- United States

- /

- Energy Services

- /

- NYSE:PUMP

Three Undervalued Small Caps In US With Insider Action

Reviewed by Simply Wall St

Over the last 7 days, the United States market has risen by 1.6%, contributing to a remarkable 32% climb over the past year, with earnings forecasted to grow by 15% annually. In this dynamic environment, identifying stocks that are potentially undervalued while exhibiting insider activity can be an intriguing strategy for investors seeking opportunities in smaller companies.

Top 10 Undervalued Small Caps With Insider Buying In The United States

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Hanover Bancorp | 13.2x | 2.7x | 35.44% | ★★★★★☆ |

| ProPetro Holding | NA | 0.6x | 41.65% | ★★★★★☆ |

| Thryv Holdings | NA | 0.8x | 42.39% | ★★★★★☆ |

| Capital Bancorp | 14.6x | 3.0x | 46.52% | ★★★★☆☆ |

| HighPeak Energy | 11.5x | 1.7x | 32.66% | ★★★★☆☆ |

| German American Bancorp | 16.3x | 5.4x | 43.25% | ★★★☆☆☆ |

| USCB Financial Holdings | 19.7x | 5.6x | 46.81% | ★★★☆☆☆ |

| Community West Bancshares | 18.7x | 2.9x | 42.25% | ★★★☆☆☆ |

| Delek US Holdings | NA | 0.1x | -81.14% | ★★★☆☆☆ |

| Sabre | NA | 0.5x | -83.91% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

HighPeak Energy (NasdaqGM:HPK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: HighPeak Energy is engaged in the development, exploration, and production of oil and natural gas with a market capitalization of approximately $1.65 billion.

Operations: The primary revenue stream is from oil and natural gas development, exploration, and production, with the latest reported revenue at $1.14 billion. The gross profit margin has shown fluctuations but was most recently recorded at 82.69%. Operating expenses are significant, with general and administrative expenses being a notable component.

PE: 11.5x

HighPeak Energy's recent earnings report shows a mixed performance, with third-quarter revenue at US$271.58 million, down from US$345.59 million the previous year, yet net income rose to US$49.93 million from US$38.78 million. Insider confidence is evident as they increased their holdings recently, signaling potential undervalued opportunities despite external borrowing risks. The company repurchased 870,647 shares for US$12.69 million between July and September 2024, reflecting strategic financial management amidst a challenging funding landscape.

- Dive into the specifics of HighPeak Energy here with our thorough valuation report.

Examine HighPeak Energy's past performance report to understand how it has performed in the past.

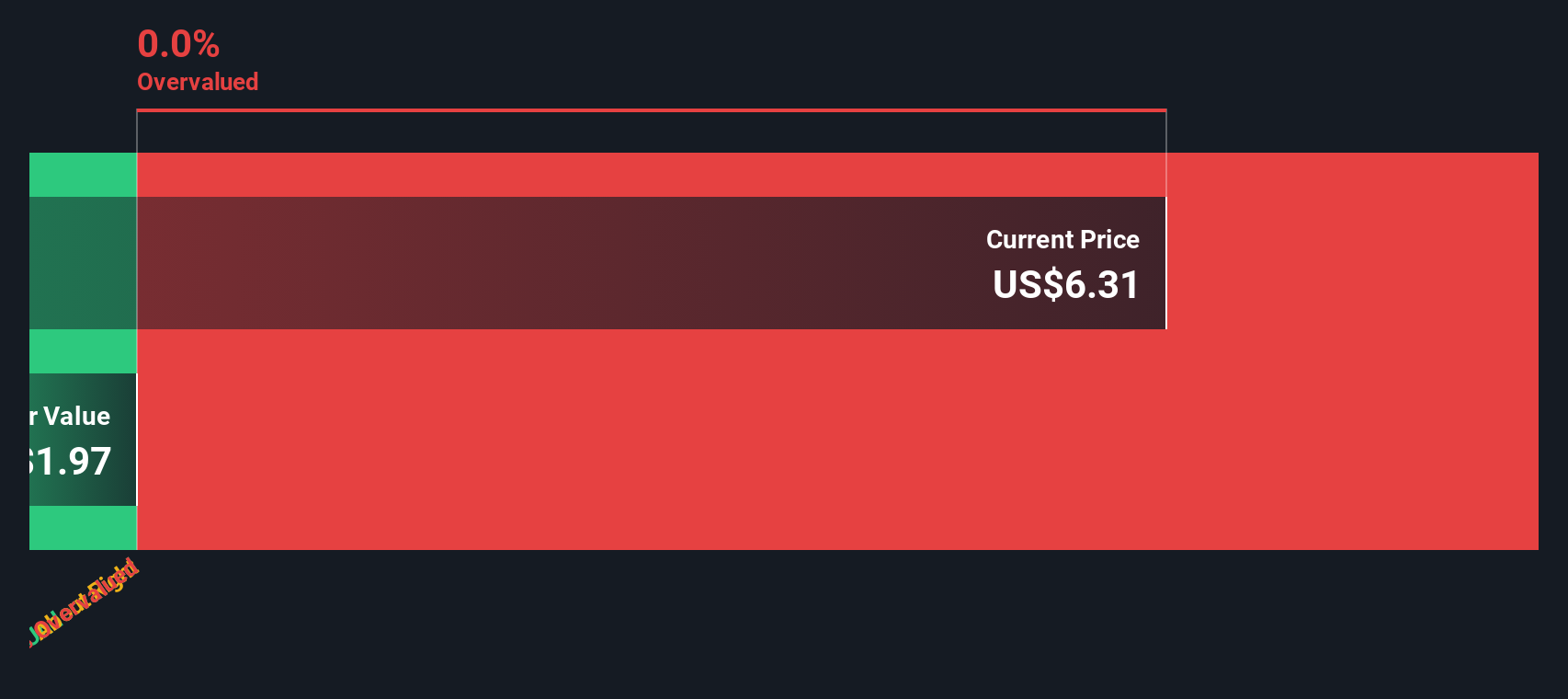

Diversified Healthcare Trust (NasdaqGS:DHC)

Simply Wall St Value Rating: ★★★★★☆

Overview: Diversified Healthcare Trust is a real estate investment trust that primarily focuses on owning and operating medical office, life science, and senior housing properties, with a market capitalization of $1.22 billion.

Operations: The primary revenue streams include the Senior Housing Operating Portfolio, Medical Office and Life Science Portfolio, and Non-Segment activities. The gross profit margin has shown fluctuations over time, with a notable decrease from 61.65% in early 2015 to around 16.87% by late 2024.

PE: -1.6x

Diversified Healthcare Trust, a smaller player in the U.S. market, has been navigating challenging financial waters. Despite reporting a net loss of US$98.69 million for Q3 2024, revenue increased to US$373.64 million from the previous year’s US$356.52 million, indicating some operational resilience. However, debt remains a concern as it's not well-covered by operating cash flow and relies solely on external borrowing sources. Insider confidence is reflected through recent share purchases, hinting at potential future value despite current hurdles.

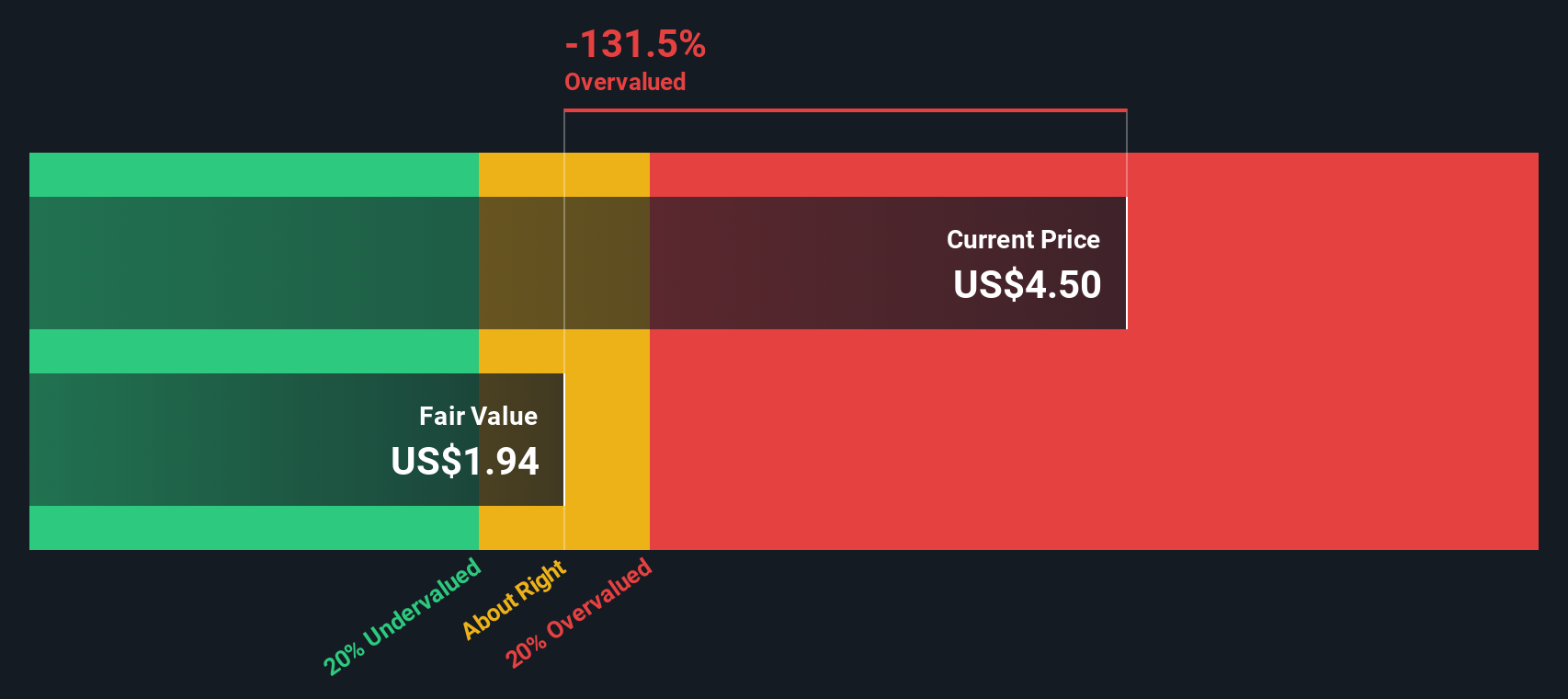

ProPetro Holding (NYSE:PUMP)

Simply Wall St Value Rating: ★★★★★☆

Overview: ProPetro Holding is an oilfield services company primarily focused on hydraulic fracturing and wireline services, with a market cap of approximately $1.22 billion.

Operations: Hydraulic fracturing is the primary revenue stream, generating $1.12 billion, followed by wireline services at $208.38 million. The gross profit margin has shown variability, peaking at 32.18% in mid-2023 before declining to 26.40% by late 2024.

PE: -6.3x

ProPetro Holding, a small cap company in the United States, shows signs of being undervalued despite recent financial challenges. The company reported a net loss of US$137.07 million for Q3 2024, contrasting with the previous year's net income of US$34.75 million. However, insider confidence is evident with significant share repurchases—over 12.5 million shares since May 2023 for US$107.44 million—indicating potential value recognition within the organization amidst forecasted earnings growth at over 110% annually.

- Navigate through the intricacies of ProPetro Holding with our comprehensive valuation report here.

Explore historical data to track ProPetro Holding's performance over time in our Past section.

Where To Now?

- Navigate through the entire inventory of 44 Undervalued US Small Caps With Insider Buying here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PUMP

Flawless balance sheet and undervalued.