- United States

- /

- Oil and Gas

- /

- NYSE:MGY

We Ran A Stock Scan For Earnings Growth And Magnolia Oil & Gas (NYSE:MGY) Passed With Ease

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Magnolia Oil & Gas (NYSE:MGY). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

See our latest analysis for Magnolia Oil & Gas

How Fast Is Magnolia Oil & Gas Growing Its Earnings Per Share?

Investors and investment funds chase profits, and that means share prices tend rise with positive earnings per share (EPS) outcomes. So a growing EPS generally brings attention to a company in the eyes of prospective investors. It is awe-striking that Magnolia Oil & Gas' EPS went from US$0.49 to US$2.70 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. Could this be a sign that the business has reached an inflection point?

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. The music to the ears of Magnolia Oil & Gas shareholders is that EBIT margins have grown from 24% to 59% in the last 12 months and revenues are on an upwards trend as well. Both of which are great metrics to check off for potential growth.

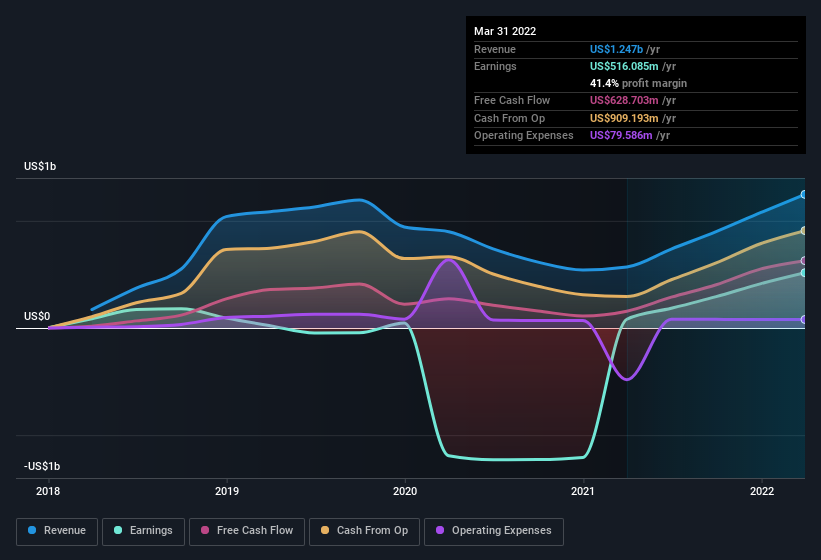

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Magnolia Oil & Gas' forecast profits?

Are Magnolia Oil & Gas Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, small purchases are not always indicative of conviction, and insiders don't always get it right.

The first bit of good news is that no Magnolia Oil & Gas insiders reported share sales in the last twelve months. But the important part is that President Stephen Chazen spent US$706k buying stock, at an average price of US$14.12. Purchases like this can offer an insight into the faith of the company's management - and it seems to be all positive.

On top of the insider buying, it's good to see that Magnolia Oil & Gas insiders have a valuable investment in the business. We note that their impressive stake in the company is worth US$202m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

Shareholders have more to smile about than just insiders adding more shares to their already sizeable holdings. The cherry on top is that the CEO, Steve Chazen is paid comparatively modestly to CEOs at similar sized companies. The median total compensation for CEOs of companies similar in size to Magnolia Oil & Gas, with market caps between US$2.0b and US$6.4b, is around US$6.9m.

The CEO of Magnolia Oil & Gas only received US$349k in total compensation for the year ending December 2021. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Magnolia Oil & Gas Worth Keeping An Eye On?

Magnolia Oil & Gas' earnings per share have been soaring, with growth rates sky high. To sweeten the deal, insiders have significant skin in the game with one even acquiring more. These factors seem to indicate the company's potential and that it has reached an inflection point. We'd suggest Magnolia Oil & Gas belongs near the top of your watchlist. What about risks? Every company has them, and we've spotted 3 warning signs for Magnolia Oil & Gas (of which 1 can't be ignored!) you should know about.

The good news is that Magnolia Oil & Gas is not the only growth stock with insider buying. Here's a list of them... with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:MGY

Magnolia Oil & Gas

An independent oil and natural gas company, engages in the acquisition, development, exploration, and production of oil, natural gas, and natural gas liquids reserves in the United States.

Adequate balance sheet with acceptable track record.