- United States

- /

- Energy Services

- /

- NYSE:LBRT

Liberty Energy Inc. (NYSE:LBRT) Shares Fly 33% But Investors Aren't Buying For Growth

Liberty Energy Inc. (NYSE:LBRT) shares have had a really impressive month, gaining 33% after a shaky period beforehand. But the gains over the last month weren't enough to make shareholders whole, as the share price is still down 8.6% in the last twelve months.

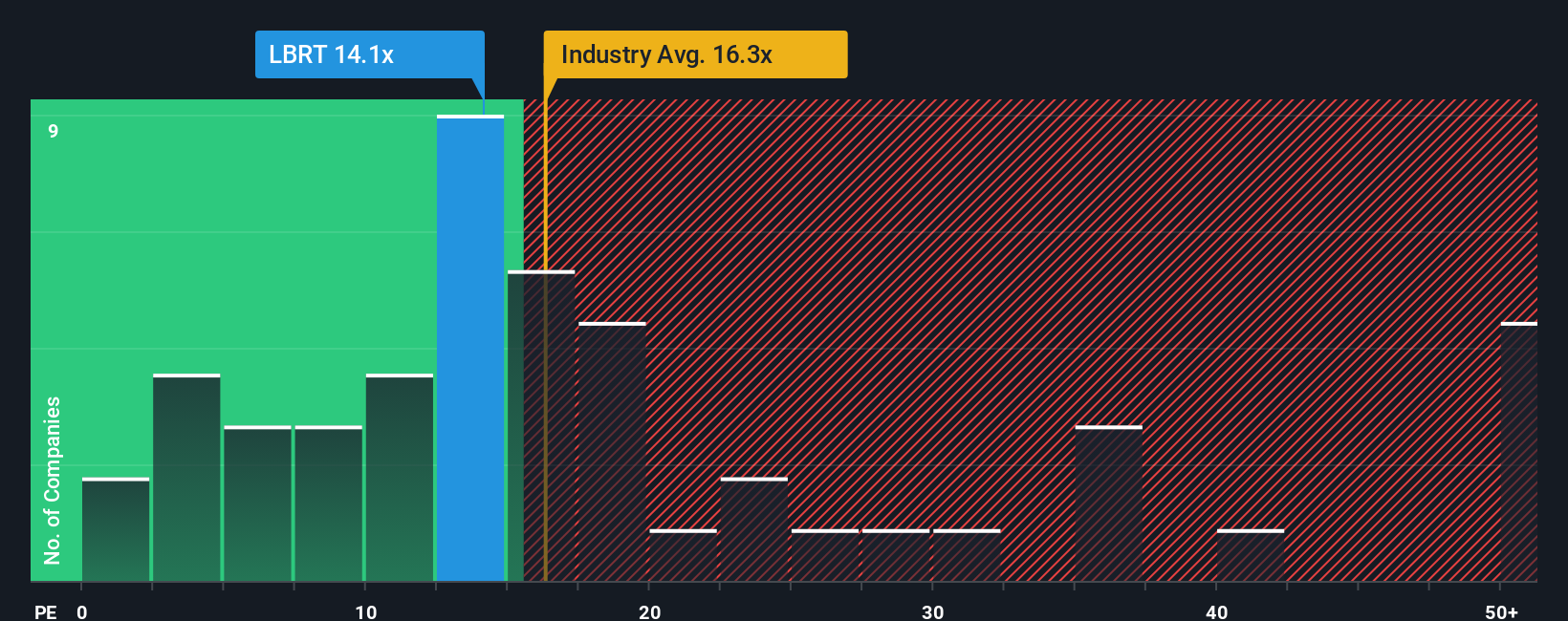

In spite of the firm bounce in price, Liberty Energy may still be sending bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 14.1x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. However, the P/E might be low for a reason and it requires further investigation to determine if it's justified.

Liberty Energy could be doing better as its earnings have been going backwards lately while most other companies have been seeing positive earnings growth. It seems that many are expecting the dour earnings performance to persist, which has repressed the P/E. If you still like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

Check out our latest analysis for Liberty Energy

Does Growth Match The Low P/E?

There's an inherent assumption that a company should underperform the market for P/E ratios like Liberty Energy's to be considered reasonable.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 46%. Regardless, EPS has managed to lift by a handy 11% in aggregate from three years ago, thanks to the earlier period of growth. So we can start by confirming that the company has generally done a good job of growing earnings over that time, even though it had some hiccups along the way.

Looking ahead now, EPS is anticipated to slump, contracting by 34% per annum during the coming three years according to the eleven analysts following the company. That's not great when the rest of the market is expected to grow by 11% each year.

In light of this, it's understandable that Liberty Energy's P/E would sit below the majority of other companies. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. There's potential for the P/E to fall to even lower levels if the company doesn't improve its profitability.

The Bottom Line On Liberty Energy's P/E

Liberty Energy's stock might have been given a solid boost, but its P/E certainly hasn't reached any great heights. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Liberty Energy maintains its low P/E on the weakness of its forecast for sliding earnings, as expected. At this stage investors feel the potential for an improvement in earnings isn't great enough to justify a higher P/E ratio. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

And what about other risks? Every company has them, and we've spotted 4 warning signs for Liberty Energy (of which 1 is a bit unpleasant!) you should know about.

Of course, you might also be able to find a better stock than Liberty Energy. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:LBRT

Liberty Energy

Provides hydraulic fracturing services and related technologies to onshore oil and natural gas exploration, and production companies in North America.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives