- United States

- /

- Energy Services

- /

- NYSE:OII

Oceaneering International (OII): Assessing Valuation in Light of Strong Q3 Results and 2025 Guidance

Reviewed by Simply Wall St

Oceaneering International (OII) just released third quarter earnings that showed clear gains in both sales and net income compared to last year. Alongside these results, management also shared guidance for the year ahead. This included projections for 2025 net income and expectations for slightly lower fourth quarter revenue.

See our latest analysis for Oceaneering International.

After a solid third quarter showing and new guidance from management, Oceaneering International’s stock has found some upward momentum lately. A recent 9% 7-day share price return has helped offset a weaker year-to-date result. The company’s long-term record stands out even more, with a staggering 593% five-year total shareholder return. This points to substantial wealth creation despite periodic setbacks and its lower-growth reputation.

If you’re looking to see what else is making big moves, now’s a great opportunity to broaden your search and discover fast growing stocks with high insider ownership

But with the stock already rebounding and management signaling tempered near-term growth, investors may wonder whether Oceaneering International is trading at a bargain based on intrinsic value, or if the market has already priced in its future prospects.

Most Popular Narrative: 10% Overvalued

Oceaneering International’s most followed valuation narrative points to a fair value below the latest closing price. This implies the share price may now run slightly ahead of consensus assumptions. The gap suggests investors have bid up the stock beyond the fair value set by widely tracked analyst models, setting up tension around future expectations.

The ongoing global energy transition and intensifying decarbonization efforts continue to limit new offshore oil & gas developments. This threatens Oceaneering's long-term project backlog and could ultimately reduce future revenue growth as the addressable market gradually contracts. There is increasing investor and regulatory pressure to reallocate capital away from traditional oilfield service providers. This trend is likely to hinder capital flows to Oceaneering's core business lines, potentially compressing growth prospects, restraining order activity, and constraining revenue and profit expansion.

Curious how a shifting global energy landscape, shrinking margins, and aggressive price assumptions converge in the calculation? The narrative incorporates a detailed financial roadmap based on projections you will want to scrutinize. What underlying assumptions tip the scales? You’ll need to dig deeper to uncover the numbers behind this fair value.

Result: Fair Value of $22.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, Oceaneering’s momentum in defense and recurring service contracts could offset energy headwinds. This may support steadier revenue even if oil demand declines.

Find out about the key risks to this Oceaneering International narrative.

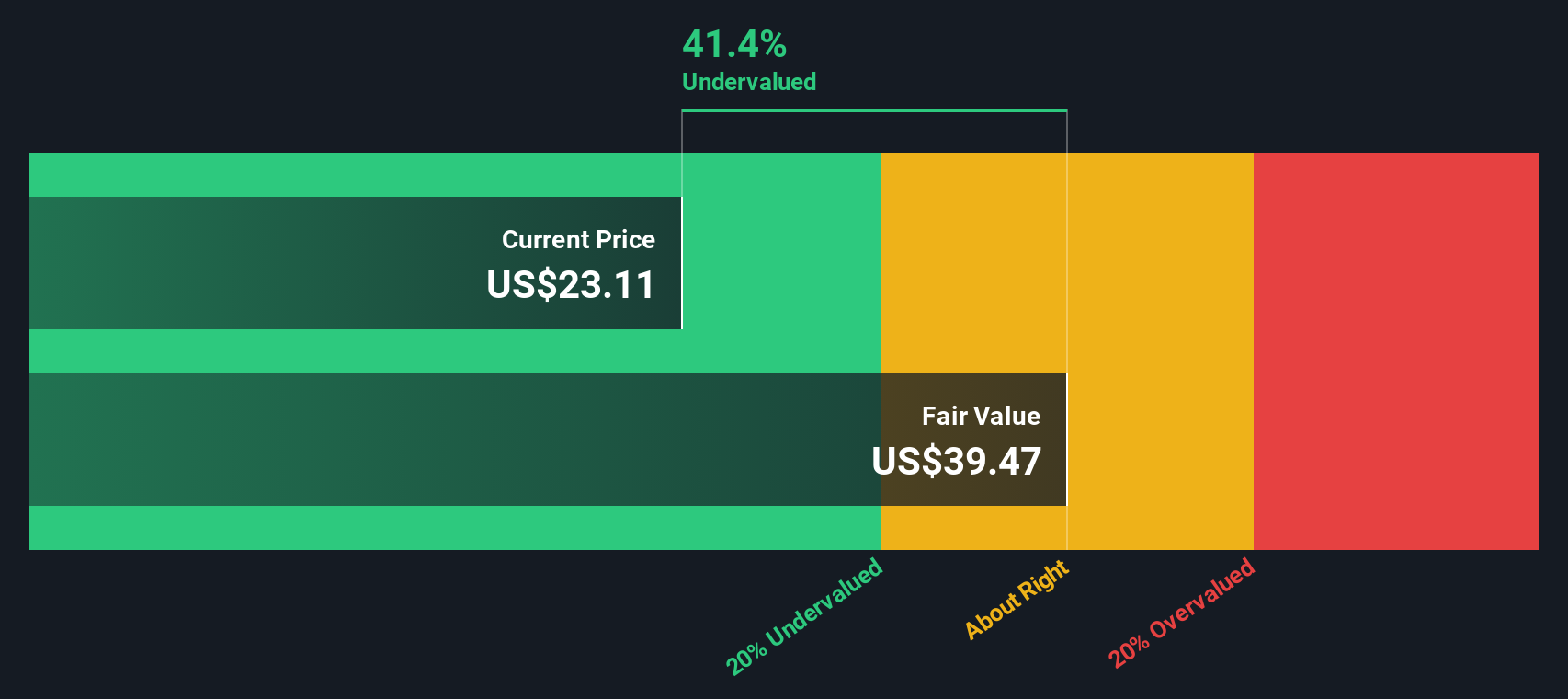

Another View: Discounted Cash Flow Model Points to Undervaluation

While analyst consensus suggests Oceaneering International is trading above fair value, our DCF model presents a different story. Using long-term cash flow projections, the SWS DCF model estimates fair value at $39.49 per share, which is significantly higher than the current price. Does the DCF capture hidden upside that a simple earnings multiple might miss?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Oceaneering International Narrative

If you see the story differently or want to dive into your own analysis, you can easily craft your own narrative in just a few minutes. Do it your way

A great starting point for your Oceaneering International research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors never limit their opportunities. If you want even more ways to get ahead, let Simply Wall Street guide you toward standout stocks and untapped sectors worth your attention.

- Tap into potential high-yield performers by checking out these 17 dividend stocks with yields > 3%. Discover companies offering attractive payouts above 3%.

- Catch the wave in artificial intelligence and see which innovative companies are making headlines among these 26 AI penny stocks.

- Capitalize on undervalued gems by unlocking access to these 877 undervalued stocks based on cash flows. Reveal stocks trading below their intrinsic worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives