- United States

- /

- Oil and Gas

- /

- NYSE:NVGS

Navigator Holdings (NVGS): Assessing Valuation After Profitable Quarter and Significant Share Buyback

Reviewed by Simply Wall St

Most Popular Narrative: 21.9% Undervalued

According to community narrative, Navigator Holdings is considered significantly undervalued, with analyst consensus placing its current fair value meaningfully above the latest share price.

Expansion of U.S. export infrastructure, including the Enterprise Beaumont terminal and associated new ethylene/ethane contracts, is expected to further increase Navigator's volumes and tonnage. This enables more long-haul shipments and diversified cargoes, which supports sustained revenue and facilitates earnings growth through higher asset utilization.

Curious what powers such a bullish price target? This community viewpoint is based on transformative assumptions about future profitability and efficiency upgrades. There is one core expectation in these projections that could change how investors see the company, and it might surprise you. Want to know why some are willing to price in a major premium above today’s market? The full story has the concrete numbers you will want to uncover.

Result: Fair Value of $21.00 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, persistent geopolitical tensions or unexpected downturns in charter rates could quickly shift the outlook. These factors may challenge the current undervaluation thesis for Navigator Holdings.

Find out about the key risks to this Navigator Holdings narrative.Another View: Testing the Numbers

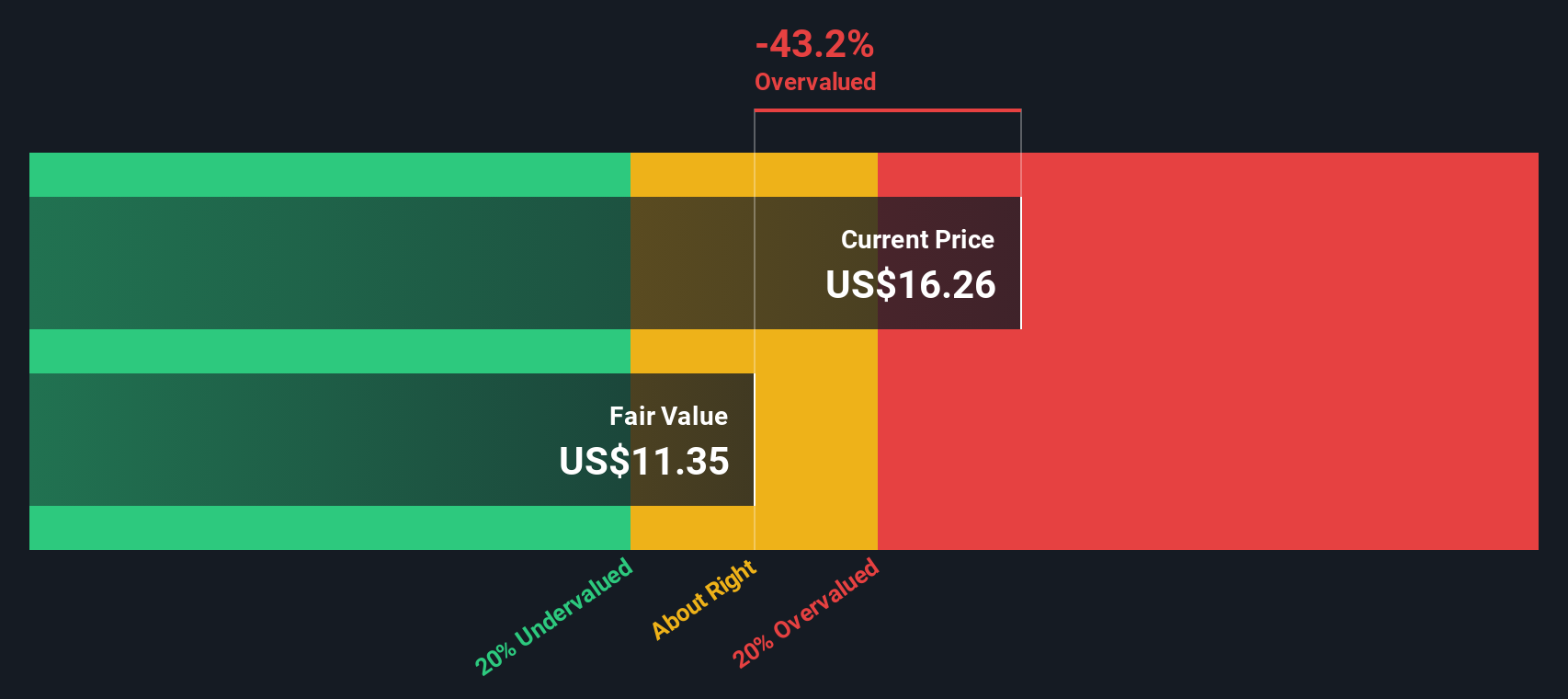

While the analyst target suggests strong upside, the SWS DCF model reaches a much more cautious conclusion and indicates Navigator may be overvalued at current prices. Which approach do you think better fits the company's prospects?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Navigator Holdings Narrative

If the current consensus does not align with your perspective or research preferences, you can dive into the data and develop your own take in just a few minutes. Simply do it your way.

A great starting point for your Navigator Holdings research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investing means always keeping your eye on the next big opportunity. If you want to stay one step ahead, use these powerful tools to uncover stocks that could reshape your portfolio. Here are some standout ideas ready for your attention:

- Capture reliable payouts for your future by checking out dividend stocks with yields > 3%, which consistently deliver yields above 3%.

- Target the pioneers transforming healthcare by scouting healthcare AI stocks, as they drive medical breakthroughs with artificial intelligence.

- Get ahead of market trends and strengthen your potential returns by tracking undervalued stocks based on cash flows, which are trading below their cash flow value right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVGS

Navigator Holdings

Owns and operates a fleet of liquefied gas carriers worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives