- United States

- /

- Energy Services

- /

- NYSE:RES

Further weakness as RPC (NYSE:RES) drops 9.7% this week, taking five-year losses to 74%

RPC, Inc. (NYSE:RES) shareholders should be happy to see the share price up 16% in the last month. But that doesn't change the fact that the returns over the last half decade have been stomach churning. Five years have seen the share price descend precipitously, down a full 75%. It's true that the recent bounce could signal the company is turning over a new leaf, but we are not so sure. The important question is if the business itself justifies a higher share price in the long term.

If the past week is anything to go by, investor sentiment for RPC isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

See our latest analysis for RPC

RPC isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last five years RPC saw its revenue shrink by 9.0% per year. That puts it in an unattractive cohort, to put it mildly. So it's not that strange that the share price dropped 12% per year in that period. We don't think this is a particularly promising picture. Ironically, that behavior could create an opportunity for the contrarian investor - but only if there are good reasons to predict a brighter future.

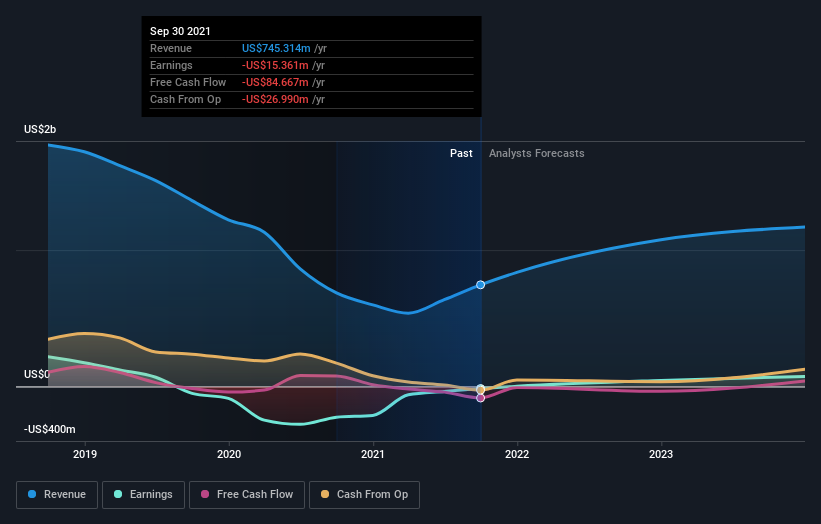

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

It's good to see that RPC has rewarded shareholders with a total shareholder return of 40% in the last twelve months. Notably the five-year annualised TSR loss of 12% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - RPC has 2 warning signs we think you should be aware of.

Of course RPC may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:RES

RPC

Engages provision of a range of oilfield services and equipment for the oil and gas companies involved in the exploration, production, and development of oil and gas properties.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives