- United States

- /

- Oil and Gas

- /

- NYSE:PR

Has Permian Resources Reset Created an Opportunity After 17% Drop in 2025?

Reviewed by Bailey Pemberton

If you have Permian Resources on your watchlist, or you already own shares, you are probably wondering what is next after a rocky few weeks. The stock has slid about 9.4% over the past month and is down 17.3% since the start of the year. However, you might notice it is impressively up over 1,900% in the last five years. That kind of history makes anyone question whether the price resets offer a real opportunity or if renewed caution is needed.

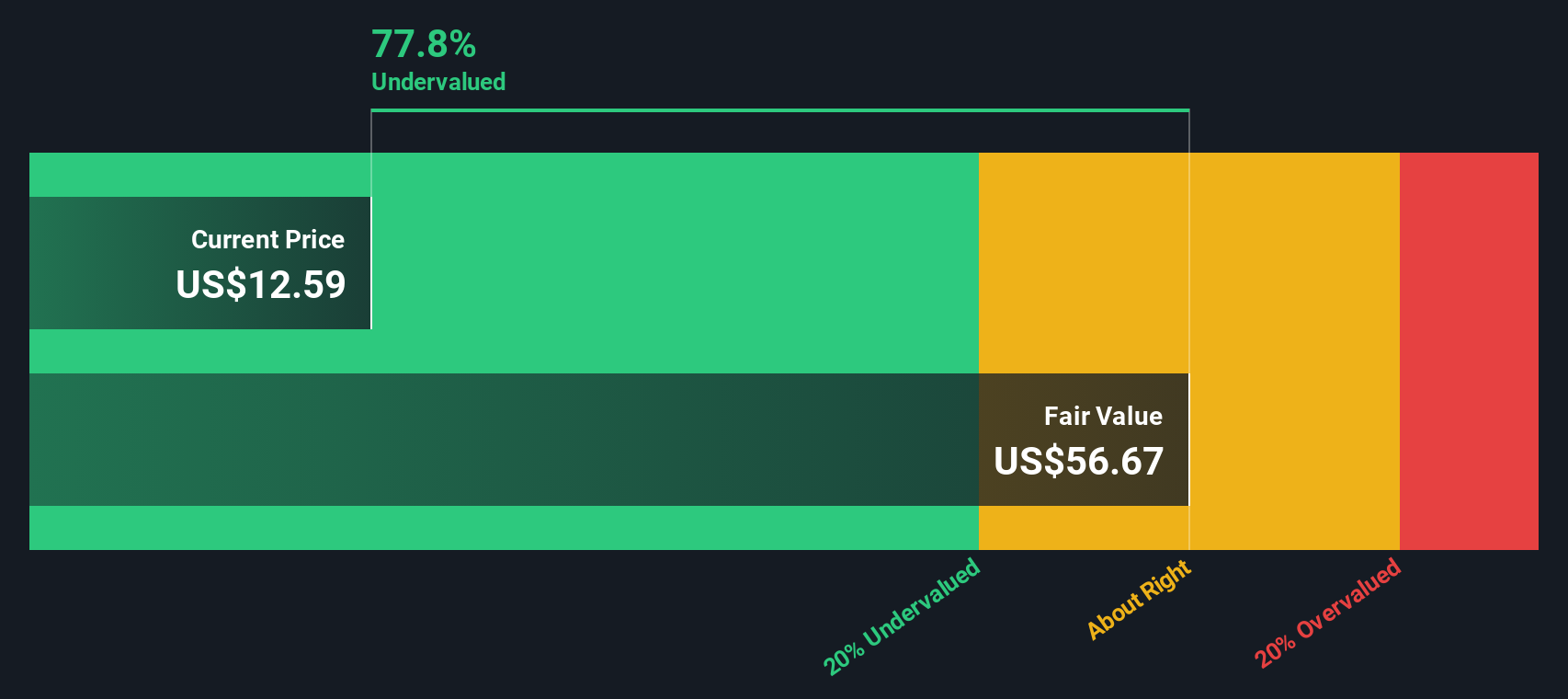

Market sentiment around energy stocks has shifted lately due to mixed signals in oil prices and broad market volatility. While uncertainty can be unnerving, it is worth looking under the hood. Right now, Permian Resources earns a 6 out of 6 on our undervaluation scorecard. In other words, it clears the bar in all six criteria we use to judge value. That is a rare event and one that demands a closer look at how the stock stacks up based on standard valuation frameworks.

If you are thinking about holding, buying, or even selling, let us walk through each valuation approach and see how Permian Resources measures up. If you are looking for an even more practical and possibly more accurate way to judge its worth, do not miss the wrap-up at the end.

Why Permian Resources is lagging behind its peers

Approach 1: Permian Resources Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates a company’s value by forecasting future cash flows and discounting them back to today’s dollars. This helps investors gauge what the business might really be worth, based on its ability to generate cash in the years ahead.

For Permian Resources, the latest reported Free Cash Flow (FCF) sits at $742.7 Million. Analysts forecast cash flows will grow over the years, with projections reaching just over $1.7 Billion by 2029. It is important to note that while analysts supply estimates for up to five years, any further projections rely on careful extrapolation, which can increase uncertainty.

Based on these projections and the cash flow model used here, Permian Resources has an estimated intrinsic value of $42.64 per share. Compared to the current share price, this suggests the stock is trading at a 71.2% discount to its fair value. This implies that Permian Resources may be significantly undervalued based on its future cash generation.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Permian Resources is undervalued by 71.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Permian Resources Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely accepted tool for evaluating the value of companies that generate steady profits, like Permian Resources. By telling us how much investors will pay for a dollar of earnings, the PE ratio is a useful gauge of whether a stock looks cheap or expensive compared to its earnings power.

Importantly, what counts as a “normal” or “fair” PE ratio depends on things like how quickly the company is expected to grow, its profitability, and the risks it faces. Higher growth or lower risk companies generally command loftier PE ratios, while slower-growing or riskier ones trade at lower multiples.

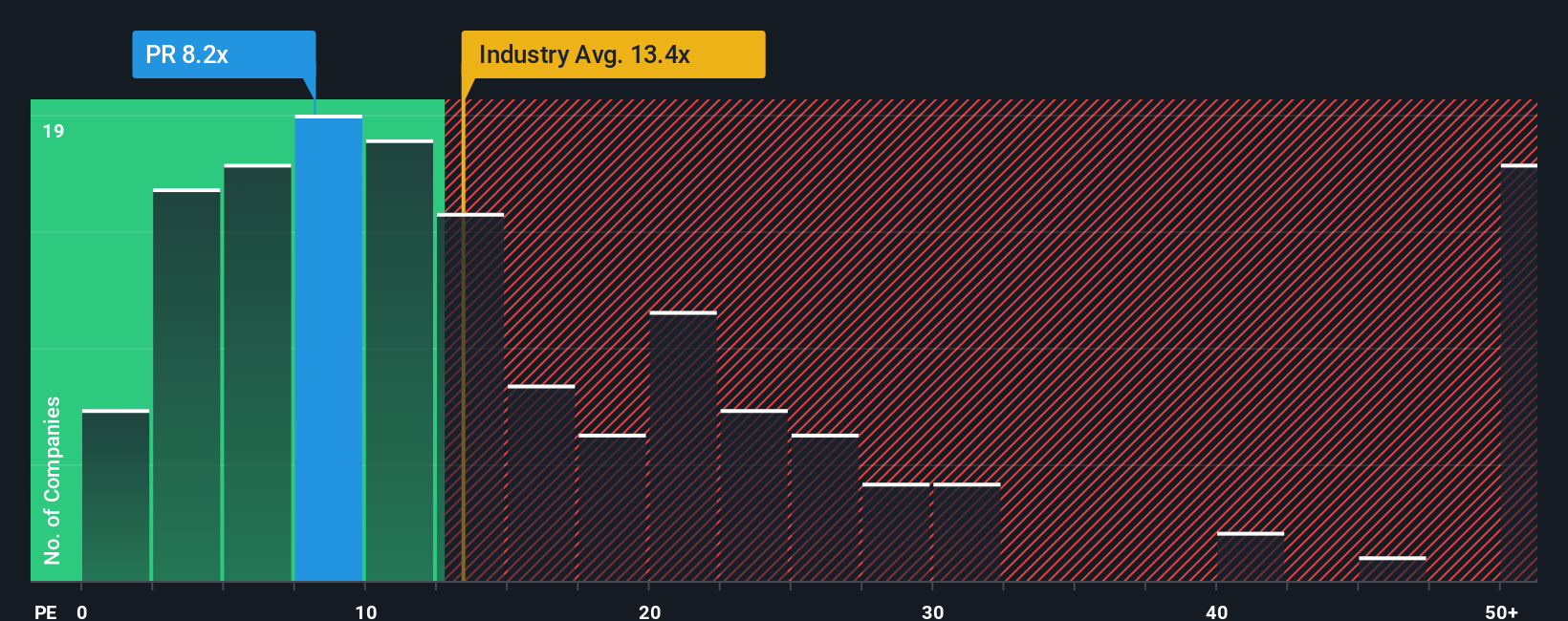

Permian Resources currently trades at a PE of 8.0x. That is well below the Oil and Gas industry average of 12.6x and also below the peer average of 14.7x, suggesting the stock looks relatively cheap by these comparisons. But these averages do not capture everything that makes a company unique.

This is where Simply Wall St's proprietary “Fair Ratio” comes in. The Fair Ratio is designed to reflect a company’s specific growth prospects, profit margins, business risk, industry, and market cap. Unlike basic industry or peer averages, it aims to reflect what a balanced, data-driven valuation should look like for this company in today's market.

Permian Resources' Fair PE Ratio is 15.6x. Comparing this to the actual PE of 8.0x signals that the stock is notably undervalued based on this multiple, especially since the difference is greater than 0.10. That could suggest compelling value for investors willing to look past short-term volatility.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Permian Resources Narrative

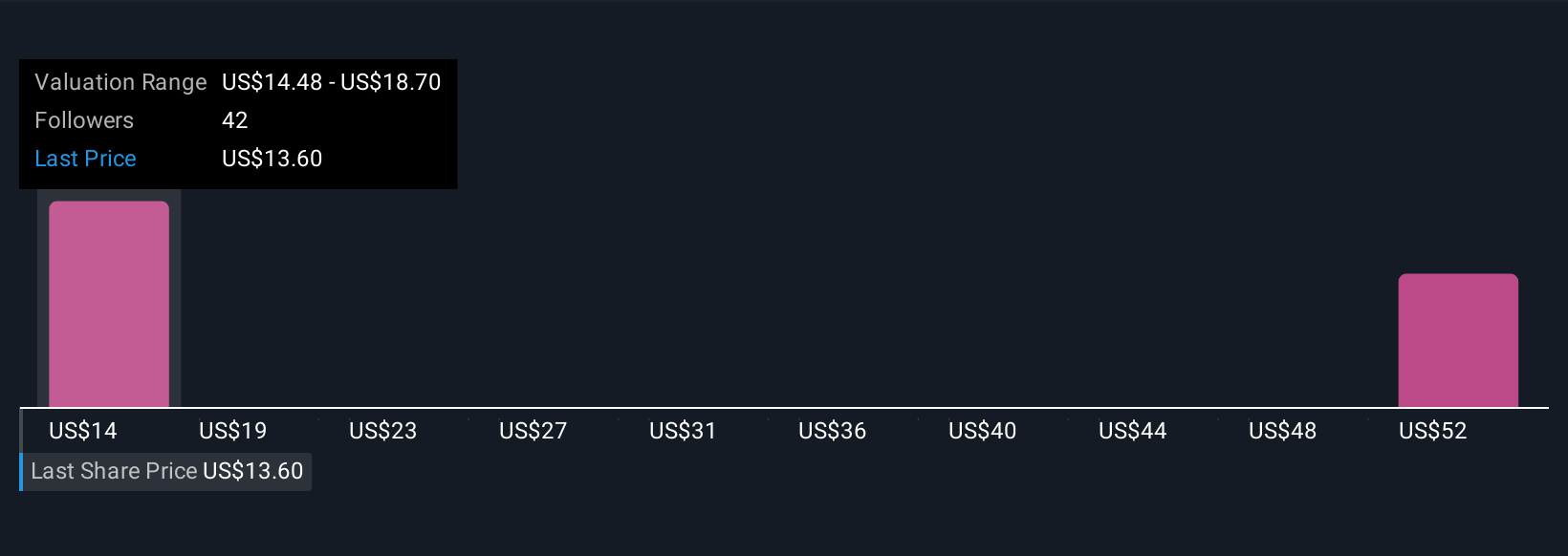

Earlier, we mentioned there is an even better way to understand valuation. Let us introduce you to Narratives. Narratives are a simple yet powerful tool for making sense of an investment. They let you tell the story behind your view of a company, connecting your assumptions about future revenue, earnings, and margins to a fair value estimate.

With Narratives, you are not just reacting to numbers; you are linking Permian Resources’ story, its financial outlook, and its risks into a clear framework that shows you what the company is worth and why. On Simply Wall St, millions of investors use Narratives within the Community page to quickly build, update, and share their investment perspectives.

Narratives make it easy to decide when to buy or sell by comparing your Fair Value directly to today’s share price. Whenever significant news or results come out, Narratives update automatically, so your view stays current even as new information emerges.

For Permian Resources, investors using Narratives may see fair values ranging from $14.0 to $22.0 per share, depending on how optimistic or cautious they are about its future earnings and growth.

Do you think there's more to the story for Permian Resources? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:PR

Permian Resources

An independent oil and natural gas company, focuses on the development of crude oil and associated liquids-rich natural gas reserves in the United States.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)