- United States

- /

- Energy Services

- /

- NYSE:OII

Oceaneering International (OII): Assessing Shareholder Value Following Modest Stock Gains

Reviewed by Kshitija Bhandaru

See our latest analysis for Oceaneering International.

While Oceaneering International’s share price has nudged higher over the past month, the real story is in its longer-term performance. The company’s 1-year total shareholder return is essentially flat, trailing much stronger figures from previous years. This hints that recent momentum is fading as investors weigh up where value may lie amid shifting market dynamics.

If you’re curious about fresh ways to spot opportunity in changing markets, now might be the perfect moment to discover fast growing stocks with high insider ownership.

With shares trading just below analyst price targets and the stock offering a notable intrinsic discount, is Oceaneering International poised for a rebound, or has the market already priced in every ounce of its future growth potential?

Most Popular Narrative: 9% Overvalued

Compared to its latest close of $24.36, the most widely followed narrative places Oceaneering International’s fair value at $22.38. While the gap has narrowed, investors face pivotal assumptions regarding long-term demand and profitability that support this fair value.

"The ongoing global energy transition and intensifying decarbonization efforts continue to limit new offshore oil & gas developments, which threatens Oceaneering's long-term project backlog and could ultimately reduce future revenue growth as the addressable market gradually contracts."

Want to know what numbers drive this high conviction? One critical variable is the future earnings power the narrative assumes, particularly as intensifying sector headwinds overlap with operating margin pressures. Find out which core forecast changes have the most impact on the outlook and the key swing factor most analysts are watching. Discover the underlying projections that shape this price target.

Result: Fair Value of $22.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the company's expansion into defense technologies and recurring long-term contracts could help offset offshore energy headwinds and provide unexpected support for future growth.

Find out about the key risks to this Oceaneering International narrative.

Another View: Discounted Cash Flow Shows a Different Story

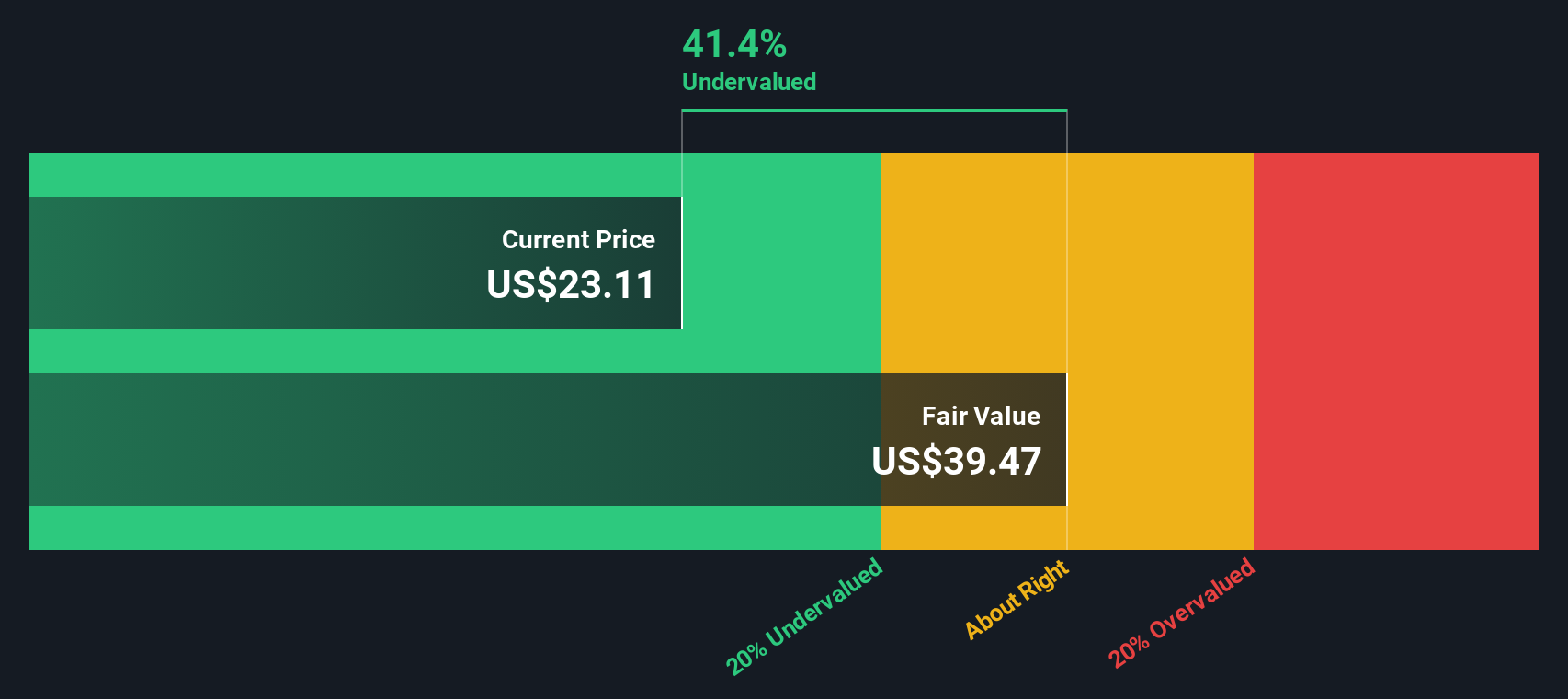

While multiples suggest Oceaneering International trades above its fair value, our DCF model offers a striking contrast. Based on projected future cash flows, the SWS DCF model indicates the stock is trading about 38% below its fair value, which signals potential undervaluation. Which method will better reflect reality as the market evolves?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Oceaneering International Narrative

If you see things differently or want to dig into the numbers yourself, you can build your own personalized narrative in just a few minutes, and Do it your way.

A great starting point for your Oceaneering International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors always scan the horizon for the next opportunity. Don’t limit yourself to just one stock when untapped gems might be hiding in plain sight.

- Supercharge your income potential by checking out these 19 dividend stocks with yields > 3%, offering reliable yields above 3% from established, shareholder-friendly companies.

- Tap into the momentum of technology by reviewing these 25 AI penny stocks, which are pioneering breakthroughs across automation, data science, and intelligent platforms.

- Unlock value by seeking out these 886 undervalued stocks based on cash flows, which are primed for long-term appreciation based on strong fundamentals and attractive cash flow outlooks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States, Africa, the United Kingdom, Norway, Brazil, Asia, Australia, and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives