- United States

- /

- Oil and Gas

- /

- NYSE:OXY

Occidental Petroleum (NYSE:OXY) Declares US$0.24 Quarterly Dividend Payment

Reviewed by Simply Wall St

Occidental Petroleum (NYSE:OXY) recently declared a regular quarterly dividend of $0.24 per share, reaffirming its commitment to shareholder returns. Despite the company's flat 1% weekly return, this dividend announcement highlights steady shareholder value amidst a market that experienced a 2.7% increase. However, strong performances from major technology companies like Microsoft and Meta drove market optimism, overshadowing any significant impact from Occidental's dividend news. While Occidental's price movement aligned with broader energy sector trends, it contrasted with the rising momentum of the broader market spurred by tech earnings and investor sentiment.

The recent dividend announcement by Occidental Petroleum, although overshadowed by the broader market's focus on tech earnings, underscores its strategy to prioritize steady shareholder returns amidst fluctuating oil prices. While the company's one-year underperformance compared to the market reflects these broader sectorial challenges, its long-term performance over five years, with a total return of more than 207%, indicates a more positive picture for patient investors.

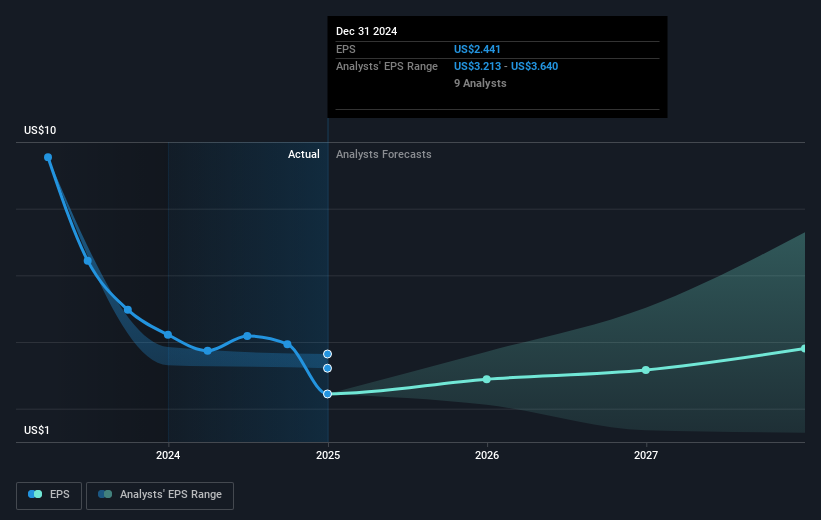

In the context of Occidental's revenue and earnings forecasts, the continuity of dividends complements the company's efforts to enhance margins through efficiency and technology integration. The anticipated impact of the STRATOS project on carbon capture could also play a critical role in shaping future revenue streams. The stock, trading at US$40.35, represents an 18.8% discount to the consensus price target of US$49.71, suggesting room for upside if the projected earnings growth materializes. These elements signify the potential for shareholder value creation in the medium to long term, assuming the company can overcome near-term challenges such as fluctuating oil prices and capital expenditure impacts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight and fair value.

Similar Companies

Market Insights

Community Narratives