- United States

- /

- Oil and Gas

- /

- NYSE:NRT

Should You Be Adding North European Oil Royalty Trust (NYSE:NRT) To Your Watchlist Today?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like North European Oil Royalty Trust (NYSE:NRT). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Check out our latest analysis for North European Oil Royalty Trust

How Fast Is North European Oil Royalty Trust Growing?

If you believe that markets are even vaguely efficient, then over the long term you'd expect a company's share price to follow its earnings per share (EPS) outcomes. That means EPS growth is considered a real positive by most successful long-term investors. To the delight of shareholders, North European Oil Royalty Trust has achieved impressive annual EPS growth of 57%, compound, over the last three years. Growth that fast may well be fleeting, but it should be more than enough to pique the interest of the wary stock pickers.

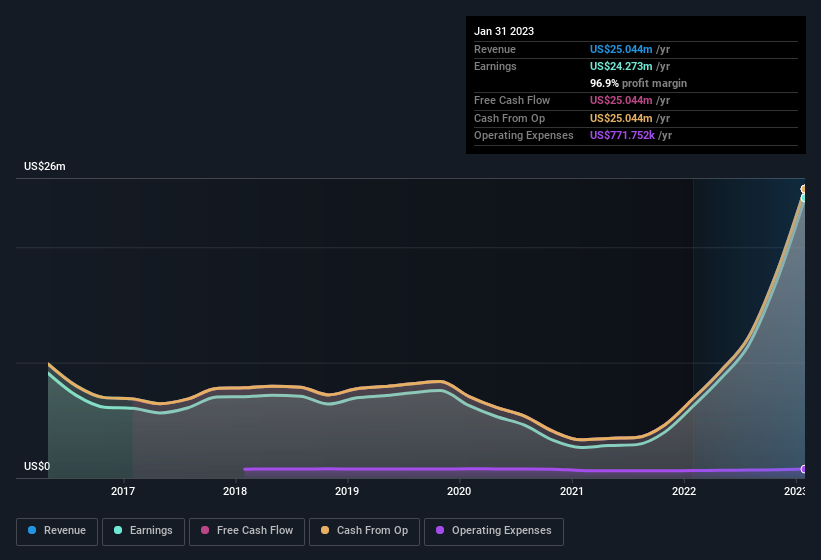

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The music to the ears of North European Oil Royalty Trust shareholders is that EBIT margins have grown from 91% to 97% in the last 12 months and revenues are on an upwards trend as well. That's great to see, on both counts.

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

North European Oil Royalty Trust isn't a huge company, given its market capitalisation of US$131m. That makes it extra important to check on its balance sheet strength.

Are North European Oil Royalty Trust Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. Because often, the purchase of stock is a sign that the buyer views it as undervalued. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

It's nice to see that there have been no reports of any insiders selling shares in North European Oil Royalty Trust in the previous 12 months. So it's definitely nice that Independent Managing Trustee Nancy J. Prue bought US$12k worth of shares at an average price of around US$12.40. Decent buying like this could be a sign for shareholders here; management sees the company as undervalued.

Recent insider purchases of North European Oil Royalty Trust stock is not the only way management has kept the interests of the general public shareholders in mind. To be specific, the CEO is paid modestly when compared to company peers of the same size. The median total compensation for CEOs of companies similar in size to North European Oil Royalty Trust, with market caps under US$200m is around US$749k.

The CEO of North European Oil Royalty Trust only received US$140k in total compensation for the year ending October 2022. First impressions seem to indicate a compensation policy that is favourable to shareholders. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. It can also be a sign of a culture of integrity, in a broader sense.

Does North European Oil Royalty Trust Deserve A Spot On Your Watchlist?

North European Oil Royalty Trust's earnings per share have been soaring, with growth rates sky high. Better yet, we can observe insider buying and the chief executive pay looks reasonable. It could be that North European Oil Royalty Trust is at an inflection point, given the EPS growth. If so, then its potential for further gains probably merit a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with North European Oil Royalty Trust , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, North European Oil Royalty Trust isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if North European Oil Royalty Trust might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NRT

North European Oil Royalty Trust

A grantor trust, holds overriding royalty rights covering gas and oil production in various concessions or leases in the Federal Republic of Germany.

Flawless balance sheet average dividend payer.