- United States

- /

- Energy Services

- /

- NYSE:OII

Oceaneering International (NYSE:OII) delivers shareholders favorable 14% CAGR over 5 years, surging 3.2% in the last week alone

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the Oceaneering International, Inc. (NYSE:OII) share price is up 96% in the last 5 years, clearly besting the market return of around 78% (ignoring dividends). On the other hand, the more recent gains haven't been so impressive, with shareholders gaining just 16%.

Since the stock has added US$79m to its market cap in the past week alone, let's see if underlying performance has been driving long-term returns.

Check out our latest analysis for Oceaneering International

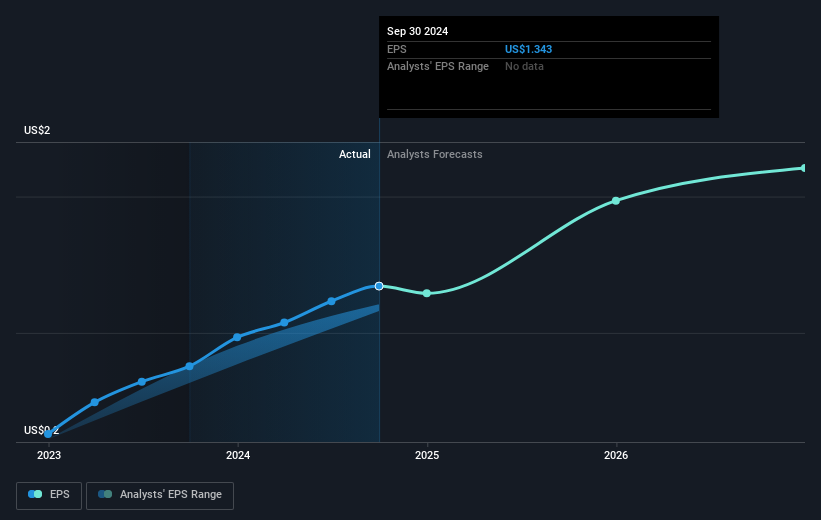

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Oceaneering International became profitable. That's generally thought to be a genuine positive, so investors may expect to see an increasing share price.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

We know that Oceaneering International has improved its bottom line over the last three years, but what does the future have in store? If you are thinking of buying or selling Oceaneering International stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

Oceaneering International shareholders gained a total return of 16% during the year. But that return falls short of the market. On the bright side, that's still a gain, and it's actually better than the average return of 14% over half a decade This suggests the company might be improving over time. If you would like to research Oceaneering International in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

But note: Oceaneering International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on American exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:OII

Oceaneering International

Provides engineered services and products, and robotic solutions to the offshore energy, defense, aerospace, manufacturing, and entertainment industries in the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives