- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Should Kinder Morgan’s (KMI) $9.3 Billion Project Backlog Shift Investors’ Outlook on Long-Term Growth?

Reviewed by Simply Wall St

- In August 2025, Kinder Morgan reported that its project backlog rose to US$9.3 billion as strong customer commitments, particularly in natural gas transportation for LNG exports, continued to drive demand.

- The company also initiated a binding open season for a potential expansion of its El Paso-Tucson refined products pipeline, offering new growth opportunities in an evolving energy infrastructure market.

- We'll explore how Kinder Morgan’s expanded project backlog underscores shifts in its long-term growth outlook and future revenue profile.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Kinder Morgan Investment Narrative Recap

To be a shareholder in Kinder Morgan, you have to believe in the enduring role of North American natural gas infrastructure and the company’s ability to secure long-term, fee-based revenues from rising LNG export demand. The announcement that Kinder Morgan’s project backlog has grown to US$9.3 billion underlines this view but does not fundamentally alter the most important near-term catalyst, continued momentum in LNG-related pipeline contracts, or the biggest risk, which remains potential revenue pressure from contract renewals and competition as older agreements expire.

One recent development closely related to this catalyst is Kinder Morgan’s launch of a binding open season for the El Paso-Tucson refined products pipeline expansion. The level of shipper interest in this expansion could serve as an indicator of ongoing demand for pipeline capacity and project viability, directly linking the announcement to Kinder Morgan’s broader pursuit of future revenue growth and expansion opportunities.

Yet, against these opportunities, investors should be aware that as legacy contracts near expiration...

Read the full narrative on Kinder Morgan (it's free!)

Kinder Morgan's outlook forecasts $20.2 billion in revenue and $3.7 billion in earnings by 2028. Achieving this would require annual revenue growth of 8.1% and a $1.0 billion increase in earnings from the current $2.7 billion.

Uncover how Kinder Morgan's forecasts yield a $31.07 fair value, a 16% upside to its current price.

Exploring Other Perspectives

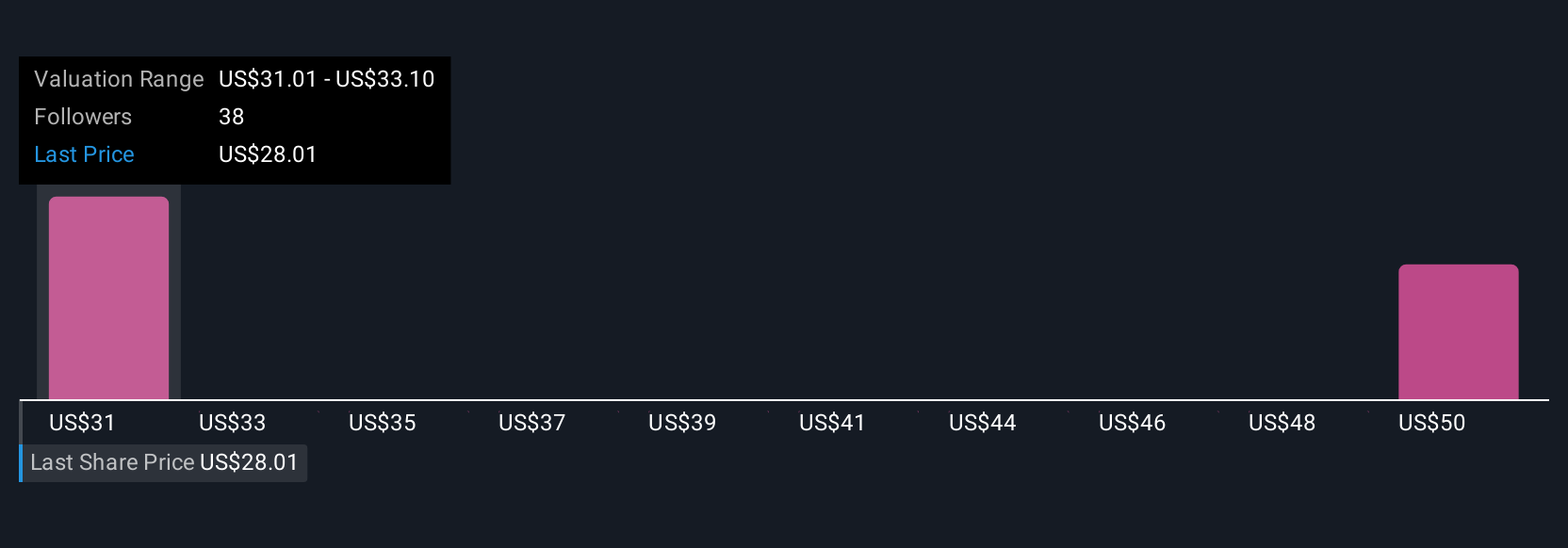

Simply Wall St Community members provided two distinct fair value estimates for Kinder Morgan, ranging widely from US$31.07 to US$46.17 per share. While contract-driven growth supports the company’s outlook, contract expirations and competition have broader implications for future returns, explore how your views might compare.

Explore 2 other fair value estimates on Kinder Morgan - why the stock might be worth just $31.07!

Build Your Own Kinder Morgan Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Kinder Morgan research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Kinder Morgan's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 27 stocks are leading the charge.

- The end of cancer? These 26 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 20 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives