- United States

- /

- Energy Services

- /

- NYSE:INVX

Benign Growth For Innovex International, Inc. (NYSE:INVX) Underpins Stock's 26% Plummet

Innovex International, Inc. (NYSE:INVX) shareholders that were waiting for something to happen have been dealt a blow with a 26% share price drop in the last month. To make matters worse, the recent drop has wiped out a year's worth of gains with the share price now back where it started a year ago.

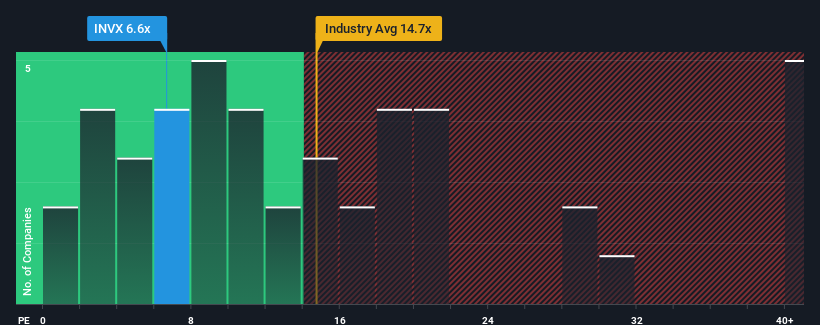

Even after such a large drop in price, Innovex International may still be sending very bullish signals at the moment with its price-to-earnings (or "P/E") ratio of 6.6x, since almost half of all companies in the United States have P/E ratios greater than 19x and even P/E's higher than 34x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so limited.

Innovex International certainly has been doing a good job lately as it's been growing earnings more than most other companies. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

Check out our latest analysis for Innovex International

How Is Innovex International's Growth Trending?

The only time you'd be truly comfortable seeing a P/E as depressed as Innovex International's is when the company's growth is on track to lag the market decidedly.

Taking a look back first, we see that the company grew earnings per share by an impressive 176% last year. The strong recent performance means it was also able to grow EPS by 180% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Looking ahead now, EPS is anticipated to slump, contracting by 75% during the coming year according to the one analyst following the company. That's not great when the rest of the market is expected to grow by 15%.

With this information, we are not surprised that Innovex International is trading at a P/E lower than the market. However, shrinking earnings are unlikely to lead to a stable P/E over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What We Can Learn From Innovex International's P/E?

Having almost fallen off a cliff, Innovex International's share price has pulled its P/E way down as well. We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

As we suspected, our examination of Innovex International's analyst forecasts revealed that its outlook for shrinking earnings is contributing to its low P/E. Right now shareholders are accepting the low P/E as they concede future earnings probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 2 warning signs for Innovex International (1 is concerning!) that you need to take into consideration.

If these risks are making you reconsider your opinion on Innovex International, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About NYSE:INVX

Innovex International

Designs, manufactures, sells, and rents mission critical engineered products to the oil and natural gas industry worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives