- United States

- /

- Oil and Gas

- /

- NYSE:NAT

Nordic American Tankers (NYSE:NAT) Is Paying Out A Larger Dividend Than Last Year

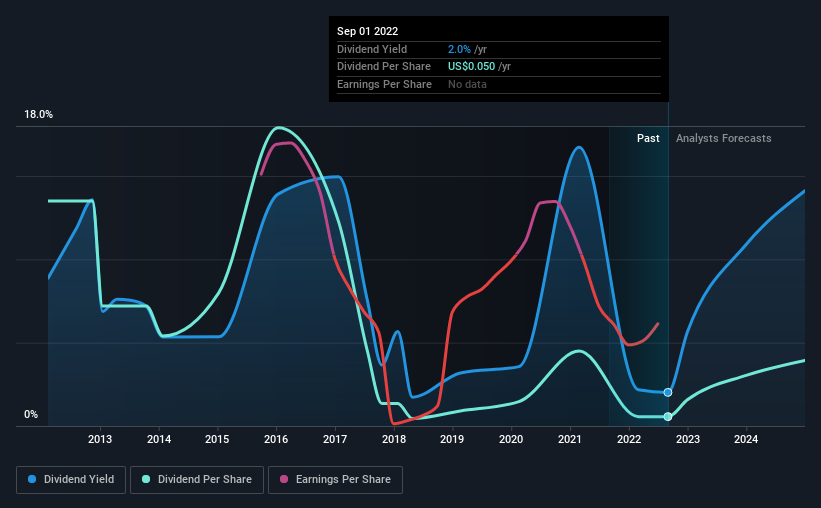

The board of Nordic American Tankers Limited (NYSE:NAT) has announced that the dividend on 12th of October will be increased to $0.03, which will be 200% higher than last year's payment of $0.01 which covered the same period. Despite this raise, the dividend yield of 2.0% is only a modest boost to shareholder returns.

Check out our latest analysis for Nordic American Tankers

Nordic American Tankers' Payment Has Solid Earnings Coverage

While yield is important, another factor to consider about a company's dividend is whether the current payout levels are feasible. Even in the absence of profits, Nordic American Tankers is paying a dividend. The company is also yet to generate cash flow, so the dividend sustainability is definitely questionable.

Analysts expect a massive rise in earnings per share in the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 0.8%, so there isn't too much pressure on the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2012, the dividend has gone from $1.20 total annually to $0.05. The dividend has fallen 96% over that period. Declining dividends isn't generally what we look for as they can indicate that the company is running into some challenges.

The Company Could Face Some Challenges Growing The Dividend

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. It's encouraging to see that Nordic American Tankers has been growing its earnings per share at 25% a year over the past five years. While the company is not yet turning a profit, it is growing at a good rate. If the company can turn a profit relatively soon, we can see this becoming a reliable income stock.

We should note that Nordic American Tankers has issued stock equal to 27% of shares outstanding. Trying to grow the dividend when issuing new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill. Companies that consistently issue new shares are often suboptimal from a dividend perspective.

Nordic American Tankers' Dividend Doesn't Look Sustainable

In summary, while it's always good to see the dividend being raised, we don't think Nordic American Tankers' payments are rock solid. While we generally think the level of distributions are a bit high, we wouldn't rule it out as becoming a good dividend payer in the future as its earnings are growing healthily. We would be a touch cautious of relying on this stock primarily for the dividend income.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. To that end, Nordic American Tankers has 3 warning signs (and 2 which are concerning) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Nordic American Tankers might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:NAT

Nordic American Tankers

A tanker company, acquires and charters double-hull tankers in Bermuda and internationally.

Slight with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives