- United States

- /

- Oil and Gas

- /

- NYSE:KNTK

Dividend Declaration Could Be a Game Changer for Kinetik Holdings (KNTK)

Reviewed by Simply Wall St

- Kinetik Holdings Inc. recently declared a quarterly cash dividend of US$0.78 per share, payable on August 1, 2025, to shareholders of record as of July 25, 2025.

- This dividend affirmation highlights the company's ongoing commitment to returning value to shareholders and may reinforce perceptions of financial strength.

- We'll explore how this dividend declaration signals management’s confidence in future cash flows and influences Kinetik Holdings' broader investment narrative.

Kinetik Holdings Investment Narrative Recap

To be a Kinetik Holdings shareholder is to back a company pursuing growth through Delaware Basin expansion, M&A activity, and long-term energy infrastructure projects, all while navigating inherent operational and market risks. The newly announced US$0.78 per share dividend for Q3 2025 underscores management’s confidence but does not materially impact the short-term catalyst of ramping up processing capacity at the Kings Landing Complex. The primary risk remains the volatility in natural gas prices and execution on new projects.

The recently expanded US$500 million share repurchase authorization, updated in May 2025, stands out as a meaningful move. While unrelated to dividend maintenance, the buyback plan reflects another approach to shareholder returns and could provide additional support to the stock alongside Kinetik’s project-driven revenue growth goals. Yet, unlike dividends, repurchases are discretionary and can vary with financial conditions, underscoring the need for ongoing due diligence.

By contrast, investors should be aware that rising power costs continue to threaten net margins if Kinetik cannot optimize electricity expenses...

Read the full narrative on Kinetik Holdings (it's free!)

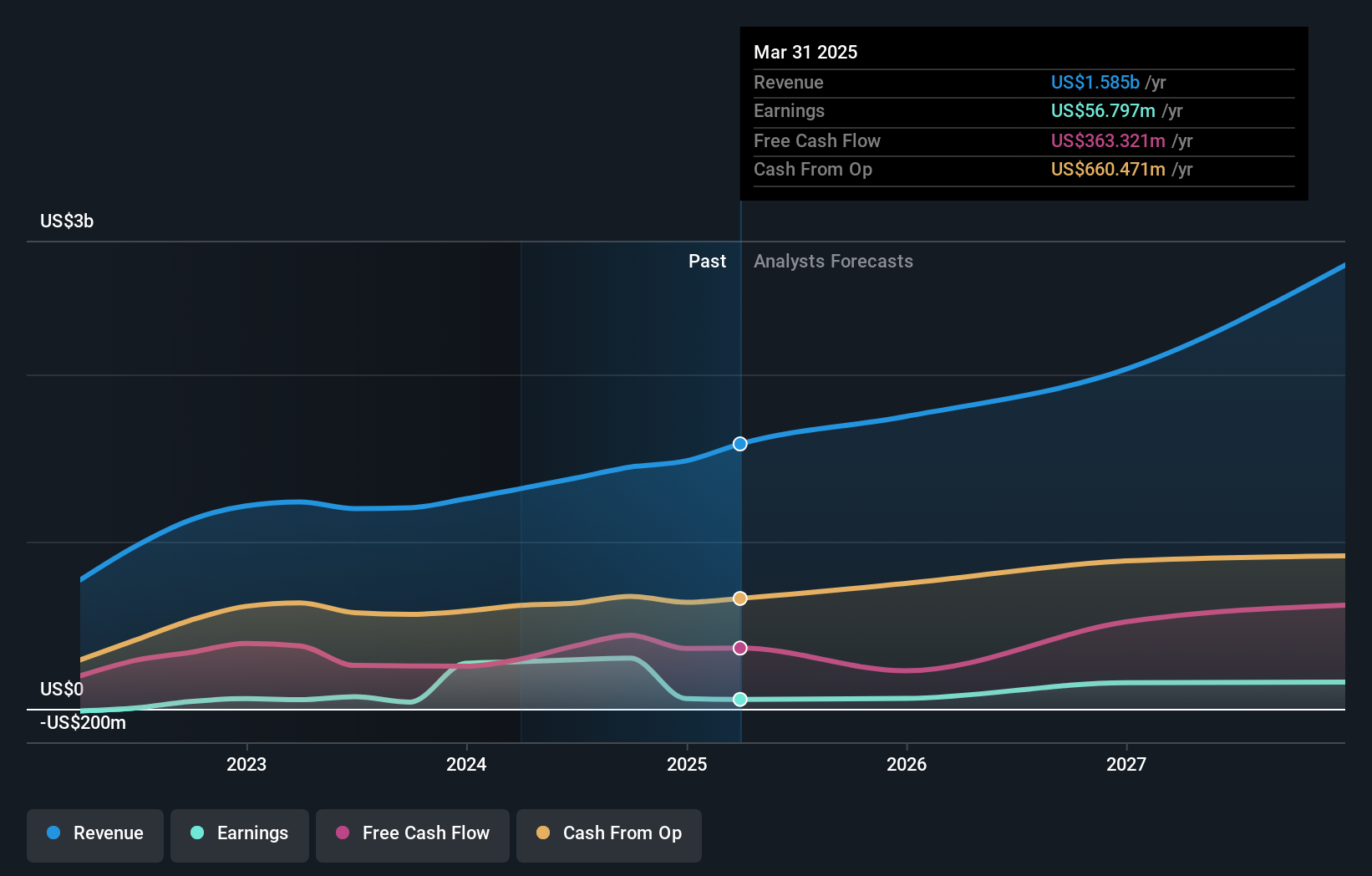

Kinetik Holdings' outlook anticipates $2.7 billion in revenue and $264.4 million in earnings by 2028. This projection is based on a 21.4% annual revenue growth rate and a $203.2 million increase in earnings from the current $61.2 million.

Exploring Other Perspectives

Community members at Simply Wall St have valued Kinetik Holdings anywhere from US$24.25 to US$155.35 per share based on two independent views. Opinions diverge significantly, and with revenue growth forecasts a key catalyst, you can explore how these alternative approaches shape expectations for future performance.

Build Your Own Kinetik Holdings Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinetik Holdings research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Kinetik Holdings research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinetik Holdings' overall financial health at a glance.

Interested In Other Possibilities?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 19 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 26 stocks are leading the charge.

- This technology could replace computers: discover the 26 stocks are working to make quantum computing a reality.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinetik Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KNTK

Kinetik Holdings

Through its subsidiaries, operates as a midstream company in the Texas Delaware Basin.

Reasonable growth potential slight.

Similar Companies

Market Insights

Community Narratives