- United States

- /

- Oil and Gas

- /

- NYSE:NVGS

Has Navigator Stock Pulled Back Too Far After Recent Volatility in 2025?

Reviewed by Bailey Pemberton

If you are wondering what to do with Navigator Holdings stock right now, you are not alone. Lately, this shipping specialist has delivered a bumpy ride for investors. After peaking earlier this year, the stock has pulled back by 8.6% over the past week and nearly 12.5% over the past month. Year-to-date, it is down 10.3%, erasing the steady gains that attracted attention in previous years. Still, it is worth remembering that Navigator Holdings remains up an impressive 81.8% over the last five years. This is proof of its long-term growth potential even when the short-term picture looks uncertain.

Much of the recent volatility can be traced to shifting sentiment in the broader shipping market, as investors recalibrate expectations on trade volumes and freight rates. These changes have sparked conversation about risk, but for savvy investors, they can also present an opportunity to revisit what the company is actually worth. That is where our analysis comes in: using a tested checklist of six valuation criteria, Navigator Holdings scores a 4, meaning it comes up as undervalued in four out of six key areas. Of course, valuation is only as good as the methods behind it. In the next section, we will break down the different approaches to see what they reveal about where Navigator Holdings stands. We will also introduce one framework that could give an even deeper picture of true value.

Why Navigator Holdings is lagging behind its peers

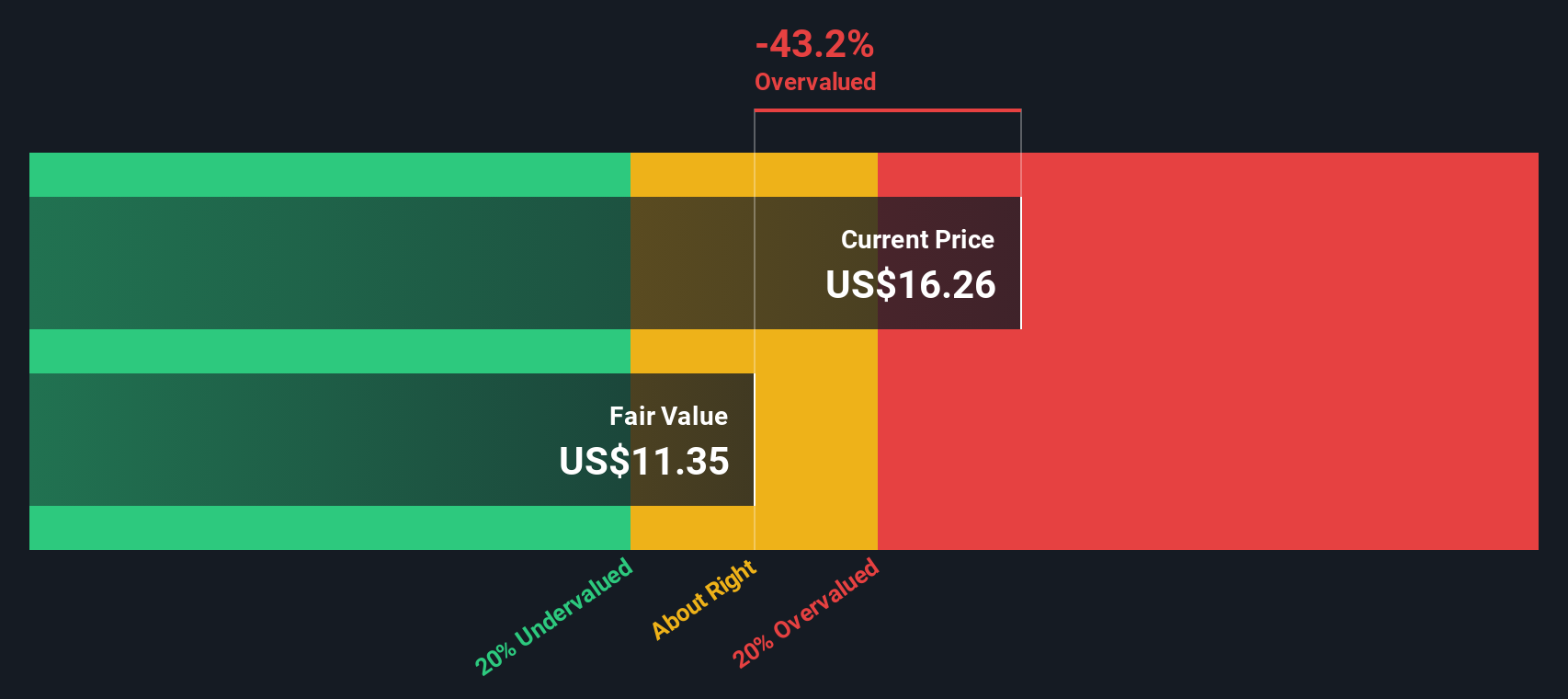

Approach 1: Navigator Holdings Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a popular method for estimating a company's value by projecting its future cash flows and then discounting them back to their value in today's dollars. This approach helps investors look past short-term market swings and focus on what a business could generate over time.

For Navigator Holdings, analysts estimate that the company generated $64.67 million in free cash flow over the last twelve months. Looking ahead, projections suggest free cash flow will reach $183.53 million in 2026, before moderating to $13 million in 2027. Subsequent years are extrapolated based on historical trends. All cash flows are calculated in US Dollars ($).

Using these estimates, the DCF model arrives at an intrinsic value of $4.62 per share. Compared with the current share price, this implies the stock is trading at a 211.8% premium to the calculated fair value. This suggests the market is pricing the business well above what its future cash flows would support on a fundamental basis.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Navigator Holdings may be overvalued by 211.8%. Find undervalued stocks or create your own screener to find better value opportunities.

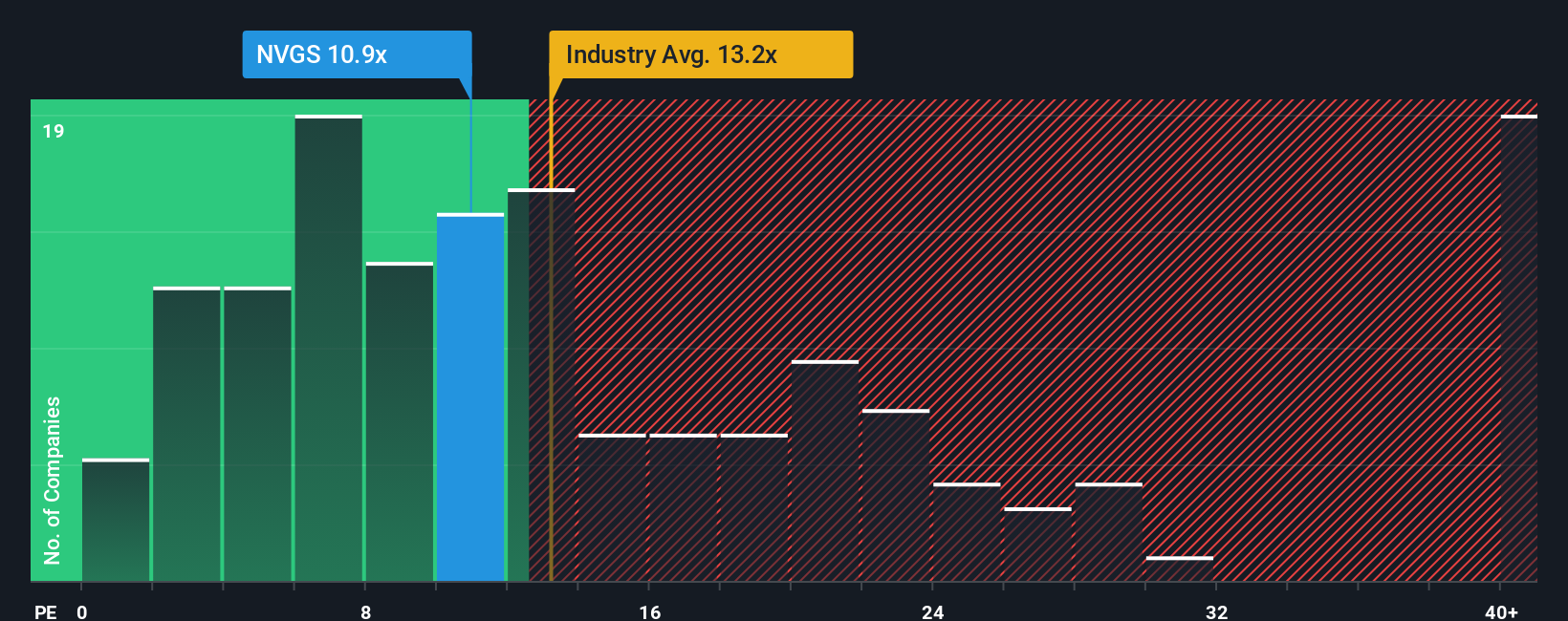

Approach 2: Navigator Holdings Price vs Earnings (PE)

For companies that consistently generate profits, the price-to-earnings (PE) ratio is a widely used metric for valuation. The PE ratio helps investors gauge how much they are paying for each dollar of earnings, offering a quick way to compare the value of similar businesses. However, it is important to remember that what counts as a "fair" PE is shaped by expectations of future growth and the level of risk. Higher growth and lower risk typically justify a higher multiple; the opposite is true for more uncertain or slower-growing firms.

Navigator Holdings currently trades at a PE ratio of 10.9x. This is well below the Oil and Gas industry average of 13.2x and significantly lower than the peer group average of 28.5x. These raw numbers might suggest value, but raw comparisons do not always capture the unique profile of each company.

That is where Simply Wall St's "Fair Ratio" comes in. The Fair Ratio for Navigator Holdings is set at 14.7x, taking into account not only peer benchmarks and industry averages, but also company-specific factors like growth outlook, profit margins, overall risk, and market cap. This tailored approach provides a more complete picture of whether the stock is reasonably priced.

With Navigator Holdings' current PE of 10.9x well below its Fair Ratio of 14.7x, the shares appear undervalued based on this methodology.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Navigator Holdings Narrative

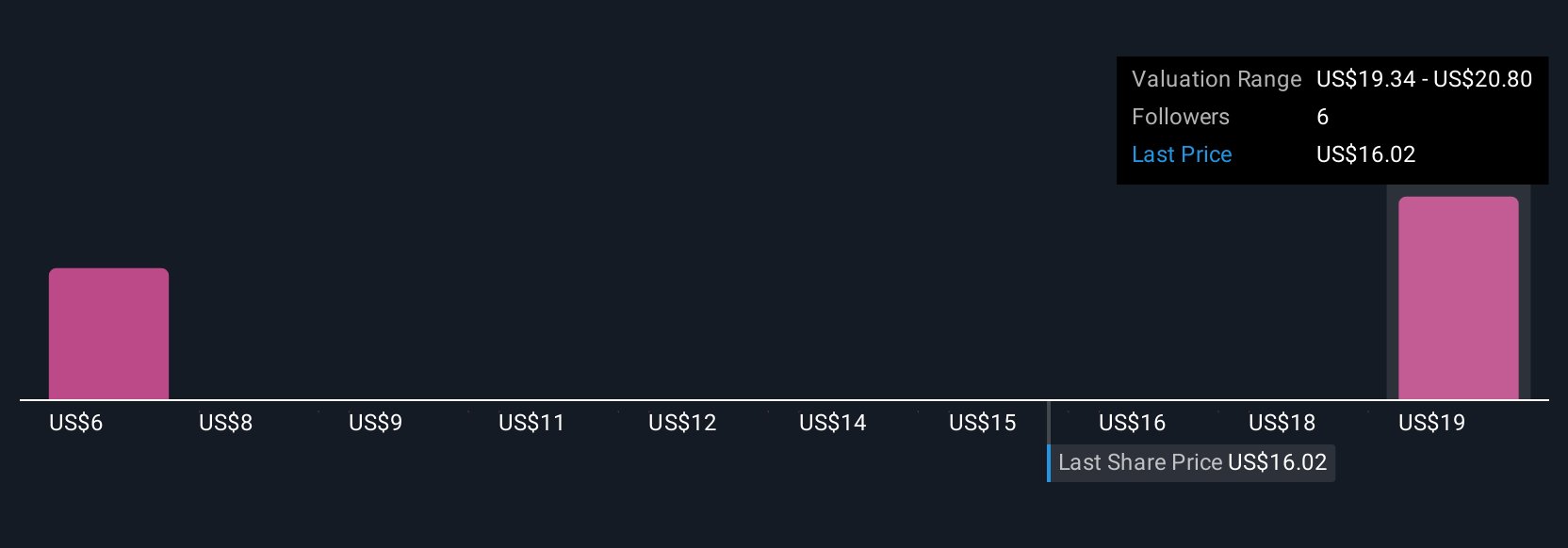

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives. A Narrative is your way to link the story you see for a company, including your assumptions about its fair value, future revenue, earnings, and margins, to a concrete financial forecast. Instead of only relying on formulas and ratios, you get to articulate the reasons behind your expectations and see how those beliefs translate into a valuation number.

Narratives are a simple, accessible tool available to everyone on Simply Wall St’s Community page, used by millions of investors to explain and update their investment thinking as new data or news arrives. Each Narrative dynamically ties your perspective to updated company data, so as fresh earnings or important headlines appear, your fair value and forecast adjust automatically.

This makes it much easier to decide when to buy or sell because you can quickly compare your Fair Value to the current share price and see if your conviction matches the market view. For example, some community members believe growth in clean fuels and a renewed fleet justifies a fair value as high as $24.00 per share, while others focus on market and regulatory risks, settling on a more conservative $18.00 per share.

Do you think there's more to the story for Navigator Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Navigator Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NVGS

Navigator Holdings

Owns and operates a fleet of liquefied gas carriers worldwide.

Good value with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)