- United States

- /

- Energy Services

- /

- NYSE:NINE

Nine Energy Service, Inc. (NYSE:NINE) Screens Well But There Might Be A Catch

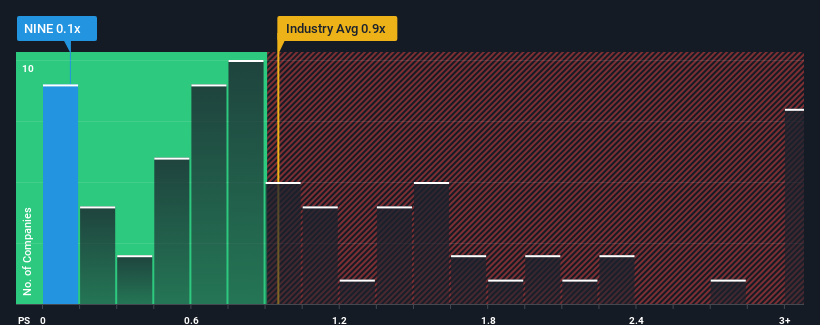

Nine Energy Service, Inc.'s (NYSE:NINE) price-to-sales (or "P/S") ratio of 0.1x may look like a pretty appealing investment opportunity when you consider close to half the companies in the Energy Services industry in the United States have P/S ratios greater than 0.9x. However, the P/S might be low for a reason and it requires further investigation to determine if it's justified.

Check out our latest analysis for Nine Energy Service

What Does Nine Energy Service's P/S Mean For Shareholders?

Nine Energy Service hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. Perhaps the P/S remains low as investors think the prospects of strong revenue growth aren't on the horizon. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Nine Energy Service.How Is Nine Energy Service's Revenue Growth Trending?

There's an inherent assumption that a company should underperform the industry for P/S ratios like Nine Energy Service's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 12%. Even so, admirably revenue has lifted 82% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Looking ahead now, revenue is anticipated to climb by 2.9% per year during the coming three years according to the sole analyst following the company. Meanwhile, the rest of the industry is forecast to expand by 4.0% per annum, which is not materially different.

With this information, we find it odd that Nine Energy Service is trading at a P/S lower than the industry. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Bottom Line On Nine Energy Service's P/S

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our examination of Nine Energy Service's revealed that its P/S remains low despite analyst forecasts of revenue growth matching the wider industry. The low P/S could be an indication that the revenue growth estimates are being questioned by the market. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

It is also worth noting that we have found 5 warning signs for Nine Energy Service (1 is potentially serious!) that you need to take into consideration.

If you're unsure about the strength of Nine Energy Service's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Valuation is complex, but we're here to simplify it.

Discover if Nine Energy Service might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NINE

Nine Energy Service

Operates as an onshore completion services provider that targets unconventional oil and gas resource development in North American basins and internationally.

Moderate and fair value.

Similar Companies

Market Insights

Community Narratives