- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Why Investors Shouldn't Be Surprised By Kinder Morgan, Inc.'s (NYSE:KMI) P/E

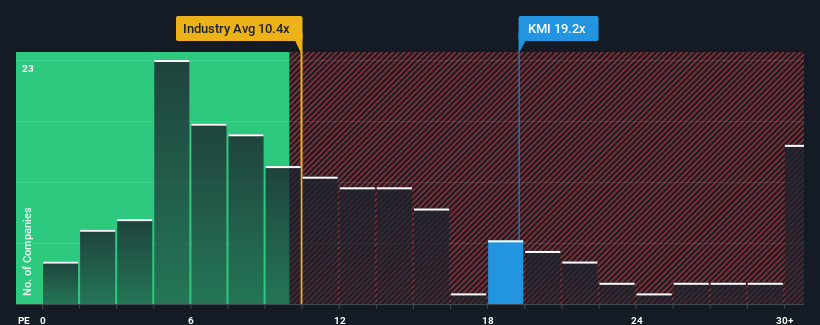

There wouldn't be many who think Kinder Morgan, Inc.'s (NYSE:KMI) price-to-earnings (or "P/E") ratio of 19.2x is worth a mention when the median P/E in the United States is similar at about 18x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/E.

There hasn't been much to differentiate Kinder Morgan's and the market's retreating earnings lately. It seems that few are expecting the company's earnings performance to deviate much from most other companies, which has held the P/E back. You'd much rather the company wasn't bleeding earnings if you still believe in the business. At the very least, you'd be hoping that earnings don't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Check out our latest analysis for Kinder Morgan

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Kinder Morgan's is when the company's growth is tracking the market closely.

Taking a look back first, the company's earnings per share growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. Still, the latest three year period has seen an excellent 46% overall rise in EPS, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would probably welcome the medium-term rates of earnings growth.

Turning to the outlook, the next three years should generate growth of 9.2% per year as estimated by the nine analysts watching the company. That's shaping up to be similar to the 10% per year growth forecast for the broader market.

With this information, we can see why Kinder Morgan is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Final Word

It's argued the price-to-earnings ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've established that Kinder Morgan maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

There are also other vital risk factors to consider and we've discovered 3 warning signs for Kinder Morgan (2 are a bit concerning!) that you should be aware of before investing here.

Of course, you might also be able to find a better stock than Kinder Morgan. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record and slightly overvalued.

Similar Companies

Market Insights

Community Narratives