- United States

- /

- Energy Services

- /

- NYSE:INVX

Innovex International (INVX) Rises 8.0% as It Becomes Exclusive Wellhead Supplier for OneSubsea Deal

Reviewed by Sasha Jovanovic

- OneSubsea announced in mid-September 2025 that Innovex International, Inc. has been selected as the exclusive global manufacturer and supplier of wellhead systems for its operations, with the transition of manufacturing already in progress and expected to complete by the end of 2026.

- This agreement integrates Innovex's wellhead products directly into OneSubsea's project delivery chain, reflecting deeper collaboration and elevating Innovex’s role in the subsea equipment market.

- We'll explore how Innovex becoming OneSubsea's sole global supplier could influence its investment narrative through embedded product alignment.

The latest GPUs need a type of rare earth metal called Dysprosium and there are only 31 companies in the world exploring or producing it. Find the list for free.

What Is Innovex International's Investment Narrative?

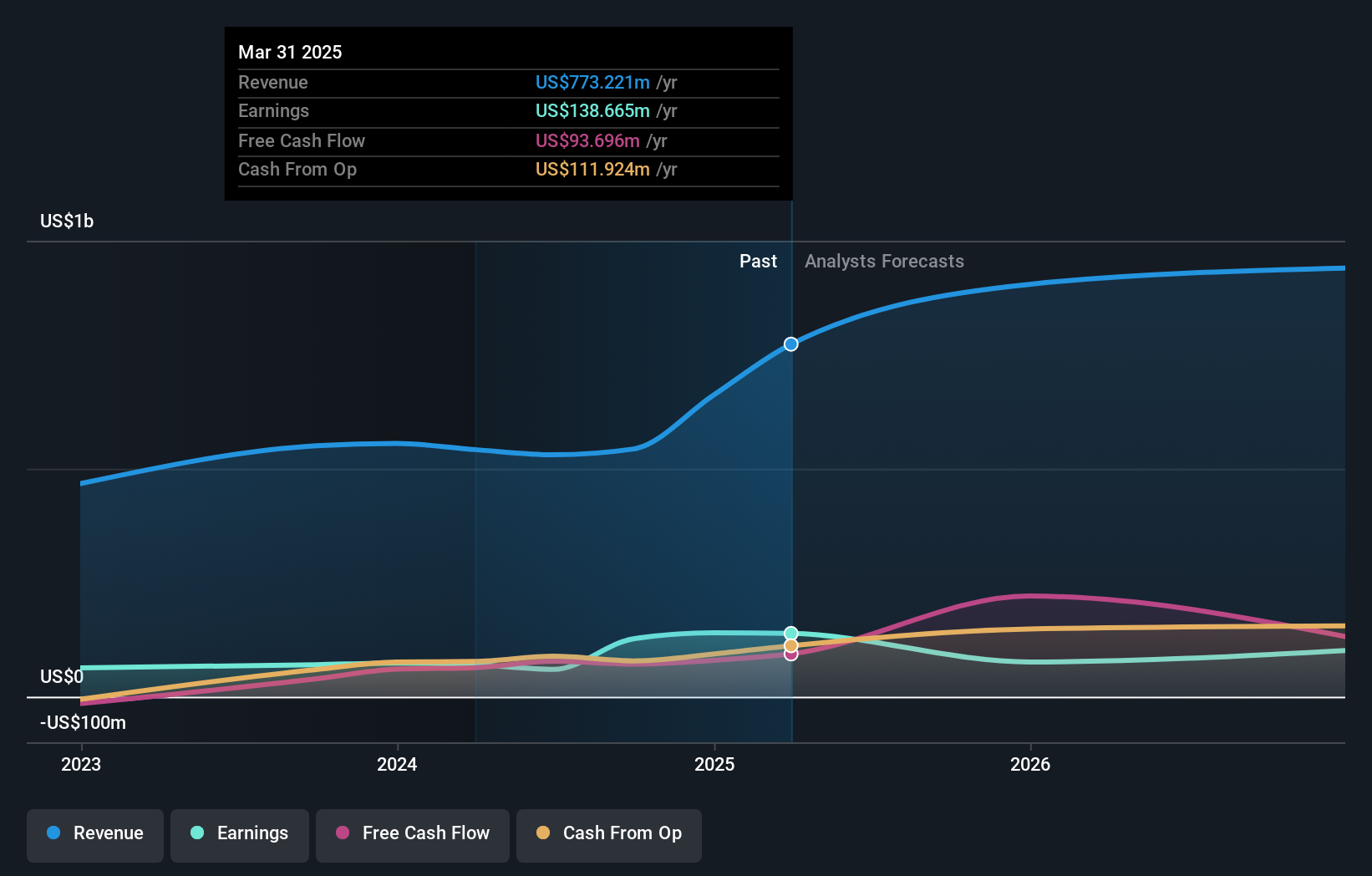

To see Innovex International as an attractive holding, you have to believe the company can convert its exclusive global supply agreement with OneSubsea into consistent execution and sustainable value creation. This new contract is set to directly feed Innovex’s products into OneSubsea’s delivery chain, which could shift near-term catalysts: order visibility and scale now look stronger, and cost controls may tighten further following Innovex’s Houston facility sale. The key risk now is ensuring Innovex transitions manufacturing smoothly while absorbing the surge in operational responsibility, especially as the transition runs into 2026. The company’s recent revenue growth and rising margins have impressed, but with profits forecast to decline over the next three years and a newer management team at the helm, it’s fair to ask if Innovex can handle bigger scale without disruptions or margin strain. This news puts operational execution squarely in focus and could materially realign both risks and opportunities. Yet despite promising headlines, short-term disruption risk is something investors should not overlook.

Innovex International's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 3 other fair value estimates on Innovex International - why the stock might be worth over 2x more than the current price!

Build Your Own Innovex International Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Innovex International research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Innovex International research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Innovex International's overall financial health at a glance.

Ready For A Different Approach?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives