- United States

- /

- Oil and Gas

- /

- NYSE:PR

Permian Resources (PR): Assessing Value After Debt Redemption and Notable Insider Trading

Reviewed by Simply Wall St

If you hold shares in Permian Resources (PR) or have been watching it lately, this week’s sudden moves might have you wondering what comes next. The company announced that it’s redeeming its 3.25% Exchangeable Senior Notes due 2028, letting noteholders swap their debt for shares at a slightly higher conversion rate. This maneuver, designed to actively manage their capital structure, comes after an eventful summer in the C-suite. Executive stock sales and a major insider purchase have raised questions about how management views the company’s future prospects.

The reaction in Permian Resources’ share price has been a bit choppy. While the stock is up nearly 8% in the past year, it has drifted slightly lower since January, even as annual revenue and net income posted moderate gains. Adding in recent insider activity, investors are left to weigh whether momentum is shifting or just pausing ahead of another leg up or down.

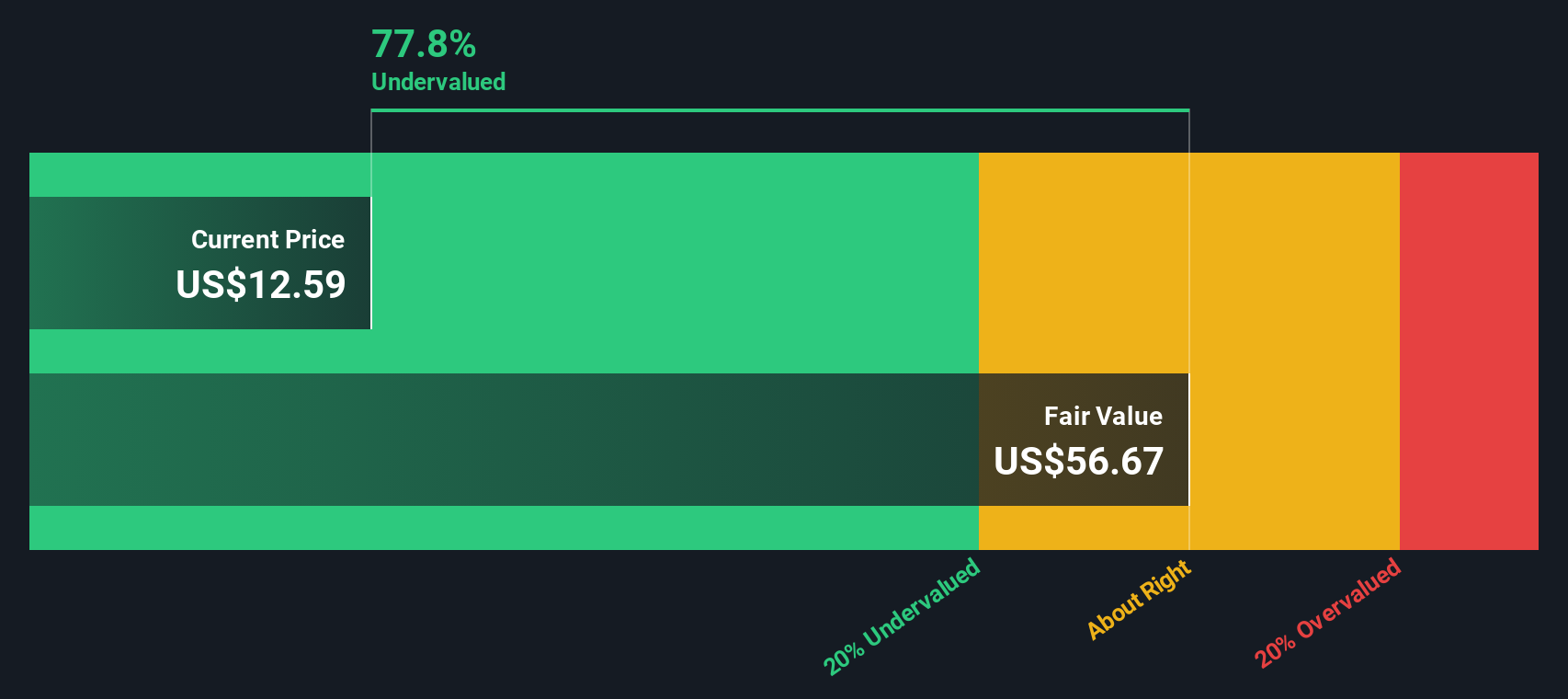

With shares still trading at a significant discount to conventional valuation metrics, the key question is whether Permian Resources offers bargain potential from here, or if markets are already factoring in all of its growth promise.

Most Popular Narrative: 26% Undervalued

The most followed narrative currently sees Permian Resources trading well below its perceived fair value. Analysts highlight operational achievements and policy changes that could unlock significant gains, suggesting the stock is priced at a discount to its future potential.

Recent optimization and expansions of transportation and marketing agreements are expected to allow Permian Resources to realize premium pricing for both crude and natural gas. This increases exposure to key Gulf Coast and non-Waha hubs. These actions are anticipated to directly uplift revenues and free cash flow, with an estimated $50 million higher free cash flow in 2026, and further increases beyond 2026 as more volume is shifted.

Want to uncover the calculations powering this bullish setup? A few aggressive financial projections and margin upgrades are stirring up debate among followers. The formula behind this eye-popping fair value blends ambitious growth forecasts with a bold call on market multiples. Curious which future milestones and shifting fundamentals are central to the narrative’s price target? Delve further to unpack the numbers analysts are betting on.

Result: Fair Value of $18.63 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, much depends on stable oil prices and consistent drilling returns. A slide in either could quickly dampen those upbeat forecasts.

Find out about the key risks to this Permian Resources narrative.Another View: What Does Our DCF Model Say?

Looking beyond market forecasts, the Simply Wall St DCF model also signals that Permian Resources is trading well below its estimated fair value. This approach digs deeper into future cash flows rather than current earnings. But could different assumptions tell a different story?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Permian Resources for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Permian Resources Narrative

If you think there’s another angle the numbers might reveal, or simply want to dig into the details yourself, you can put together your own narrative faster than you might expect. Do it your way.

A great starting point for your Permian Resources research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Moves?

Why stop now? Expand your strategy and put your money to work in places others might miss. These standout stock themes are loaded with potential, so make your next move count.

- Tap into the next tech boom by searching for innovators shaping the age of artificial intelligence with AI penny stocks.

- Hunt for overlooked value opportunities by using insights drawn from stocks that look undervalued based on their financial outlook and future cash flows, all with undervalued stocks based on cash flows.

- Boost your portfolio’s income by seeking out companies offering reliable payouts with yields above 3% using dividend stocks with yields > 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)