- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Kinetik Holdings (KNTK) Is Up 5.9% After Cutting 2025 EBITDA Guidance And Delaying Kings Landing Project

Reviewed by Sasha Jovanovic

- Kinetik Holdings recently reported weaker-than-expected third-quarter 2025 results and cut its 2025 EBITDA guidance, citing operational challenges and delays in bringing the Kings Landing project online.

- The setback underscores how execution risk around new Permian Basin gas infrastructure can quickly affect Kinetik’s earnings outlook and operating profile.

- We’ll now examine how the Kings Landing delay and reduced 2025 EBITDA guidance affect Kinetik’s previously bullish midstream investment narrative.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

Kinetik Holdings Investment Narrative Recap

To own Kinetik today, you need to believe in the long term value of its Permian Basin gas infrastructure and sour gas treating footprint, despite near term earnings bumps. The weaker third quarter and lower 2025 EBITDA guidance directly weaken the key short term catalyst, Kings Landing, while also highlighting execution and balance sheet risk as the most important issues to watch right now.

The most relevant recent announcement here is Kinetik’s third quarter 2025 earnings release, which showed revenue up year on year but a sharp drop in net income and earnings per share. That contrast between top line growth and much thinner profitability makes the Kings Landing delay more consequential, since it tightens financial flexibility at a time when high capital intensity and existing leverage already sit near the top of many investors’ risk lists.

But investors should also be aware that if Permian drilling or sour gas volumes disappoint, Kinetik’s concentrated footprint could...

Read the full narrative on Kinetik Holdings (it's free!)

Kinetik Holdings' narrative projects $2.8 billion revenue and $167.1 million earnings by 2028.

Uncover how Kinetik Holdings' forecasts yield a $46.33 fair value, a 29% upside to its current price.

Exploring Other Perspectives

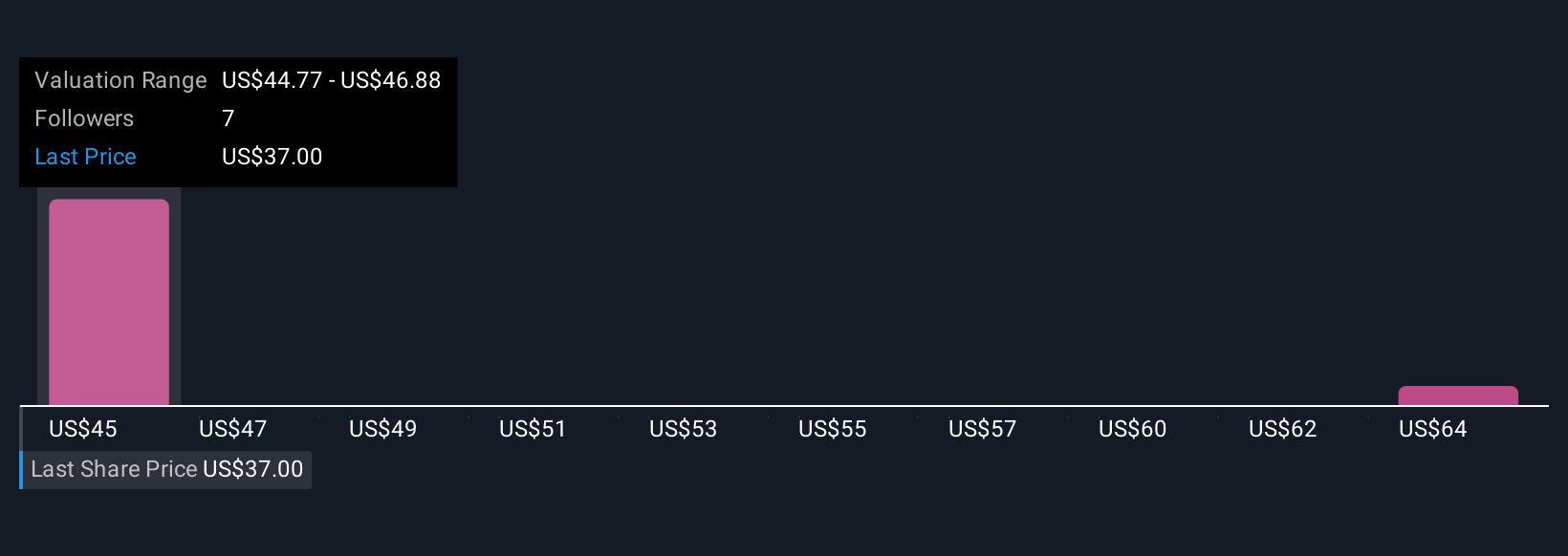

Three members of the Simply Wall St Community currently see Kinetik’s fair value between US$44.77 and US$65.85, highlighting very different return expectations. You should weigh those views against execution risk around Kings Landing and other capital intensive projects, since delays or cost overruns can quickly change how the market values the entire midstream story.

Explore 3 other fair value estimates on Kinetik Holdings - why the stock might be worth as much as 84% more than the current price!

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Want Some Alternatives?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026