- United States

- /

- Oil and Gas

- /

- NYSE:NRT

We Ran A Stock Scan For Earnings Growth And North European Oil Royalty Trust (NYSE:NRT) Passed With Ease

Investors are often guided by the idea of discovering 'the next big thing', even if that means buying 'story stocks' without any revenue, let alone profit. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

In contrast to all that, many investors prefer to focus on companies like North European Oil Royalty Trust (NYSE:NRT), which has not only revenues, but also profits. Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide North European Oil Royalty Trust with the means to add long-term value to shareholders.

View our latest analysis for North European Oil Royalty Trust

North European Oil Royalty Trust's Improving Profits

Over the last three years, North European Oil Royalty Trust has grown earnings per share (EPS) at as impressive rate from a relatively low point, resulting in a three year percentage growth rate that isn't particularly indicative of expected future performance. As a result, we'll zoom in on growth over the last year, instead. Outstandingly, North European Oil Royalty Trust's EPS shot from US$1.25 to US$3.07, over the last year. Year on year growth of 145% is certainly a sight to behold. That could be a sign that the business has reached a true inflection point.

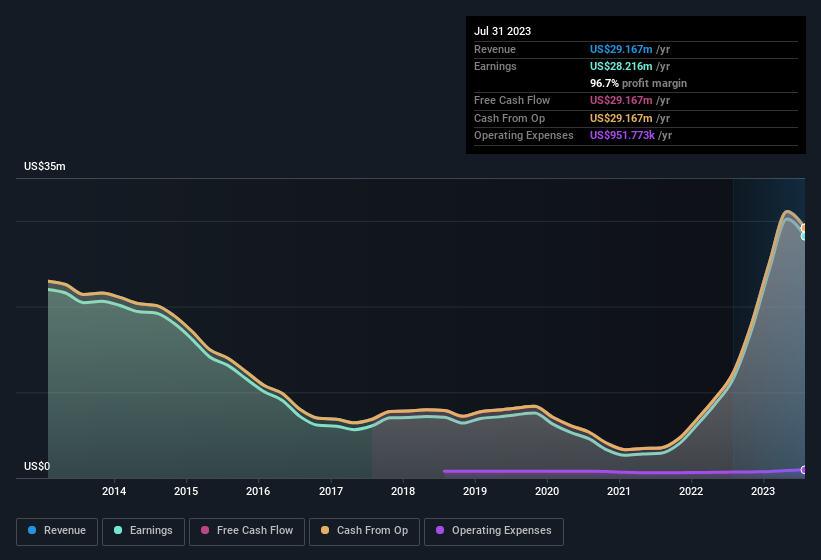

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of North European Oil Royalty Trust shareholders is that EBIT margins have grown from 94% to 97% in the last 12 months and revenues are on an upwards trend as well. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

North European Oil Royalty Trust isn't a huge company, given its market capitalisation of US$64m. That makes it extra important to check on its balance sheet strength.

Are North European Oil Royalty Trust Insiders Aligned With All Shareholders?

As a general rule, it's worth considering how much the CEO is paid, since unreasonably high rates could be considered against the interests of shareholders. For companies with market capitalisations under US$200m, like North European Oil Royalty Trust, the median CEO pay is around US$755k.

North European Oil Royalty Trust's CEO took home a total compensation package of US$140k in the year prior to October 2022. That looks like a modest pay packet, and may hint at a certain respect for the interests of shareholders. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. It can also be a sign of good governance, more generally.

Should You Add North European Oil Royalty Trust To Your Watchlist?

North European Oil Royalty Trust's earnings have taken off in quite an impressive fashion. This appreciable increase in earnings could be a sign of an upward trajectory for the company. At the same time the reasonable CEO compensation reflects well on the board of directors. It will definitely require further research to be sure, but it does seem that North European Oil Royalty Trust has the hallmarks of a quality business; and that would make it well worth watching. Before you take the next step you should know about the 3 warning signs for North European Oil Royalty Trust that we have uncovered.

Although North European Oil Royalty Trust certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if North European Oil Royalty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRT

North European Oil Royalty Trust

A grantor trust, holds overriding royalty rights covering gas and oil production in various concessions or leases in the Federal Republic of Germany.

Flawless balance sheet average dividend payer.