- United States

- /

- Oil and Gas

- /

- NYSE:MNR

Could Mach Natural Resources Be Attractive After a 6.6% Drop in 2025?

Reviewed by Bailey Pemberton

- Wondering if Mach Natural Resources stock is a bargain or about to break out? You are not alone, and getting the value right can make all the difference.

- The stock has seen some ups and downs lately, dropping 4.4% over the last week and sliding 6.6% in the past month. These moves often signal either growing opportunity or increased risk.

- One big reason for the recent changes has been the ripple effect of sector-wide energy news and shifting market sentiment toward oil and gas companies. Notably, investor focus has turned to Mach Natural Resources as more funds flow into energy stocks amid broader volatility, drawing attention to its fundamentals and growth story.

- If you are all about the numbers, Mach Natural Resources currently has a valuation score of 4 out of 6, reflecting strengths in several key measures of undervaluation. Up next, we will break down that score using different valuation approaches. We will also cover an often-overlooked way of judging if a stock is truly worth your investment.

Find out why Mach Natural Resources's -13.5% return over the last year is lagging behind its peers.

Approach 1: Mach Natural Resources Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company’s value by projecting its future cash flows and discounting them back to today’s dollars. This approach gives investors insight into what a business is really worth, based on the money it can generate in the future, rather than its current stock price alone.

For Mach Natural Resources, the most recent reported Free Cash Flow (FCF) stands at approximately -$354 million. Analysts have provided detailed forecasts for the next several years, with FCF expected to rise to $370.5 million in 2026 and reaching $278 million by 2029. From 2030 and beyond, the projections are based on modest declines or slight growth, with expected FCF figures hovering just above $260 million annually by 2035. All cash flows are denominated in US dollars.

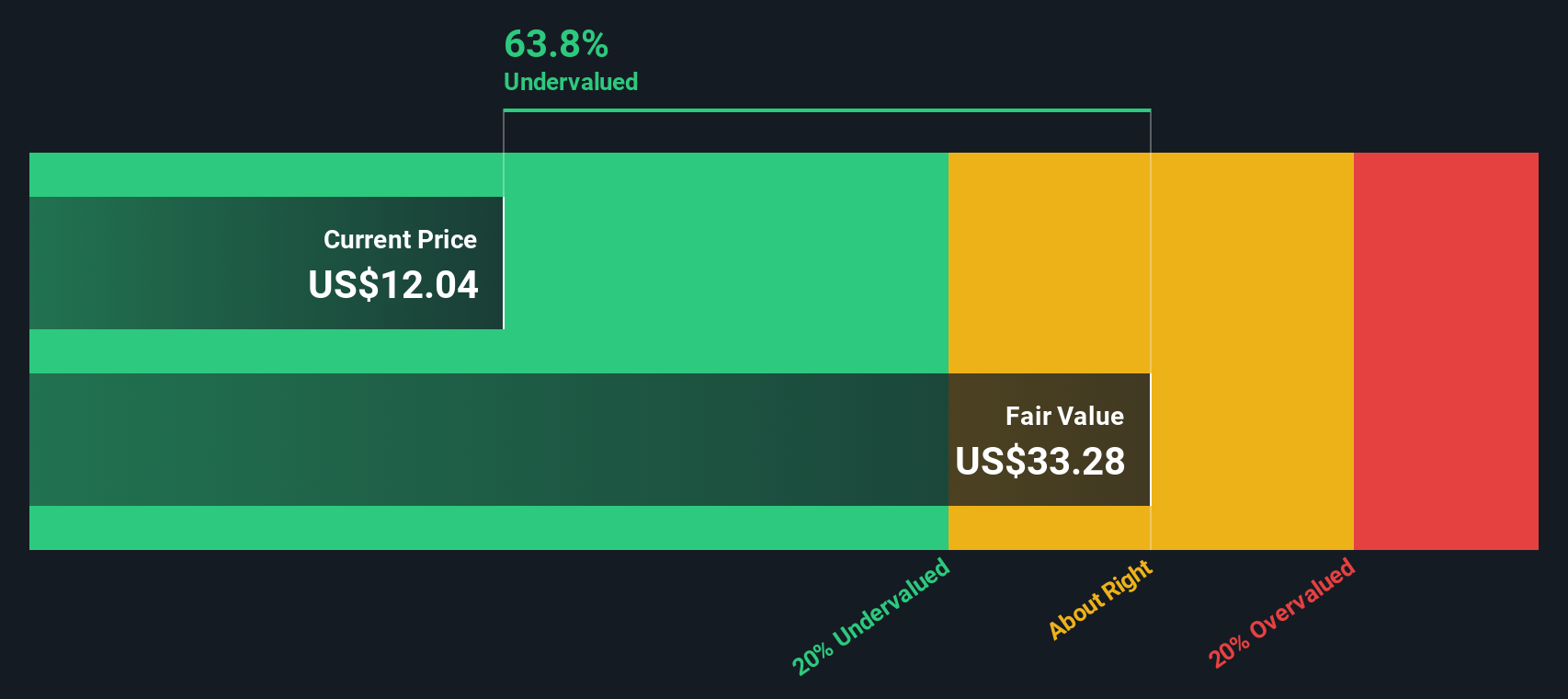

Based on these forecasts, the intrinsic value calculated through the DCF model is $32.11 per share. This value suggests that the stock is trading at a substantial discount compared to its current market price, as it is estimated to be 63.7% undervalued. Investors should note, however, that some future projections are model-based and may be less certain beyond the analyst forecast horizon.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Mach Natural Resources is undervalued by 63.7%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Mach Natural Resources Price vs Earnings

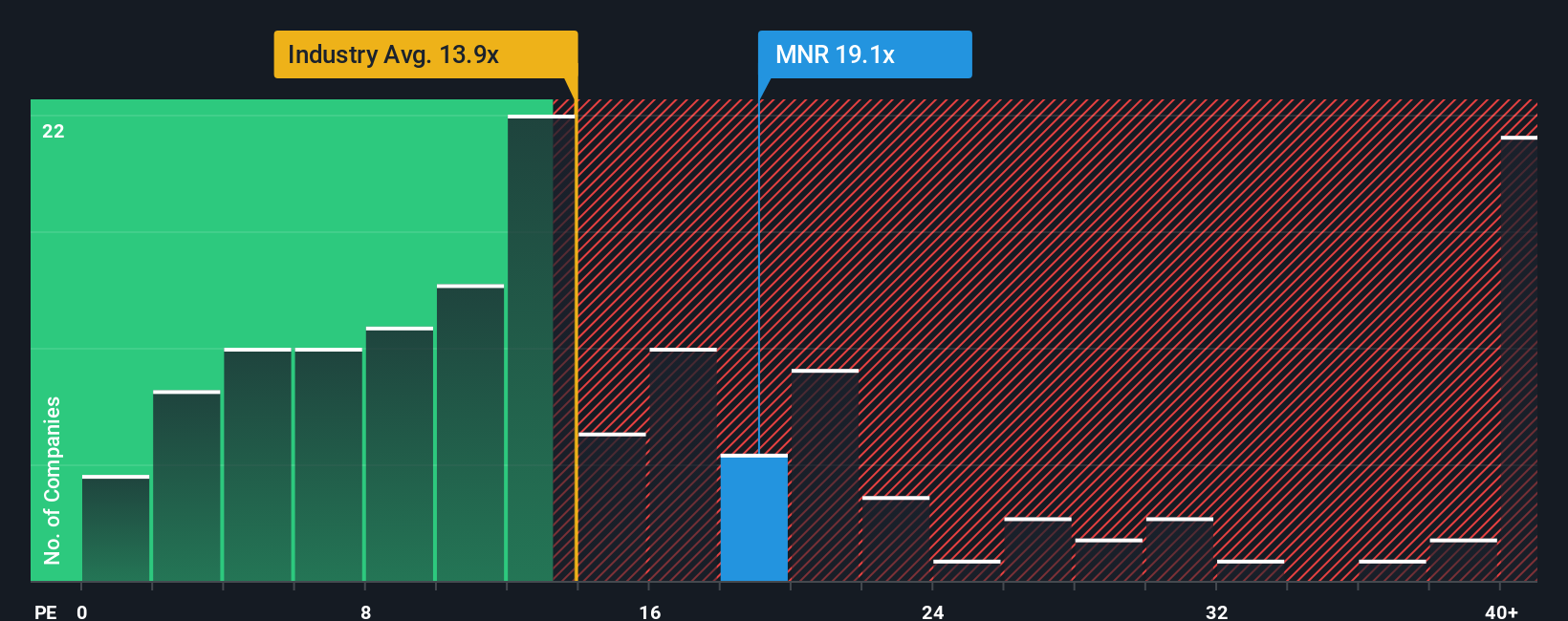

The Price-to-Earnings (PE) ratio is often the go-to valuation metric for profitable companies because it highlights how much investors are willing to pay for each dollar of earnings. It is especially useful for evaluating mature, earnings-generating businesses, offering a snapshot of market sentiment and relative value within an industry.

It is important to remember that growth expectations and risk play a major role in what a “normal” PE should be. Companies with higher profit growth or lower risk profiles tend to justify higher PE ratios, while industries facing more uncertainty or slower growth typically trade at lower multiples.

Currently, Mach Natural Resources trades at a PE ratio of 18.4x. For context, that is higher than the Oil and Gas industry average of 13.3x, but lower than its peer group average of 29.7x. Benchmarks like these help set the scene, but do not capture every nuance of a company’s story.

This is where Simply Wall St’s Fair Ratio comes in. The Fair Ratio, calculated to be 18.2x for Mach Natural Resources, reflects a more tailored benchmark. Unlike simple averages, it factors in the company’s specific fundamentals such as earnings growth outlook, profit margins, risk, and overall market cap, making it more reliable for investment decisions.

With Mach’s current PE of 18.4x sitting nearly on top of the Fair Ratio of 18.2x, the valuation looks balanced relative to its true prospects. This suggests the stock is priced about right given current information.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1440 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Mach Natural Resources Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about what you think Mach Natural Resources is really worth. It is a set of personal assumptions about how much money you believe the company can make in the future, and why. Narratives link that story directly to a forward-looking forecast and calculate a fair value based on your expectations for what the business could achieve.

Narratives make investing easier and more actionable, turning your insights and opinions about Mach’s strategy, market position, or industry trends into hard numbers. On Simply Wall St’s Community page, millions of investors create and share their Narratives, allowing you to see a wide range of perspectives, from the most bullish to the most cautious, all in one place.

The real power of Narratives is that they update automatically when news or fresh results are released, so you can always see how your story connects to the latest fair value. You can see whether that value is higher or lower than today’s price. For example, some investors might set a higher narrative price target of $22, based on strong revenue growth and margin expansion, while others forecast a lower target of $18, reflecting more caution around regulatory risk and market volatility.

Do you think there's more to the story for Mach Natural Resources? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MNR

Mach Natural Resources

An independent upstream oil and gas company, focuses on the acquisition, development, and production of oil, natural gas, and natural gas liquids reserves in the Anadarko Basin region of Western Oklahoma, Southern Kansas, and the panhandle of Texas.

Undervalued with slight risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion