- United States

- /

- Oil and Gas

- /

- NYSE:OXY

How Investors Are Reacting To Occidental Petroleum (OXY) Earnings Slump Amid Efficiency Gains And Carbon Bets

Reviewed by Sasha Jovanovic

- Occidental Petroleum recently reported past third-quarter results showing higher production efficiency, improved cost control, and debt reduction efforts, even as revenue fell 6.1% and adjusted earnings dropped 36% year over year.

- At the same time, the company is accelerating carbon capture and other low-carbon initiatives, highlighting a push to balance traditional oil operations with longer-term energy transition goals despite analyst concerns about future earnings.

- Next, we'll examine how this mix of lower revenue, better-than-expected earnings, and rising carbon capture investment affects Occidental's investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

Occidental Petroleum Investment Narrative Recap

To own Occidental Petroleum, you need to believe its traditional oil and gas business can keep generating solid cash flows while its carbon capture ambitions gradually become meaningful. The latest quarter supports that thesis on operations and debt reduction, but the sharp year over year earnings drop underlines how exposed the story remains to weaker pricing and the risk that higher leverage and capital needs could start to bite if conditions turn.

Against that backdrop, Occidental’s push into Carbon Capture, Utilization, and Storage, including its growing Direct Air Capture plans, matters more for the narrative. Rising CCUS investment ties directly into the main upside catalyst of turning carbon management into a new, higher margin revenue stream, but it also interacts with the key risk that these capital intensive projects may not scale or pay off as expected.

Yet for investors, the bigger issue to watch is how Occidental’s debt load could interact with...

Read the full narrative on Occidental Petroleum (it's free!)

Occidental Petroleum's narrative projects $29.0 billion revenue and $3.7 billion earnings by 2028.

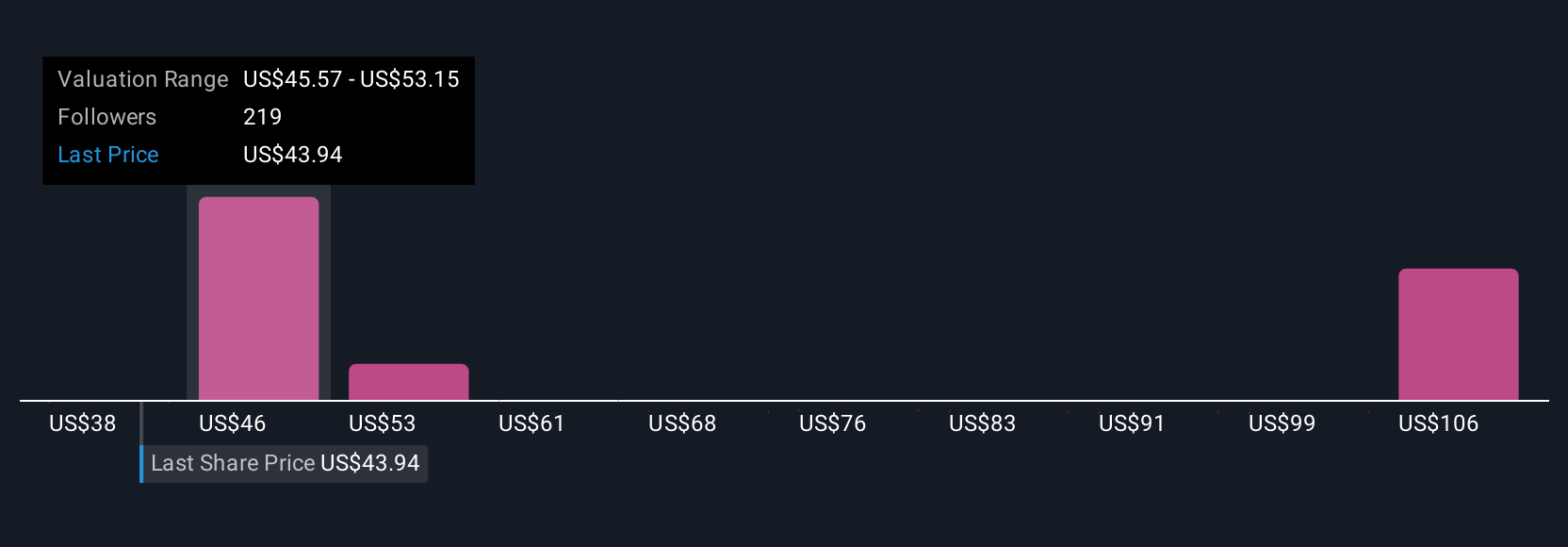

Uncover how Occidental Petroleum's forecasts yield a $50.21 fair value, a 20% upside to its current price.

Exploring Other Perspectives

Twenty eight members of the Simply Wall St Community currently place Occidental’s fair value anywhere between about US$31 and roughly US$236, with many estimates clustered well above the present share price. When you set those views against the company’s heavy exposure to oil price swings and the uncertainty around commercialising large scale carbon capture, it is clear you should compare several different outlooks before deciding how this stock might fit your portfolio.

Explore 28 other fair value estimates on Occidental Petroleum - why the stock might be worth over 5x more than the current price!

Build Your Own Occidental Petroleum Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Occidental Petroleum research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Occidental Petroleum research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Occidental Petroleum's overall financial health at a glance.

Curious About Other Options?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OXY

Occidental Petroleum

Engages in the acquisition, exploration, and development of oil and gas properties in the United States and internationally.

Slight risk with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026