- United States

- /

- Oil and Gas

- /

- NYSE:LNG

How Investors May Respond To Cheniere Energy (LNG) Earnings Amid Tightening US Natural Gas Supplies

Reviewed by Sasha Jovanovic

- Cheniere Energy recently announced it will release its third quarter 2025 financial results on October 30, 2025, with a webcast and conference call for investors to follow.

- Stronger natural gas prices, underpinned by lower-than-expected U.S. storage injections and robust LNG demand, have brought added focus to Cheniere Energy ahead of its earnings report.

- With anticipation building around Cheniere's upcoming earnings amid tightening natural gas supplies, we'll examine the potential effect on its investment outlook.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Cheniere Energy Investment Narrative Recap

Owning Cheniere Energy relies on a belief in sustained global LNG demand and the company's ability to capture value from its expansion and contract portfolio. The recent news around stronger natural gas prices and lower-than-expected U.S. storage injections could enhance near-term optimism ahead of the Q3 2025 results, though it does not fundamentally shift the central short-term catalyst, Cheniere's ability to lock in additional long-term contracts, nor the largest risk, which remains the looming global oversupply in LNG that could pressure prices and margins. One of the most relevant recent announcements is the substantial completion of Corpus Christi Stage 3 Train 1, which is now contributing to reported revenues and establishes a credible foundation for further capacity growth. This development is closely tied to Cheniere's ability to benefit from robust spot and contract demand amid current tightness but must be viewed in the context of the potential for global LNG oversupply if the expected surge in new capacity comes online as projected. However, investors should also be aware that, in contrast to current bullish sentiment around natural gas pricing, the risk of structural oversupply may challenge...

Read the full narrative on Cheniere Energy (it's free!)

Cheniere Energy's outlook forecasts $24.1 billion in revenue and $3.1 billion in earnings by 2028. This scenario assumes a 9.8% annual revenue growth rate and a decrease in earnings of $0.7 billion from the current $3.8 billion.

Uncover how Cheniere Energy's forecasts yield a $270.67 fair value, a 16% upside to its current price.

Exploring Other Perspectives

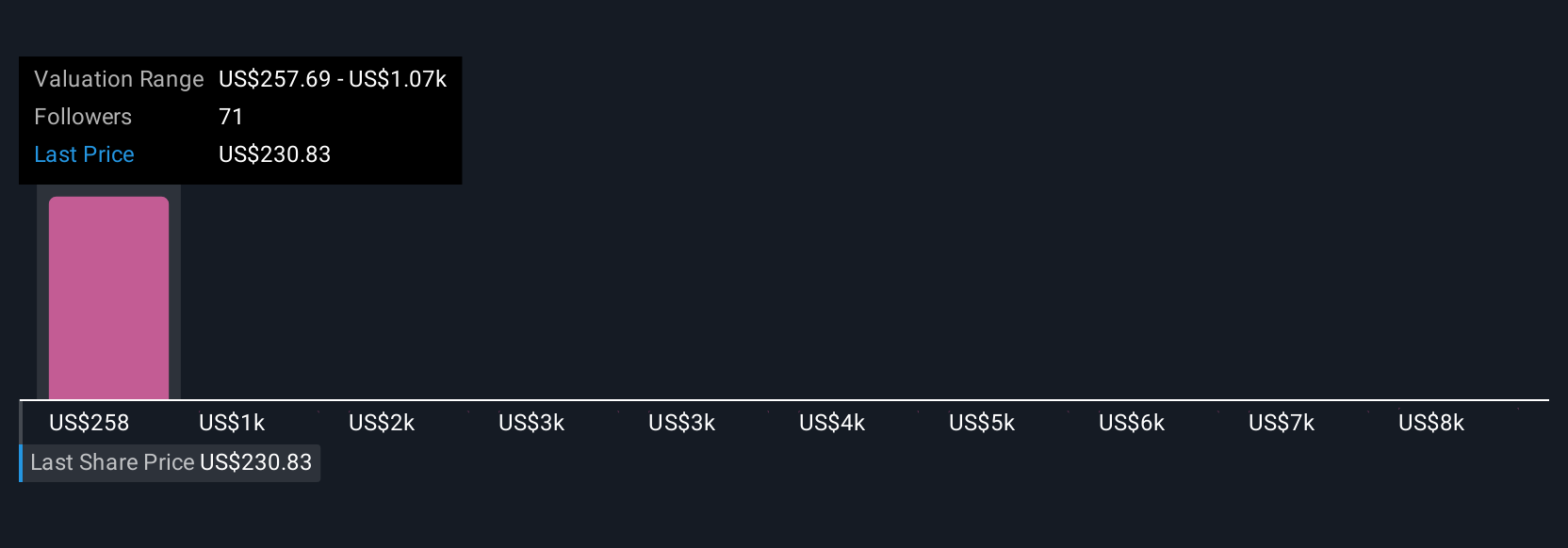

Five individual Simply Wall St Community fair value estimates for Cheniere Energy span from US$270.61 to US$6,591.19, reflecting substantial differences in outlook. As you consider these contrasting views, remember that the market’s attention is turning to global LNG supply growth and its long-term impact on Cheniere’s earnings power.

Explore 5 other fair value estimates on Cheniere Energy - why the stock might be a potential multi-bagger!

Build Your Own Cheniere Energy Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Cheniere Energy research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Cheniere Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Cheniere Energy's overall financial health at a glance.

Contemplating Other Strategies?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:LNG

Cheniere Energy

An energy infrastructure company, primarily engages in the liquefied natural gas (LNG) related businesses in the United States.

Good value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives