- United States

- /

- Oil and Gas

- /

- NYSE:MPLX

MPLX Valuation in 2025: Does Strong Cash Flow Signal More Upside After Recent Gains?

Reviewed by Simply Wall St

Deciding what to do with MPLX stock right now might feel like standing at a crossroads, especially after seeing its confident climb over the last year. If you’re watching for strong returns, MPLX hasn’t disappointed; its total return over the past year is up an impressive 28.6%, while the five-year figure is a striking 236%. Even in 2024 so far, the stock is up over 4%. Still, recent weeks have seen some hesitation, with a small dip in the last month and only a minor gain in the last quarter. This back-and-forth might be giving investors pause, but it also poses a big question: is MPLX undervalued, or is the market finally catching up?

Part of the renewed optimism stems from steady fundamental growth. With annual revenue and net income both on the rise, and a closing price that sits around a 12% discount to average analyst targets, there is a reasonable argument for further upside. On top of that, valuation models lend MPLX a strong endorsement; by our undervaluation scoring system, it comes in at a 5 out of 6. That suggests the company looks undervalued on almost every major metric we check.

But what does that really mean for you, as an investor considering whether MPLX deserves a place in your portfolio? In the next section, I’ll walk through the details behind these different valuation tests. Stay tuned, because we’ll close out with a perspective on valuation that cuts even closer to what matters for long-term gains.

MPLX delivered 28.6% returns over the last year. See how this stacks up to the rest of the Oil and Gas industry.Approach 1: MPLX Cash Flows

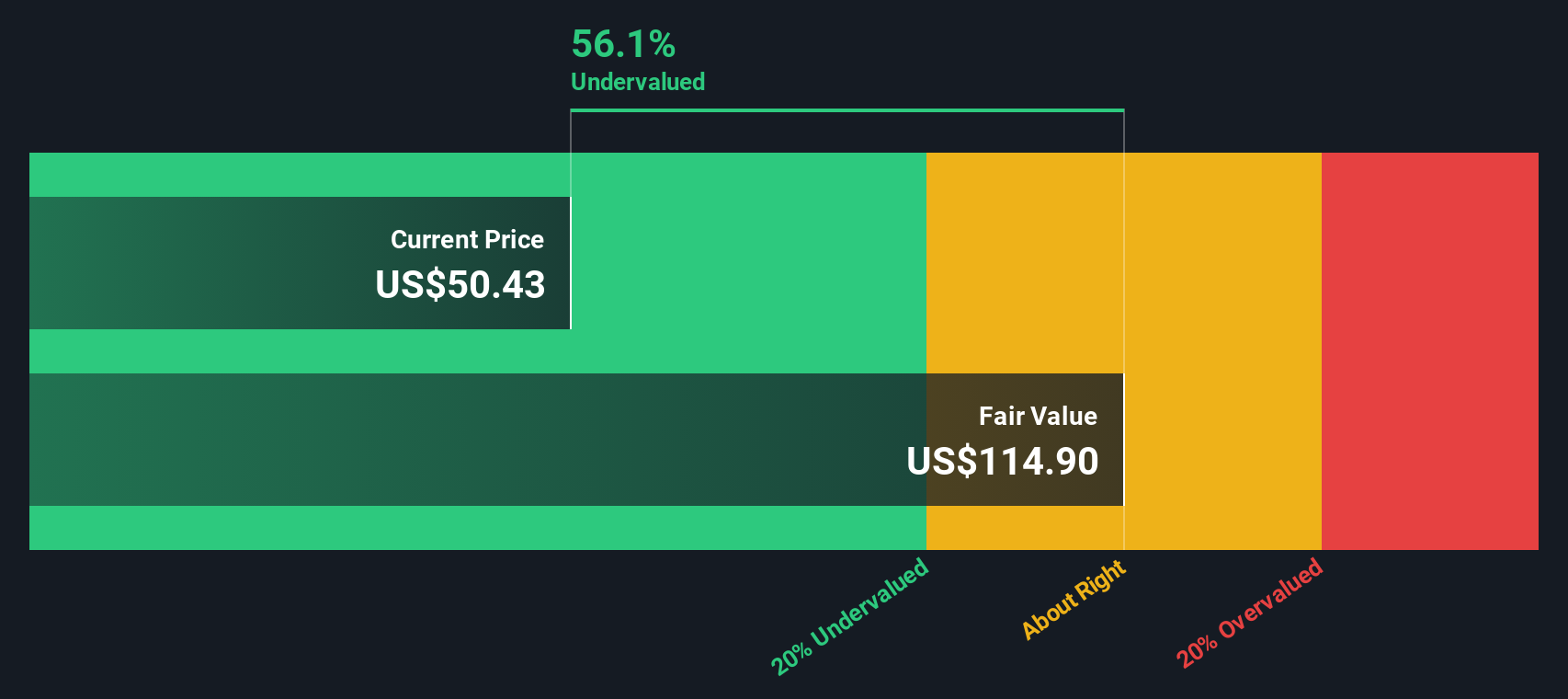

A discounted cash flow (DCF) model takes the company’s expected future cash flows, projects them over the next decade, and then discounts those back to today’s dollars to estimate what the business is really worth right now.

MPLX’s latest trailing twelve months Free Cash Flow (FCF) is just over $5 billion. Looking ahead, analysts expect continued steady growth, projecting FCF to rise each year and reach about $6.8 billion by 2035. This ongoing expansion supports a healthy outlook for the company’s cash generation capabilities.

Using these forecasts in a two-stage DCF model yields an intrinsic fair value estimate of $115.74 per share. Compared to the current price, this suggests MPLX is approximately 56.2% undervalued.

In summary, the discounted cash flow approach suggests MPLX is significantly undervalued at today’s price, which may be of interest to value-focused investors.

Result: UNDERVALUED

Approach 2: MPLX Price vs Earnings

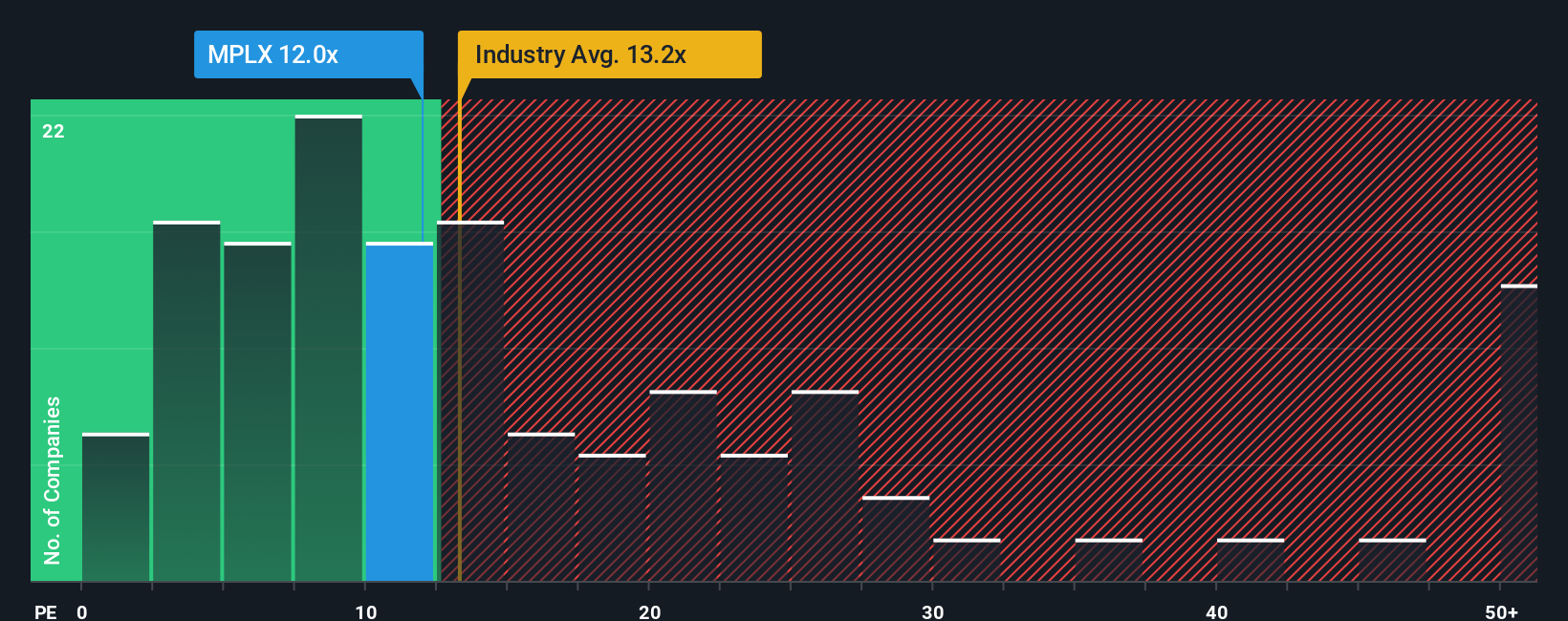

The price-to-earnings (PE) ratio is a standard valuation tool for profitable companies like MPLX because it directly connects a company's share price to the underlying earnings it generates. Investors often rely on the PE ratio to quickly gauge if a stock is richly or cheaply valued compared to its financial fundamentals.

Of course, what counts as a "normal" or "fair" PE ratio depends not just on current profits, but also on how fast the business is expected to grow and how risky those projections are. Higher expected earnings growth or lower risk often justifies a higher PE, while slower growth or higher uncertainty pulls the fair value down.

Currently, MPLX trades at a PE ratio of 12x. That is lower than the broader oil and gas industry average of about 13.2x, and also trails the peer group's average of roughly 15.6x. To add more nuance, our Fair Ratio for MPLX, factoring in things like its projected earnings growth, industry conditions, profit margins, and potential risks, lands at 16.3x. The stock's current PE is notably below this custom benchmark, pointing toward a company that is still getting less credit than its performance might warrant.

Result: UNDERVALUED

Upgrade Your Decision Making: Choose your MPLX Narrative

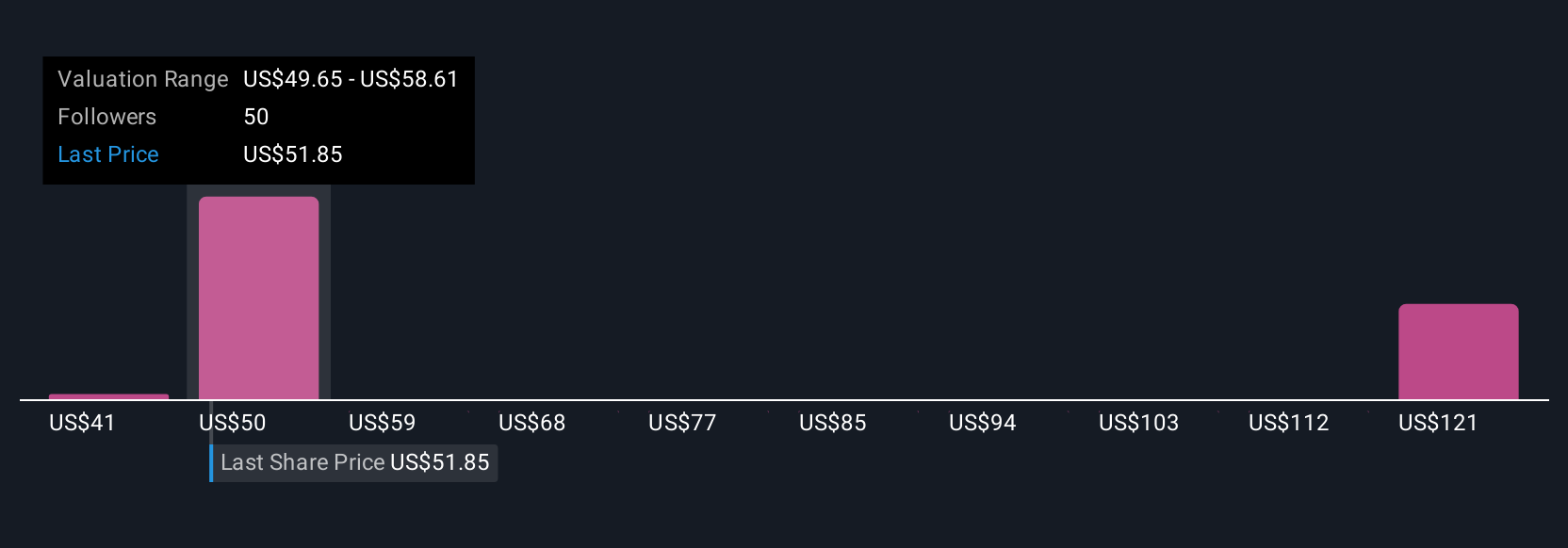

While valuation ratios like PE offer valuable clues, a Narrative goes further by connecting your view of the company’s story with a forecast for its financial future and, ultimately, a fair value for the stock.

In simple terms, a Narrative is your personal investment story. It lets you blend what you know and believe about MPLX’s growth, strategy, and challenges with concrete estimates of its future revenue, earnings, and profit margins. This turns abstract company data into a clear, actionable perspective: what you think MPLX is worth, and why.

Narratives are at the heart of the Simply Wall St platform, making it easy for anyone to analyze companies just like experienced investors do. With a few clicks, you can map out scenarios, see how your fair value stacks up against the current share price, and understand if it is time to act. In addition, Narratives update automatically whenever new information such as earnings releases or major news hits the market, so your outlook stays current without extra effort.

For example, some MPLX investors may lean on a bullish Narrative, expecting strong margin growth and targeting $64 per share, while others focus on risks like contract turnover and see a fair value closer to $53. This is a quick illustration of how Narratives tie personal views to real financial decisions.

Do you think there's more to the story for MPLX? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MPLX

MPLX

Owns and operates midstream energy infrastructure and logistics assets primarily in the United States.

Undervalued established dividend payer.

Similar Companies

Market Insights

Community Narratives