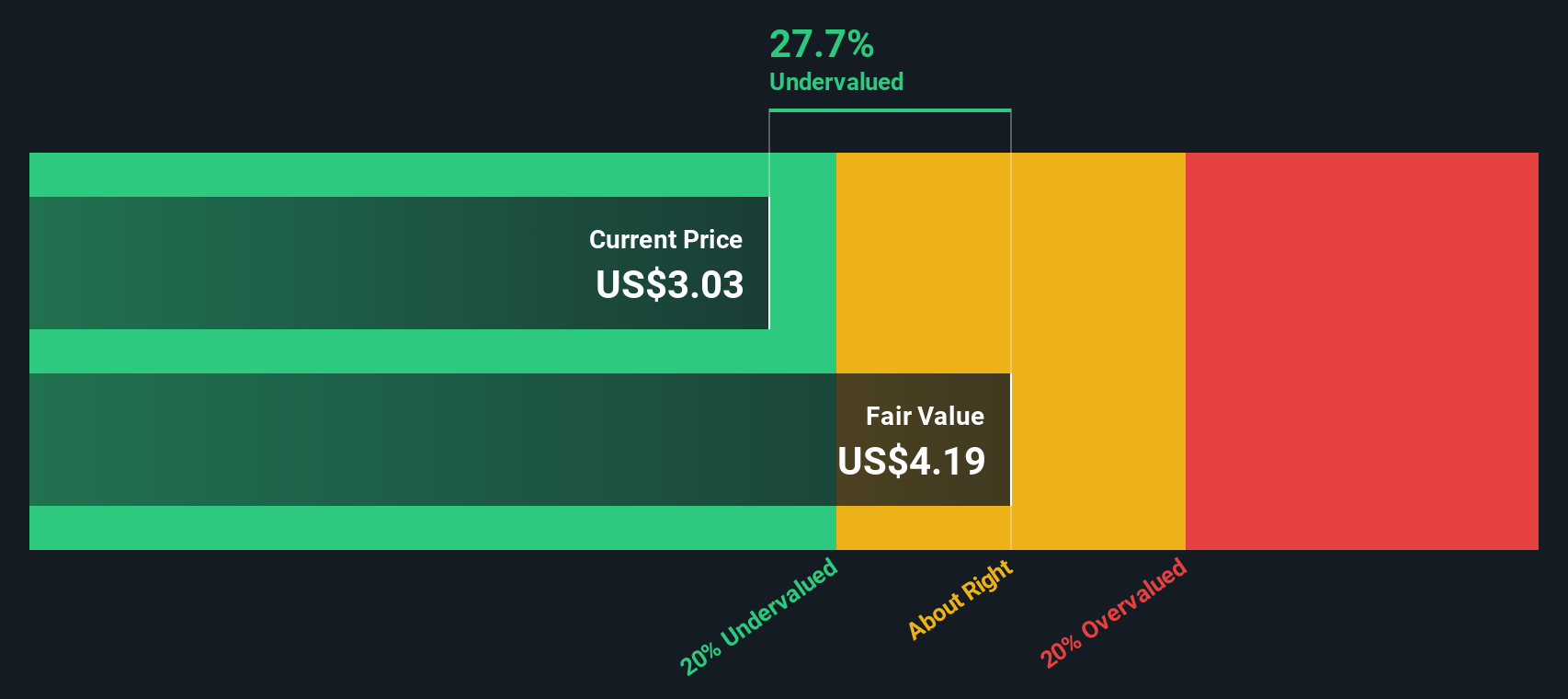

Based on this long-range forecast, the DCF analysis concludes that Transocean shares have an intrinsic value of $4.14. This is 17.2% above the current market price, indicating the stock is undervalued by the DCF metric.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Transocean is undervalued by 17.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Transocean Price vs Sales

The Price-to-Sales (P/S) ratio is often used to value companies like Transocean that may not be profitable on a net income basis but still generate substantial revenues. This metric helps investors gauge how much the market is willing to pay for each dollar of sales. It is especially useful for cyclical or capital-intensive sectors where profits can fluctuate.

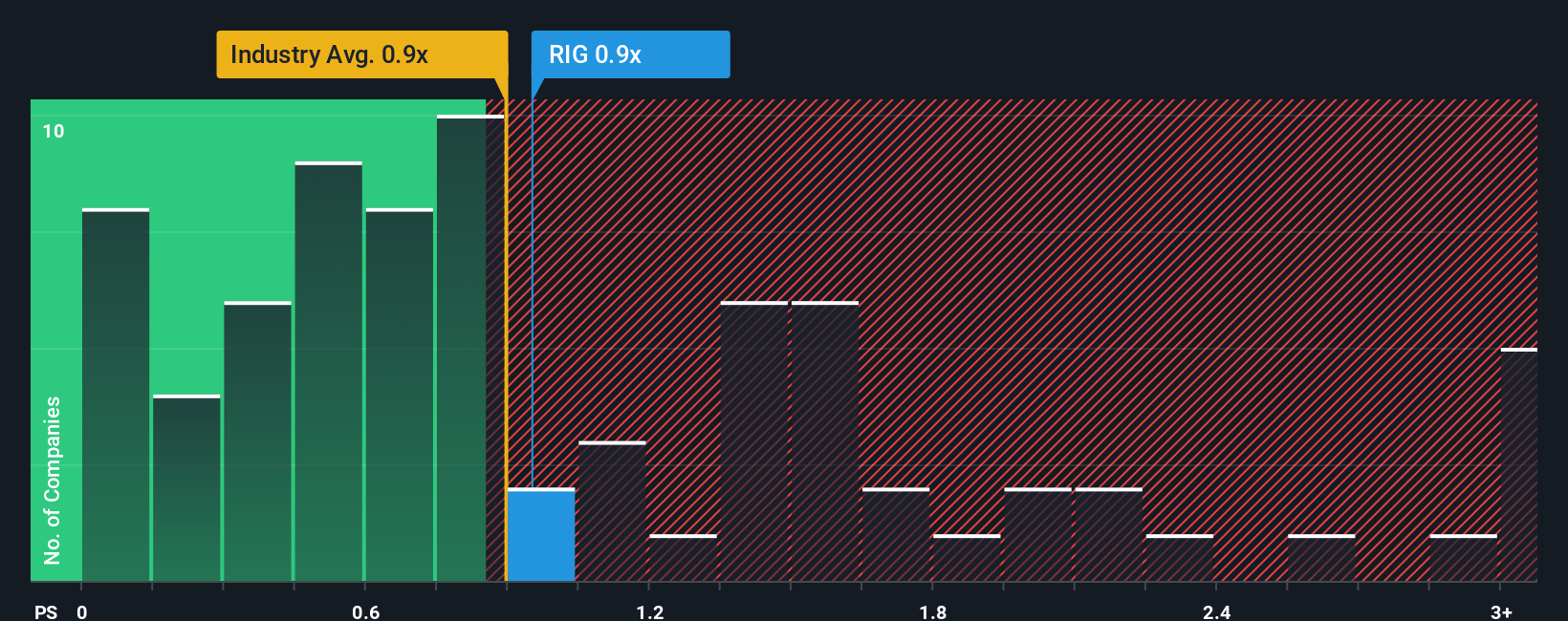

A company’s "normal" or "fair" P/S ratio is shaped by expectations for future growth and the risks it faces. Higher growth prospects usually justify a higher ratio, while greater risks or thin margins push it lower. Comparing Transocean’s numbers, its current P/S stands at 0.97x. By contrast, the Energy Services industry averages 0.90x and the peer group sits at 1.30x.

Simply Wall St’s “Fair Ratio” evaluates what multiple is reasonable for Transocean specifically by taking into account factors such as its growth outlook, profit margins, market cap, sector trends, and business risk. This tailored approach offers a more accurate picture than simply lining up the company next to industry or peer averages, which may miss what truly makes Transocean unique.

Transocean’s proprietary Fair Ratio is calculated at 1.00x, placing it almost exactly in line with the current P/S of 0.97x. This suggests the stock is more or less appropriately priced relative to its sales after considering all the key dynamics that matter most to valuation.

Result: ABOUT RIGHT

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Transocean Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company, connecting what you believe about its business outlook to realistic financial forecasts and, ultimately, what you think its shares are really worth.

Rather than just focusing on ratios or past numbers, Narratives help you make investment decisions by tying together what drives the business, your expectations for future revenue and margins, and a resulting Fair Value. This approach means your reasoning is structured, transparent, and grounded in actual numbers, not just opinions.

On Simply Wall St’s Community page, millions of investors use Narratives as an intuitive tool to monitor or refine their view on stocks like Transocean. Because new information, such as earnings or fresh news, can quickly change the facts, Narratives update dynamically to ensure your assessment always reflects the latest developments.

With Narratives, you can decide whether to buy or sell by simply comparing your Fair Value to today’s share price. For Transocean, for example, some investors see a fair value as high as $5.5 and others as low as $2.5, highlighting how each Narrative reveals a different but actionable investment thesis.

Do you think there's more to the story for Transocean? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Transocean might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RIG

Transocean

Provides offshore contract drilling services for oil and gas wells in Switzerland and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026