- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (NYSE:KMI) Sees 5% Drop Over Last Month Amid Broader Market Declines

Reviewed by Simply Wall St

In recent market news, the major U.S. stock indexes experienced significant declines due to concerns over new tariffs, with the Nasdaq entering a bear market. Amid this backdrop, Kinder Morgan (NYSE:KMI) saw its share price decline by 5.39% over the past month. This price movement aligns with broader market trends, particularly affecting energy stocks due to falling oil prices and increasing economic uncertainties from global trade tensions. The broader markets' significant drops, such as the 6% plunge in the S&P 500, likely impacted investor sentiment towards KMI, contributing to the company's share price movement.

While Kinder Morgan's share price has seen fluctuations, the company managed a total return of 125.86% over the past five years, a significant feat amid the broader market's volatility. This performance can be attributed to a combination of dividend payouts and share buybacks. The company exceeded the US oil and gas industry over the past year, showcasing resilience against the backdrop of a challenging energy market.

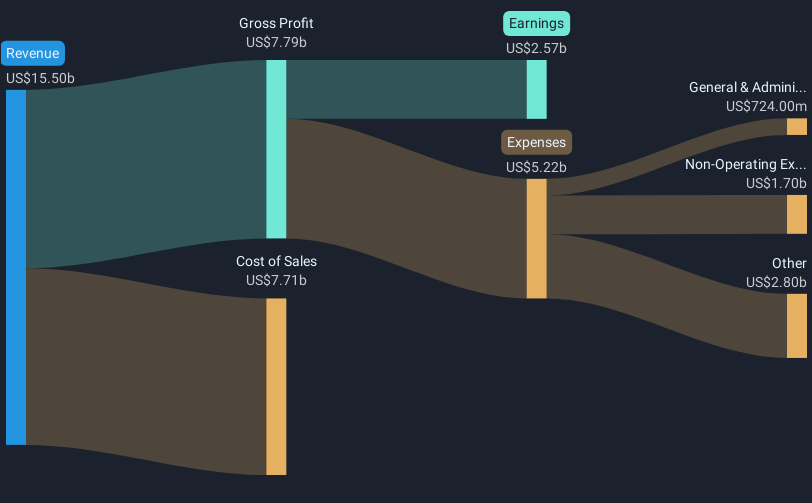

Noteworthy developments include the announcement of major infrastructure projects such as the Trident and MSX lines, which aim to enhance transport capacity in response to increased natural gas demand. Despite challenges such as commodity price fluctuations and regulatory hurdles, Kinder Morgan has maintained a focus on LNG exports, positioning itself for future growth. Earnings reports, reflecting both increased net income and dividends, further describe the financial health and shareholder returns of the company over the period.

Review our historical performance report to gain insights into Kinder Morgan's track record.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record and fair value.

Similar Companies

Market Insights

Community Narratives