- United States

- /

- Oil and Gas

- /

- NYSE:KMI

The Bull Case For Kinder Morgan (KMI) Could Change Following Surging Natural Gas Demand and Q3 Results

Reviewed by Sasha Jovanovic

- Kinder Morgan reported its fiscal third-quarter results on October 15, 2025, following analyst forecasts that projected a 7% increase in earnings and 8% growth in sales compared to the prior year.

- With surging natural gas demand due to LNG exports, power generation, and AI, investors paid close attention to the company's performance amid industry tailwinds and historic post-earnings stock fluctuations.

- We'll examine how stronger natural gas demand, highlighted by these recent earnings, may impact Kinder Morgan's long-term investment case.

Find companies with promising cash flow potential yet trading below their fair value.

Kinder Morgan Investment Narrative Recap

The core belief behind owning Kinder Morgan is that sustained natural gas demand growth, from LNG exports, power generation, and energy-intensive technologies, will drive ongoing pipeline utilization and steady cash flows. While the recent third-quarter earnings report met analyst expectations for growth and reflects industry momentum, it does not materially alter the short-term focus on demand catalysts or the continued risk posed by Kinder Morgan's high leverage and limited financial flexibility.

Among recent company announcements, the consistent year-over-year dividend increases are particularly relevant, as they showcase management's ongoing commitment to returning capital to shareholders, a key strength as natural gas demand strengthens. However, this emphasis on dividend growth comes as Kinder Morgan's financial position and capital allocation priorities remain central to the long-term investment thesis, especially against a backdrop of large infrastructure needs and competition for growth projects.

Yet, despite strong demand signals, it is important for investors to be mindful of Kinder Morgan’s elevated debt burden and how...

Read the full narrative on Kinder Morgan (it's free!)

Kinder Morgan's narrative projects $20.2 billion revenue and $3.7 billion earnings by 2028. This requires 8.2% yearly revenue growth and a $1.0 billion earnings increase from $2.7 billion today.

Uncover how Kinder Morgan's forecasts yield a $31.06 fair value, a 14% upside to its current price.

Exploring Other Perspectives

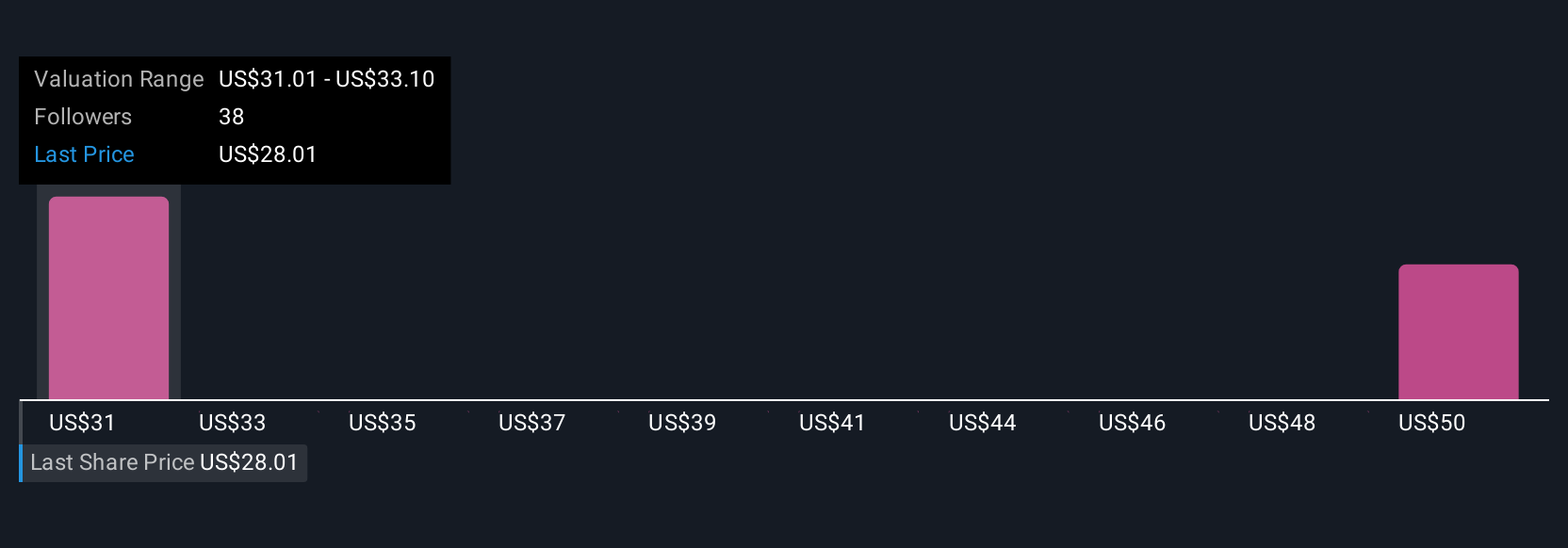

Simply Wall St Community members provided four fair value estimates for Kinder Morgan ranging from US$28.06 to US$45.03 per share. With high leverage underscoring one of the most debated risks, you can see how sharply opinions differ on Kinder Morgan's outlook, considering several perspectives can be especially valuable here.

Explore 4 other fair value estimates on Kinder Morgan - why the stock might be worth as much as 65% more than the current price!

Build Your Own Kinder Morgan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Kinder Morgan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinder Morgan's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives