- United States

- /

- Oil and Gas

- /

- NYSE:KMI

Kinder Morgan (KMI): Is the Stock Undervalued After Recent Mixed Performance?

Reviewed by Kshitija Bhandaru

Kinder Morgan (KMI) shares have shown a mixed performance recently, with a small dip over the past week and month, but a solid gain year over year. Curious investors might be wondering what is guiding these moves and whether the stock’s current pricing presents an opportunity.

See our latest analysis for Kinder Morgan.

Kinder Morgan's share price has slipped recently, but its total shareholder return over the past year is an impressive 13.8%. This reflects solid long-term momentum as investors weigh ongoing growth and changing risk perceptions in the energy sector.

If you’re keeping an eye on what’s fueling long-term outperformance, consider broadening your search and discover fast growing stocks with high insider ownership.

With shares sitting below analyst targets and strong financial growth in recent years, the question now is whether Kinder Morgan is still undervalued or if the market has already taken its future prospects into account.

Most Popular Narrative: 12.8% Undervalued

Kinder Morgan's most widely followed narrative values the stock at $31.06, about 13% above the last close price. With bullish long-term growth factors at play and future project optimism growing, this fair value suggests the crowd sees room for upside.

Anticipated growth in global natural gas demand, driven by rising populations in Asia and Africa and increased energy needs from urbanization, is expected to sustain or increase utilization of Kinder Morgan's core pipeline and LNG infrastructure. This trend could underpin long-term revenue growth through higher throughput volumes and long-term contracts.

Curious how analysts arrive at such a premium? The heart of this narrative depends on bold profit margin targets and surprisingly aggressive assumptions about future contract volumes. Want to know if this optimism has the numbers to back it up, or if it’s all hot air? The details fueling this price target will surprise you.

Result: Fair Value of $31.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, rising debt levels and the accelerating shift toward renewables could challenge Kinder Morgan's growth outlook and put pressure on future revenue stability.

Find out about the key risks to this Kinder Morgan narrative.

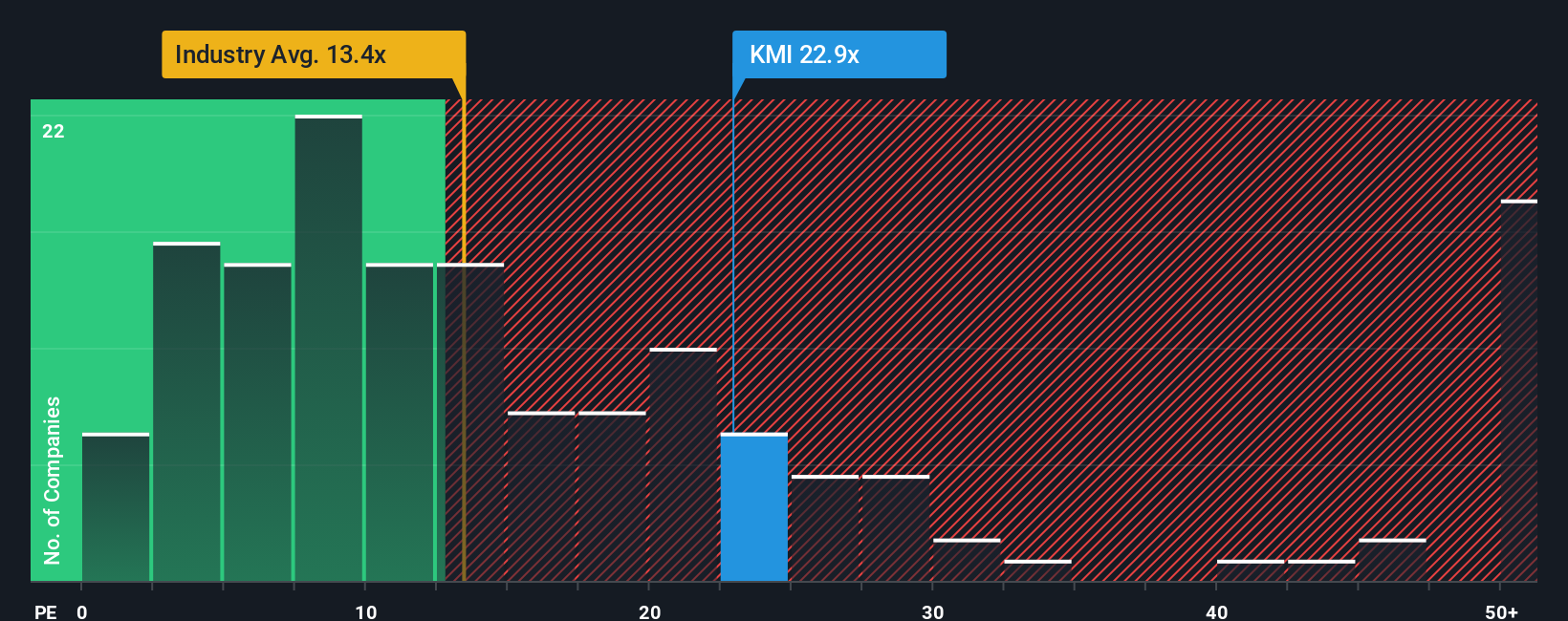

Another View: How Multiples Stack Up

While analyst models may see Kinder Morgan as undervalued, its current price-to-earnings ratio of 22.2x stands out as expensive compared to the US Oil and Gas industry average of 13.2x, its peer average of 16.7x, and even its own fair ratio at 19.4x. This premium raises the question: is the market truly pricing in future growth, or could expectations be a bit too high?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Kinder Morgan Narrative

If these viewpoints do not align with your own or you prefer charting your own course, you can easily craft your own perspective in just a few minutes using our tools, so Do it your way.

A great starting point for your Kinder Morgan research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Opportunities?

Take your investing to the next level by tapping into market trends others overlook. Don’t miss your chance to uncover under-the-radar opportunities with these hand-selected screens:

- Unlock consistent income streams by targeting these 19 dividend stocks with yields > 3%, which features yields above 3% and demonstrates resilient performance through all markets.

- Ride the technological wave and get ahead of the curve with these 24 AI penny stocks, as these companies are transforming industries through automation and machine learning breakthroughs.

- Capture growth before the crowd by zeroing in on these 893 undervalued stocks based on cash flows, which is poised for a potential rebound based on strong cash flow fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kinder Morgan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:KMI

Kinder Morgan

Operates as an energy infrastructure company primarily in North America.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives